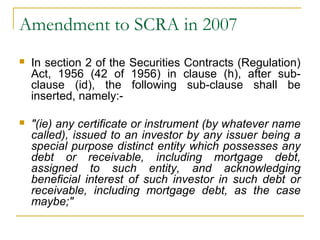

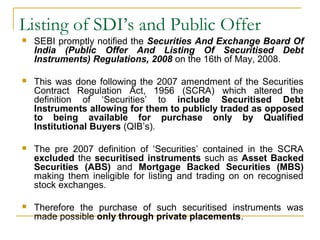

This document summarizes regulations surrounding the listing of securitized debt instruments in India. It discusses how 2007 amendments to the Securities Contracts Regulation Act allowed securitized debt instruments to be publicly traded by defining them as securities. In response, SEBI introduced regulations in 2008 governing public offerings and listings of securitized debt instruments. The regulations establish rules for special purpose entities issuing the instruments and require disclosures. SEBI also released a listing agreement for these instruments in 2011 to increase transparency and secondary market liquidity. Issues remaining include lack of effective foreclosure laws and ambiguity in the tax treatment of SPV trusts.