This document discusses letters of credit (L/Cs), which are payment mechanisms used in international trade that involve banks. It covers:

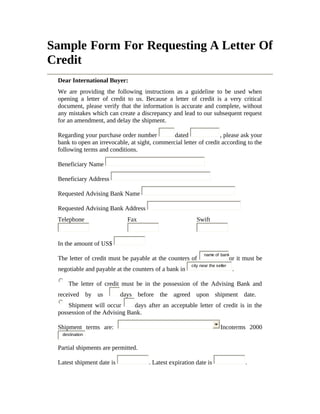

- The key parties in an L/C transaction are the buyer (applicant), seller (beneficiary), issuing bank, and advising/confirming bank. Each party has specific responsibilities.

- An L/C is a payment undertaking from an issuing bank to a beneficiary, on behalf of an applicant/buyer, to pay a specified amount if the beneficiary presents complying documents by a deadline.

- L/Cs have characteristics like negotiability, meaning the issuing bank is obligated to pay not just the beneficiary but banks nominated by them. They