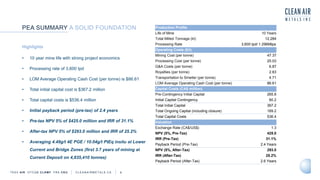

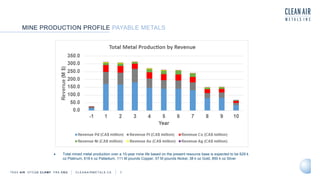

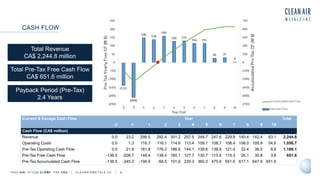

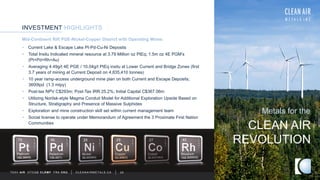

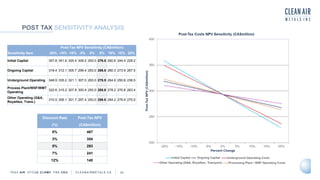

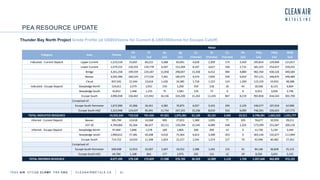

- Clean Air Metals completed a preliminary economic assessment for its Thunder Bay North Project which outlined a 10 year mine life with strong economics including a pre-tax NPV of $425 million and IRR of 31.1%.

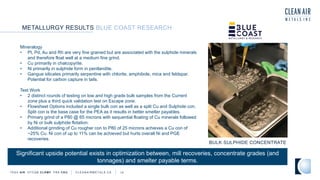

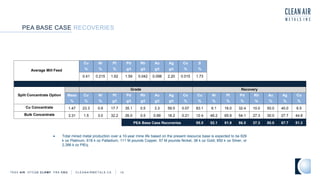

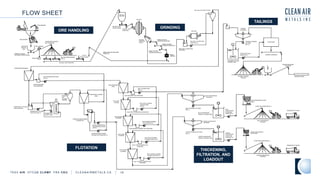

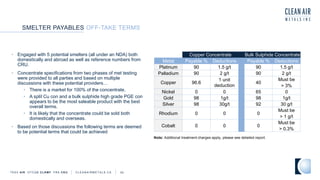

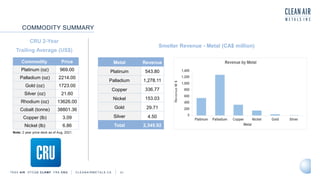

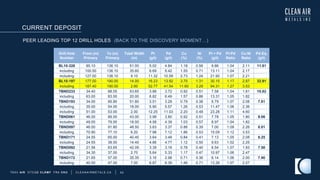

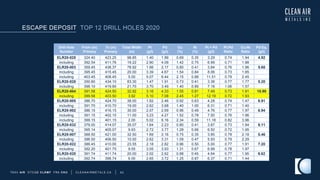

- Metallurgical test work showed the deposit can produce concentrates containing platinum, palladium, copper, nickel, gold and silver with average recoveries of 95.5%, 52.1%, 81.9%, 86.5%, 80% and 67.7% respectively.

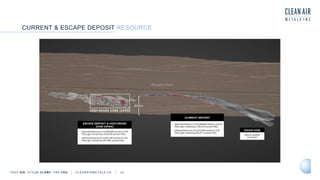

- The next steps include upgrade drilling to increase resources and optimize the technical plan, with the goal of delivering an enhanced pre-feasibility study in 2023 to further unlock the project's potential.