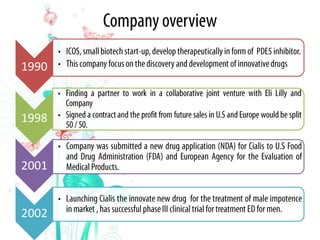

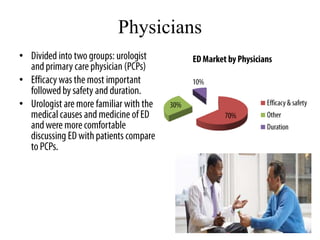

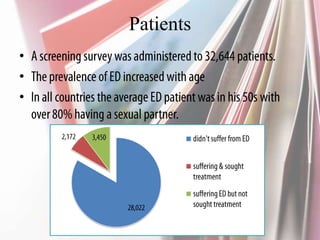

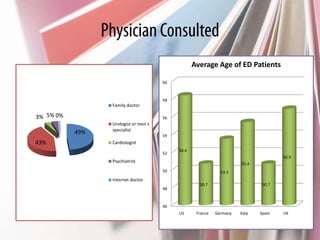

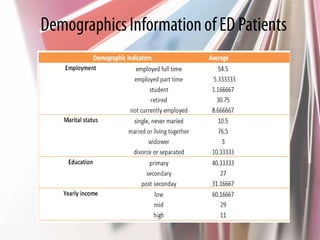

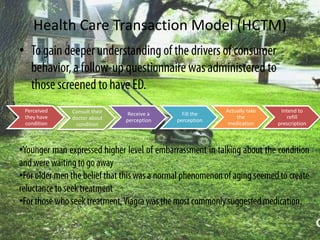

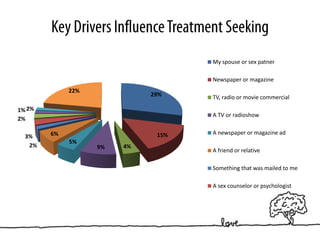

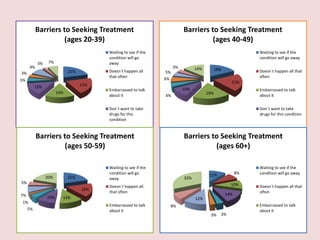

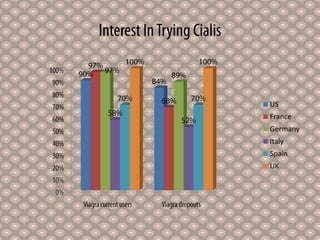

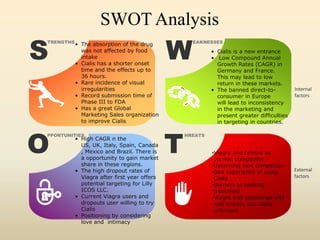

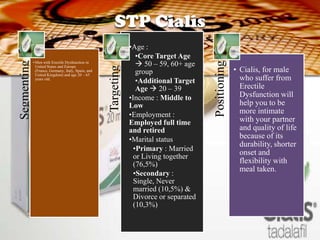

The document provides background information on erectile dysfunction (ED) treatment options and market analysis. It discusses key events and competitors from 1990-2002. An analysis of ED patients' ages across different countries found the average age was highest in the US and UK. Barriers to treatment varied by age, with embarrassment and believing the condition wasn't serious enough being top barriers. A SWOT analysis identified Cialis' strengths as its effects lasting up to 36 hours and fewer side effects, while weaknesses included being a new drug and banned direct-to-consumer advertising in Europe. The document proposes targeting men aged 50-65 with Cialis and positioning it as allowing for more intimacy due to its duration and flexibility. It provides pricing