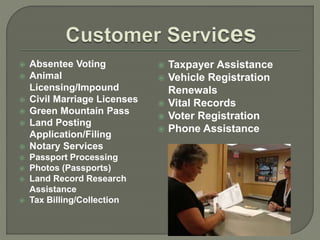

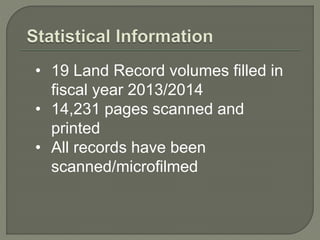

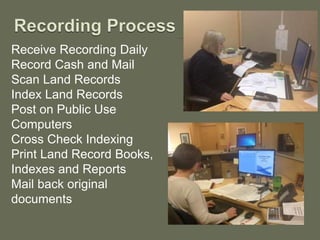

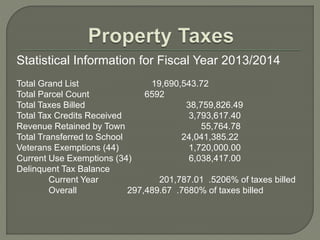

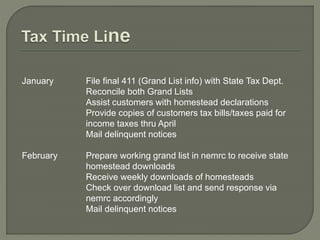

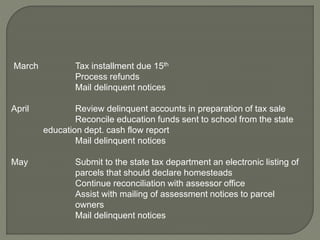

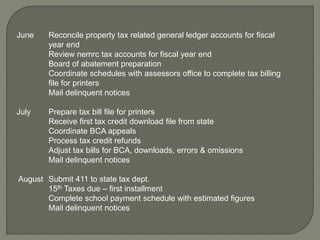

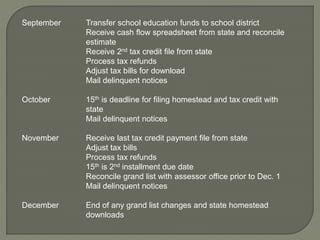

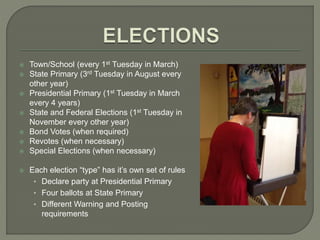

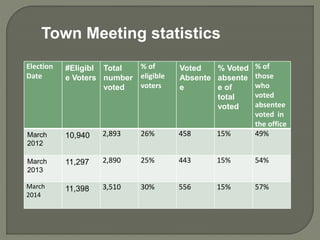

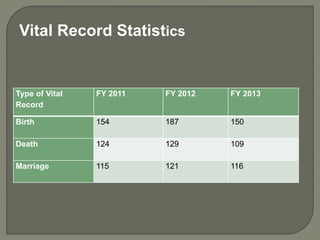

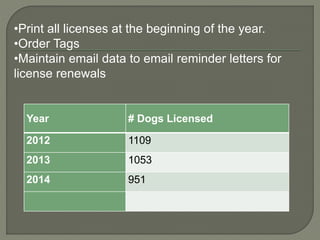

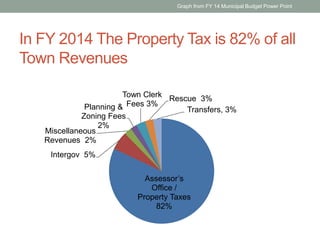

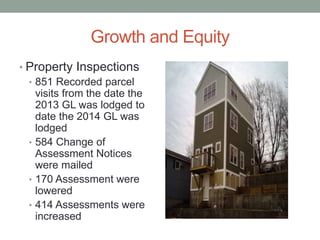

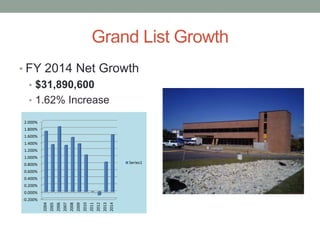

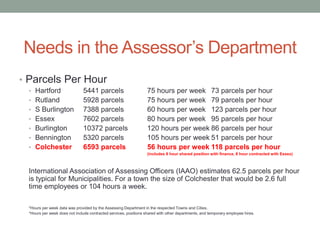

This document provides information on the services and operations of a town clerk's office and assessor's office. It outlines the duties of each including land records, vital records, elections, dog licensing, property taxes, and maintaining the grand list. Statistics are given for transactions in various areas from fiscal years 2011-2014. The importance of the assessor's role in ensuring an equitable grand list for taxation purposes is discussed. Maintaining accurate property data and conducting inspections are described as key to this role.