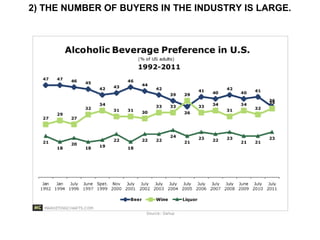

The document discusses conducting a feasibility analysis before starting a new business. It explains that a feasibility analysis answers whether an idea is viable and consists of three parts: an industry and market analysis, a product or service analysis, and a financial analysis. The industry and market analysis assesses attractiveness using Porter's Five Forces model to evaluate competition, suppliers, buyers, potential entrants and substitutes. It also identifies potential market niches.