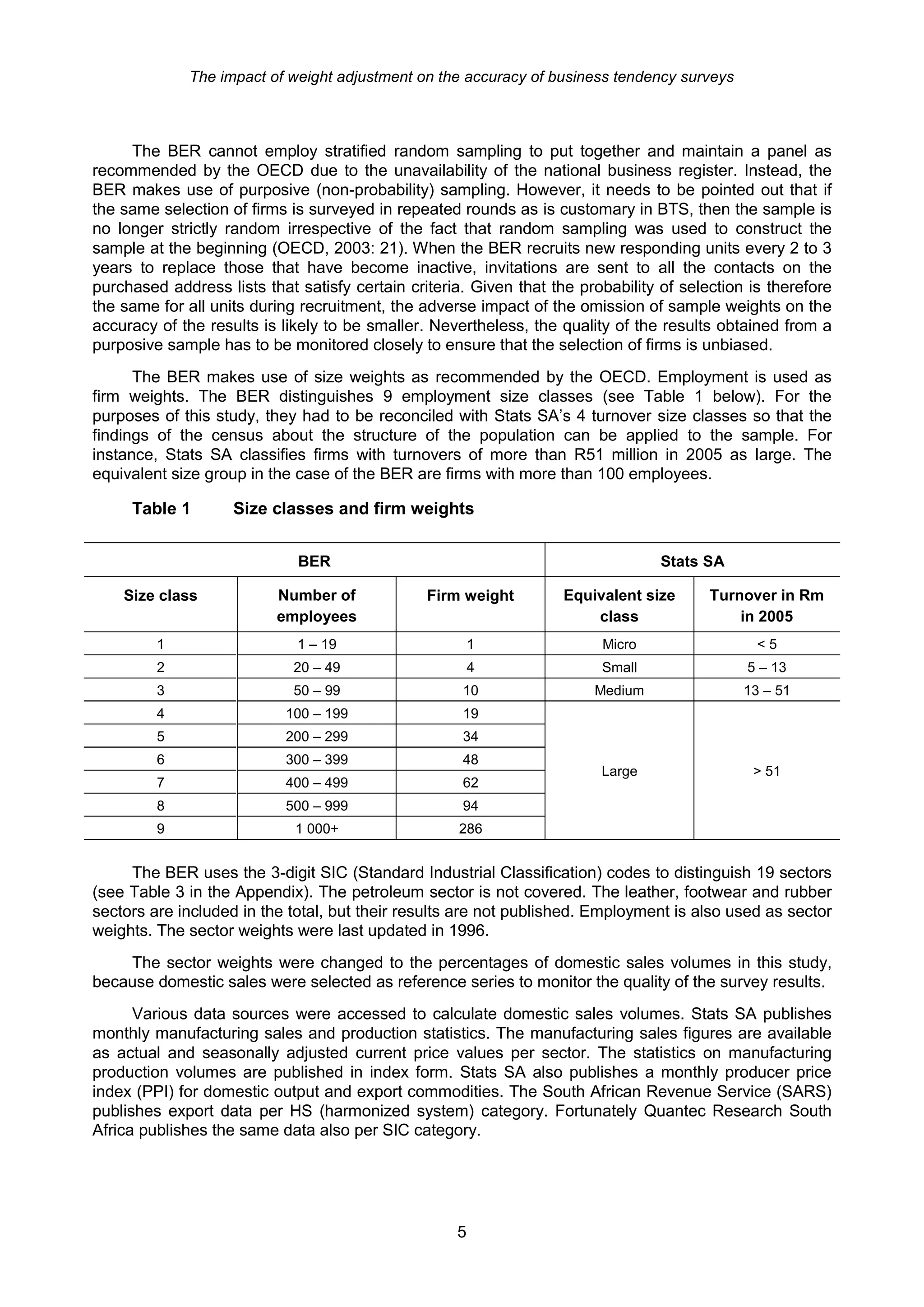

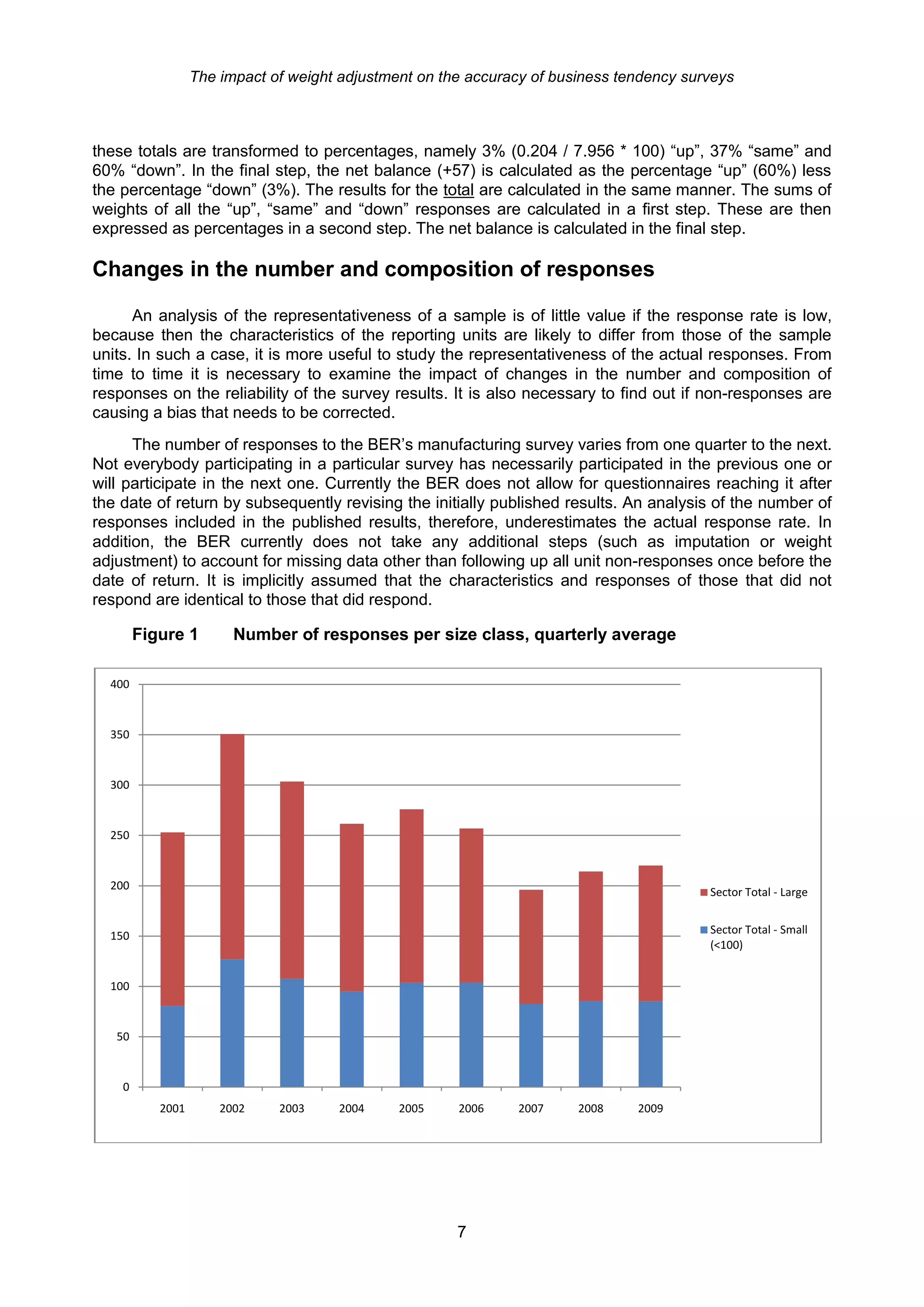

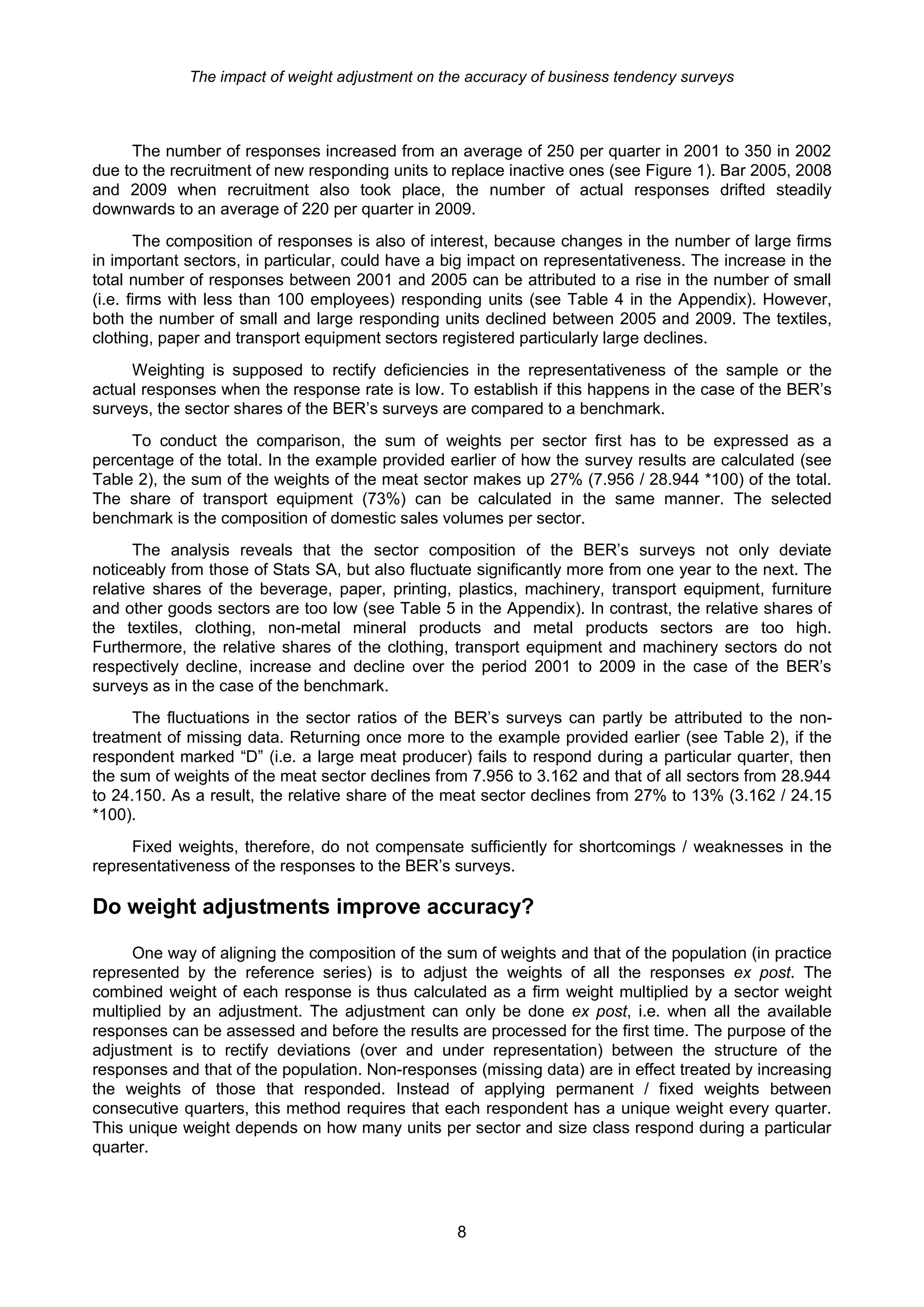

