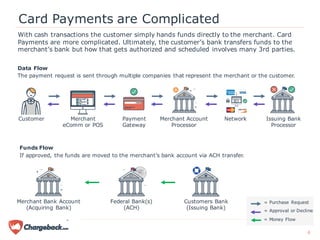

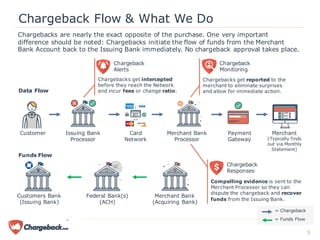

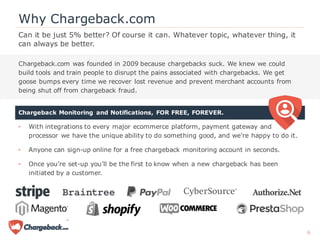

Chargeback.com offers services to help merchants recover lost revenue and protect against chargeback fraud through monitoring, alerts, and comprehensive response strategies. By utilizing integration with various e-commerce platforms and analyzing transaction data, the company aims to subvert the significant financial losses associated with chargebacks, which cost merchants billions annually. Their services focus on intercepting chargebacks before they negatively affect merchant accounts, ensuring timely responses, and improving overall chargeback ratios.

![That’s money back in your account!

Chargeback Responses put lost revenue back in your account. You

decide when you need a response; discounts are available.

No set-up fee - No-commitment - No minimums

*Varies by merchant. Average recovery rates for Large Merchants with 100MM+ Annual Revenue is over 90%

Simple Pricing, Worth Every Penny

Chargebacks Fee per Annual Recovered Revenue @ [Average Transaction Amount] Average

Per Month Response $50 $100 $250 $500 $1,000 ROI

1 $15 $540 $1,080 $2,700 $5,400 $10,800 2280%

10 $10 $5,400 $10,800 $27,000 $54,000 $108,000 3420%

100 $9 $54,000 $108,000 $270,000 $540,000 $1,080,000 3800%

500 $7 $270,000 $540,000 $1,350,000 $2,700,000 $5,400,000 4886%

= = ROI

C * T * 90%*

C * F

Annual Recovered Revenue

Total Fees to Recover

C = Annual Chargebacks, T = Average Transaction Amount, F = Fee per Response, ROI = Return on Investment

8](https://image.slidesharecdn.com/chargebackmangementformerchants-160301070122/85/Chargeback-Mangement-Solutions-for-Merchants-8-320.jpg)