This document provides an overview of simultaneous equation models. Some key points:

- Simultaneous equation models account for relationships where one variable is determined by others, which are also determined by the first variable (two-way relationship).

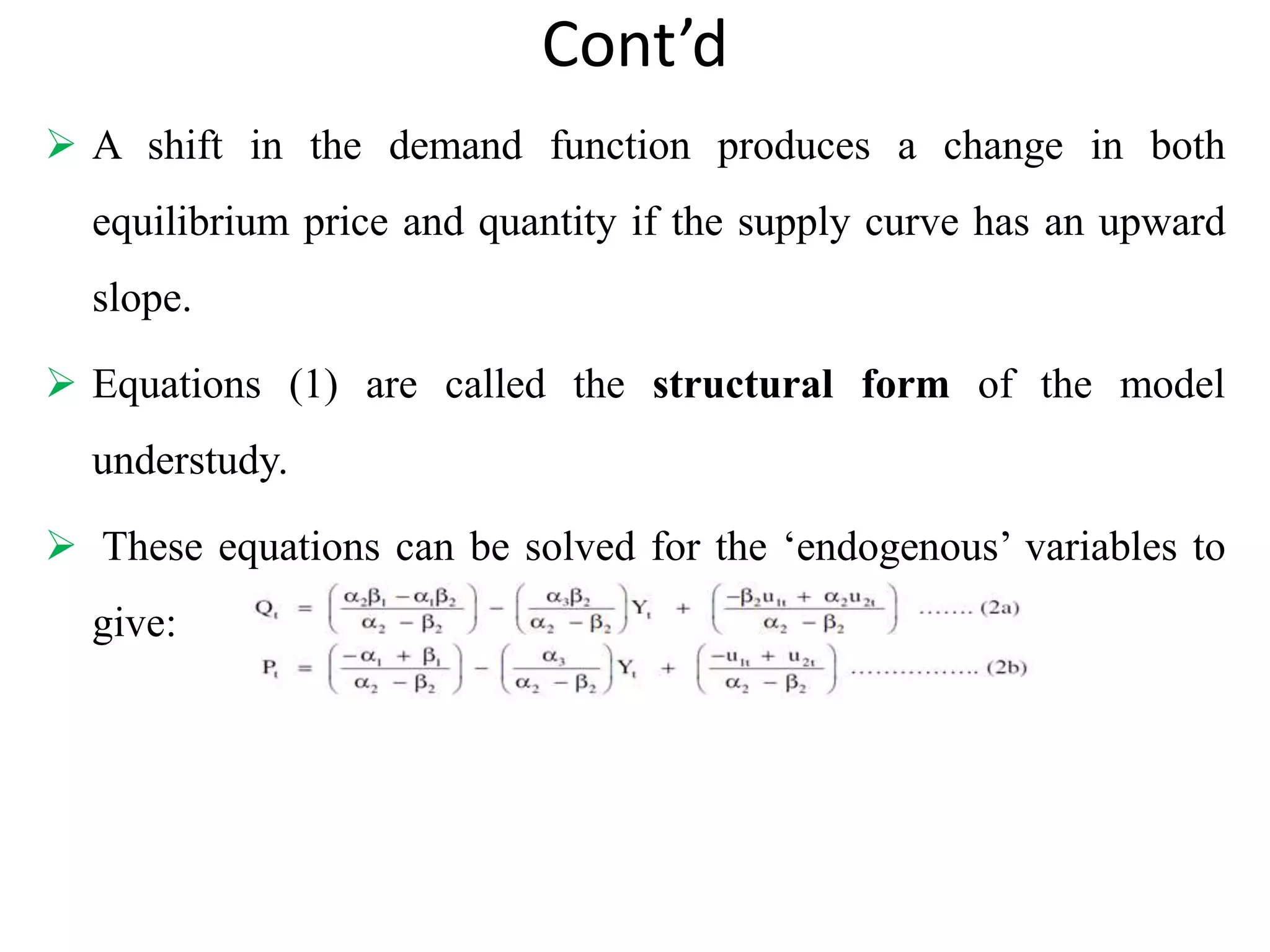

- They consist of multiple equations, with one for each endogenous (jointly determined) variable. The parameters cannot be estimated by looking at single equations.

- Reduced form equations express the endogenous variables solely in terms of exogenous variables and error terms. This allows consistent estimation of coefficients using OLS.

- Identification concerns whether the structural form parameters can be uniquely determined from the reduced form parameters. Exact, over- or under-identification can occur.