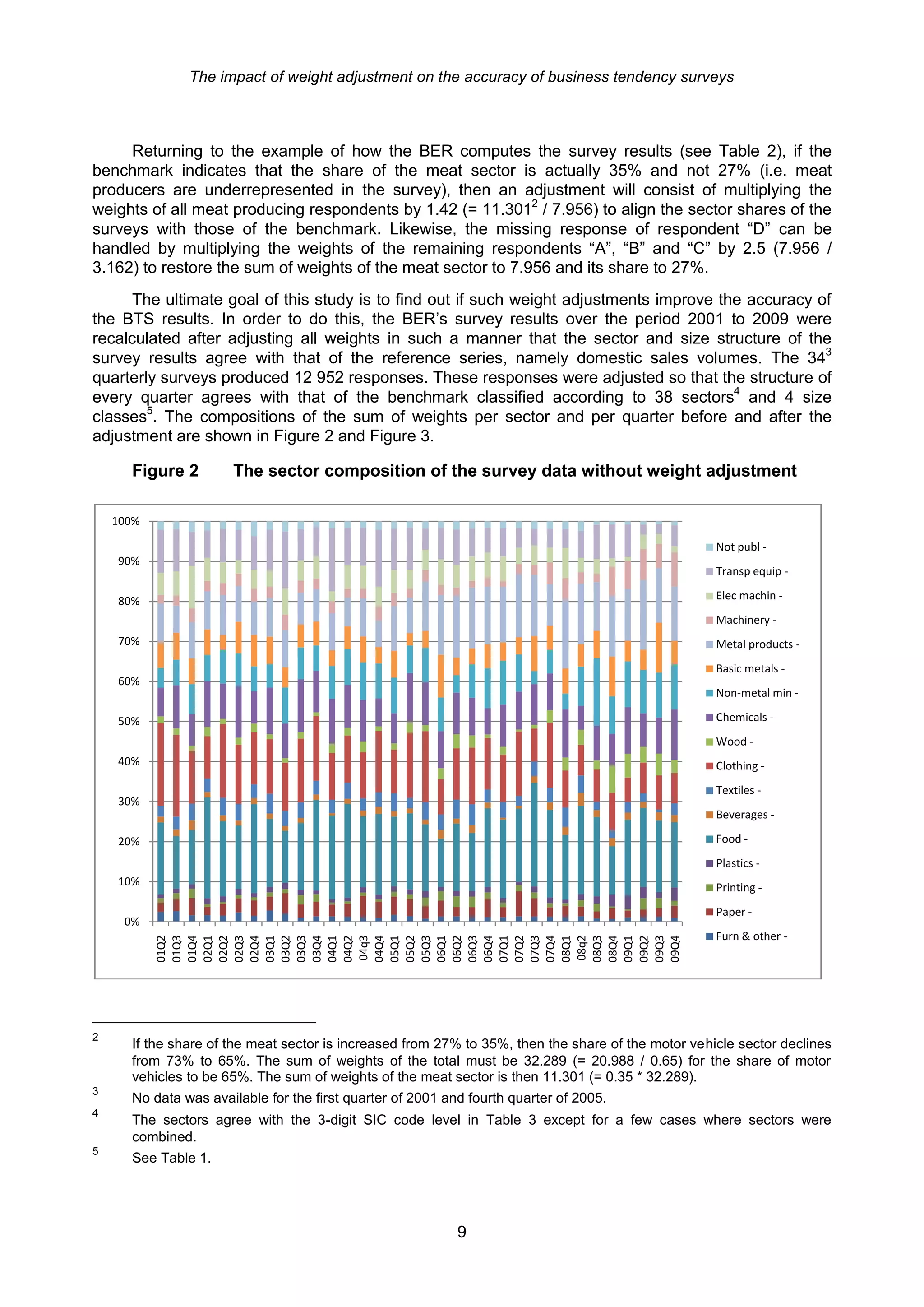

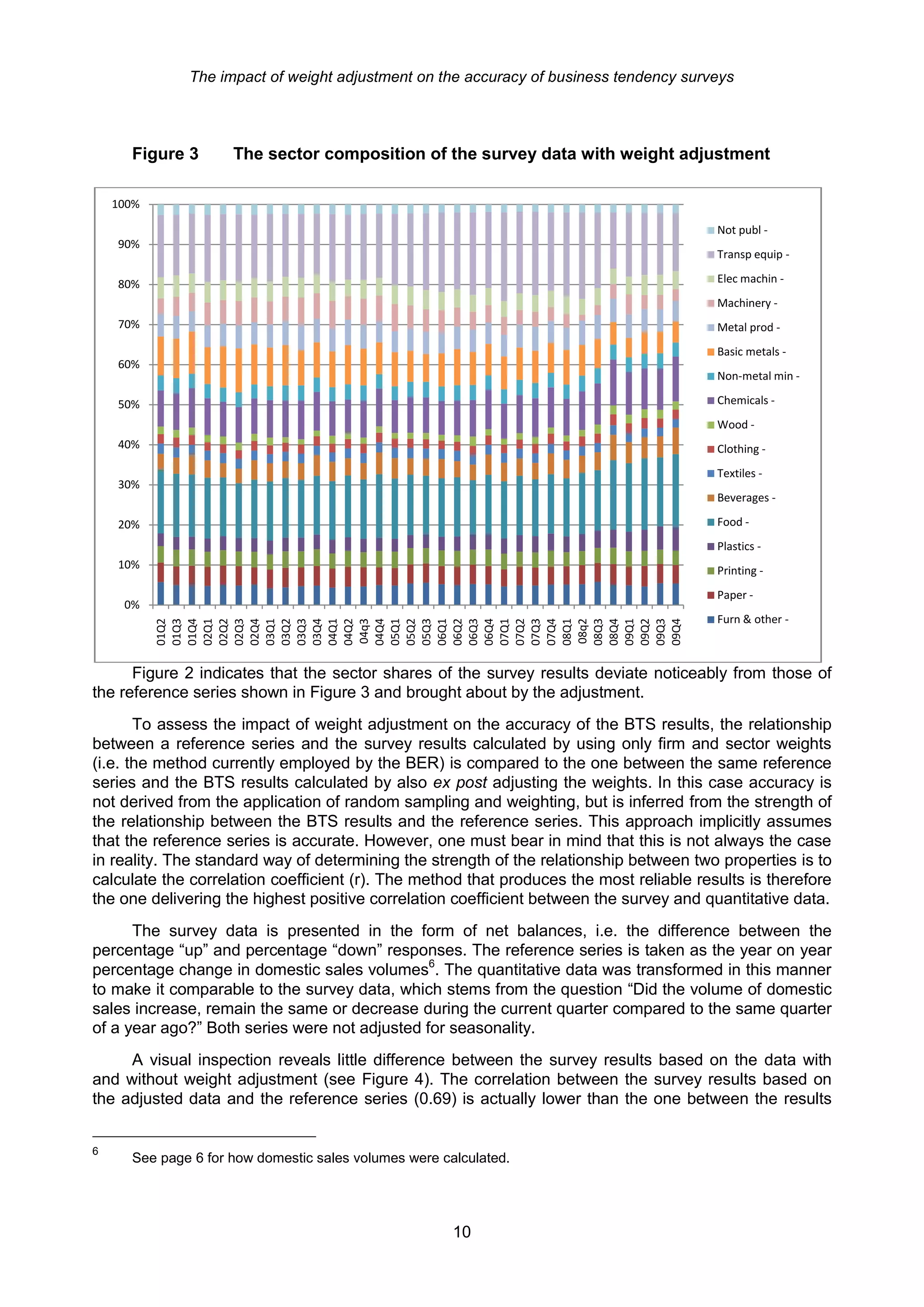

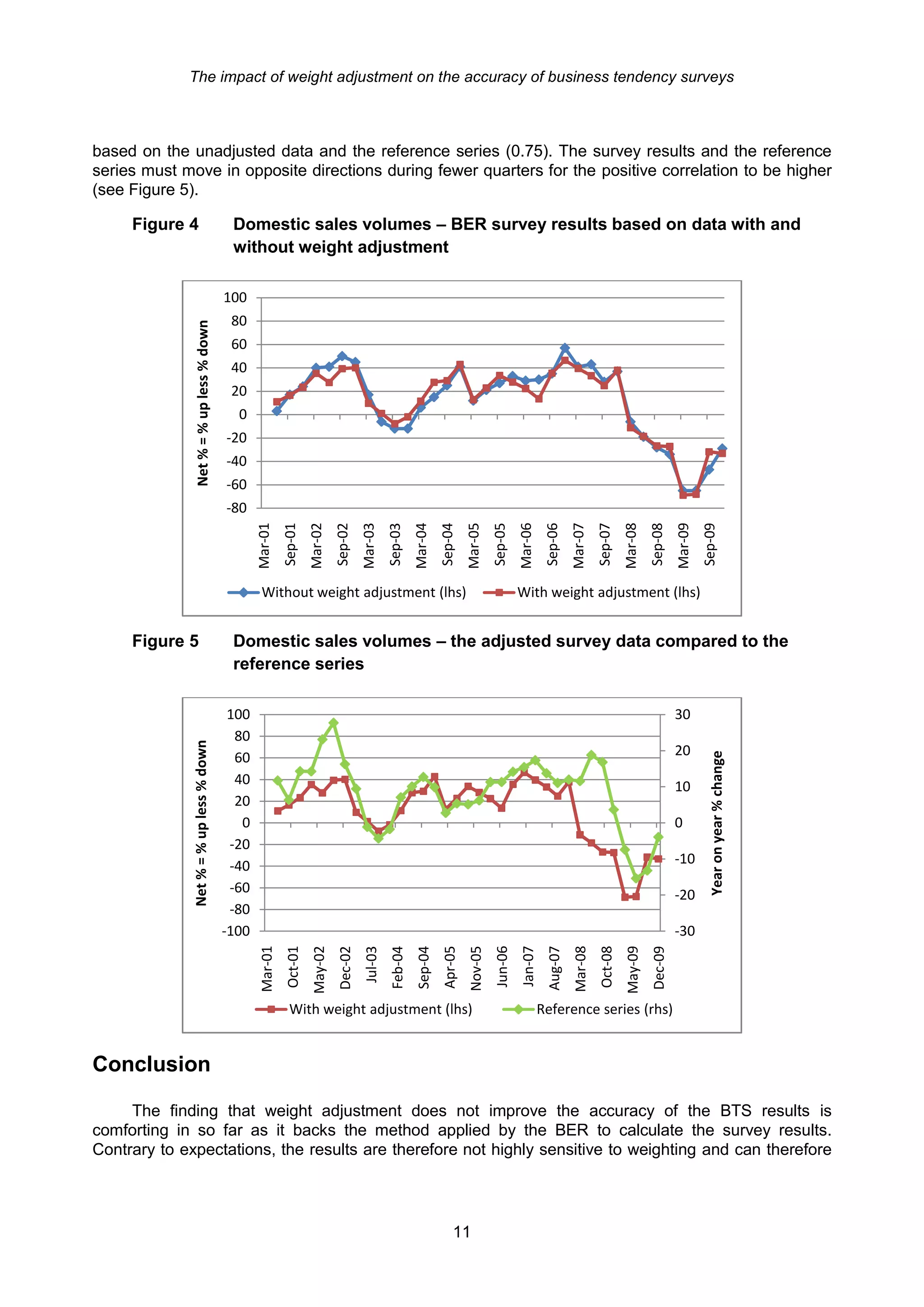

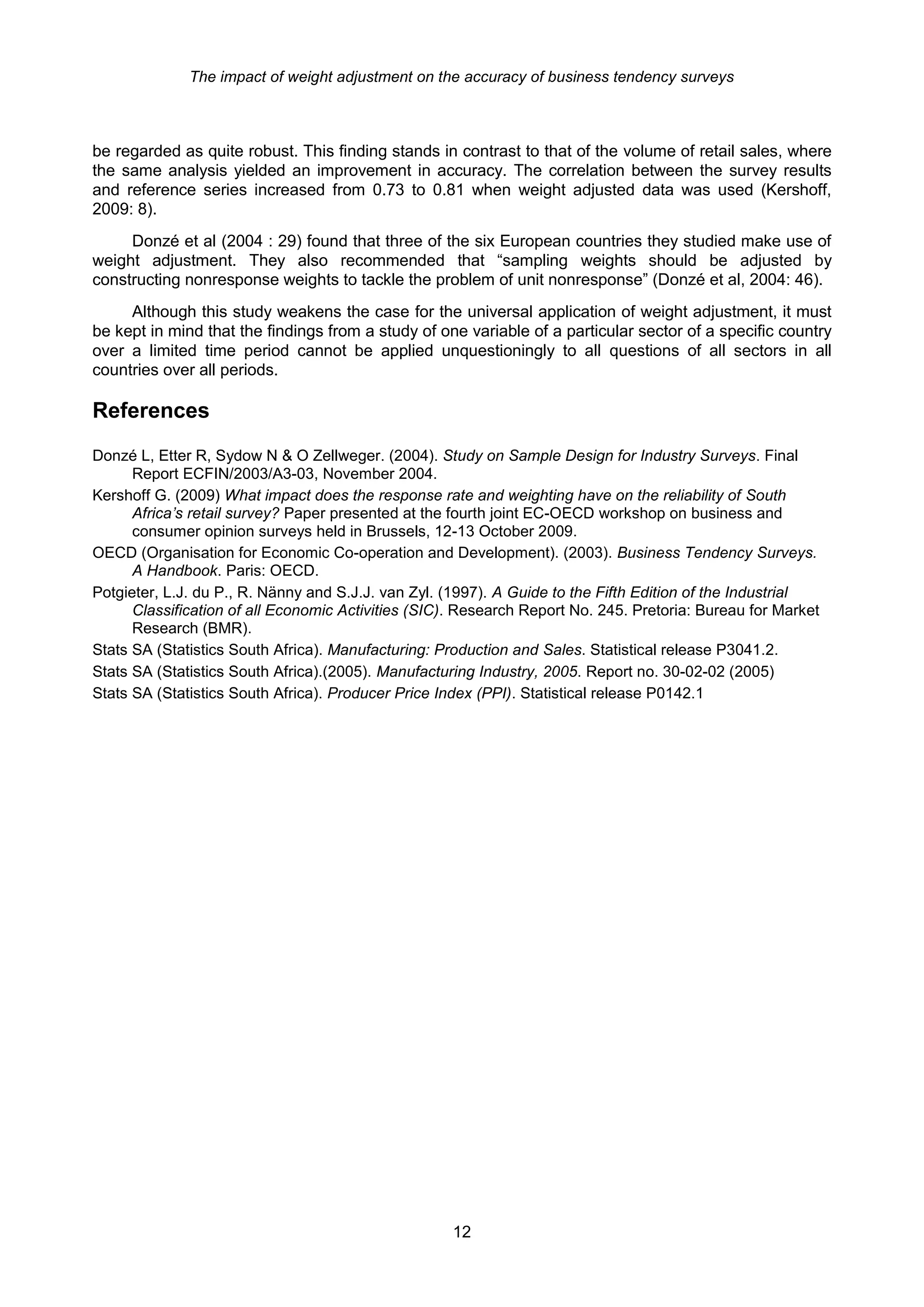

This document analyzes the impact of weight adjustment on the accuracy of business tendency survey (BTS) results in South Africa. It compares BTS results calculated using only firm and sector weights to results calculated with additional ex post weight adjustment. Weight adjustment accounts for non-responses by increasing weights of respondents. The correlation between adjusted-weight results and a reference series is lower than for unadjusted-weight results, suggesting weight adjustment does not improve accuracy. This finding supports the BER's current weighting methodology and indicates BTS results are robust to weighting methods when a business register is unavailable.