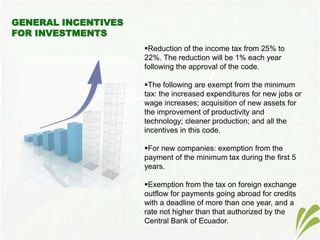

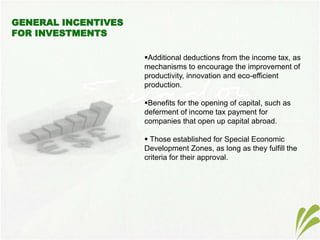

The National Government of Ecuador has established an ethical economy policy through regulations that promote entrepreneurial activities while respecting the environment, workers, and society. Key aspects of the new policy include a gradual reduction of the income tax rate, tax exemptions for new companies and investments in priority sectors like agriculture and renewable energy, deductions for productivity improvements, and benefits for special economic development zones to attract investment. The goal is to foster sustainable and inclusive economic growth through innovative tax policies and incentives.