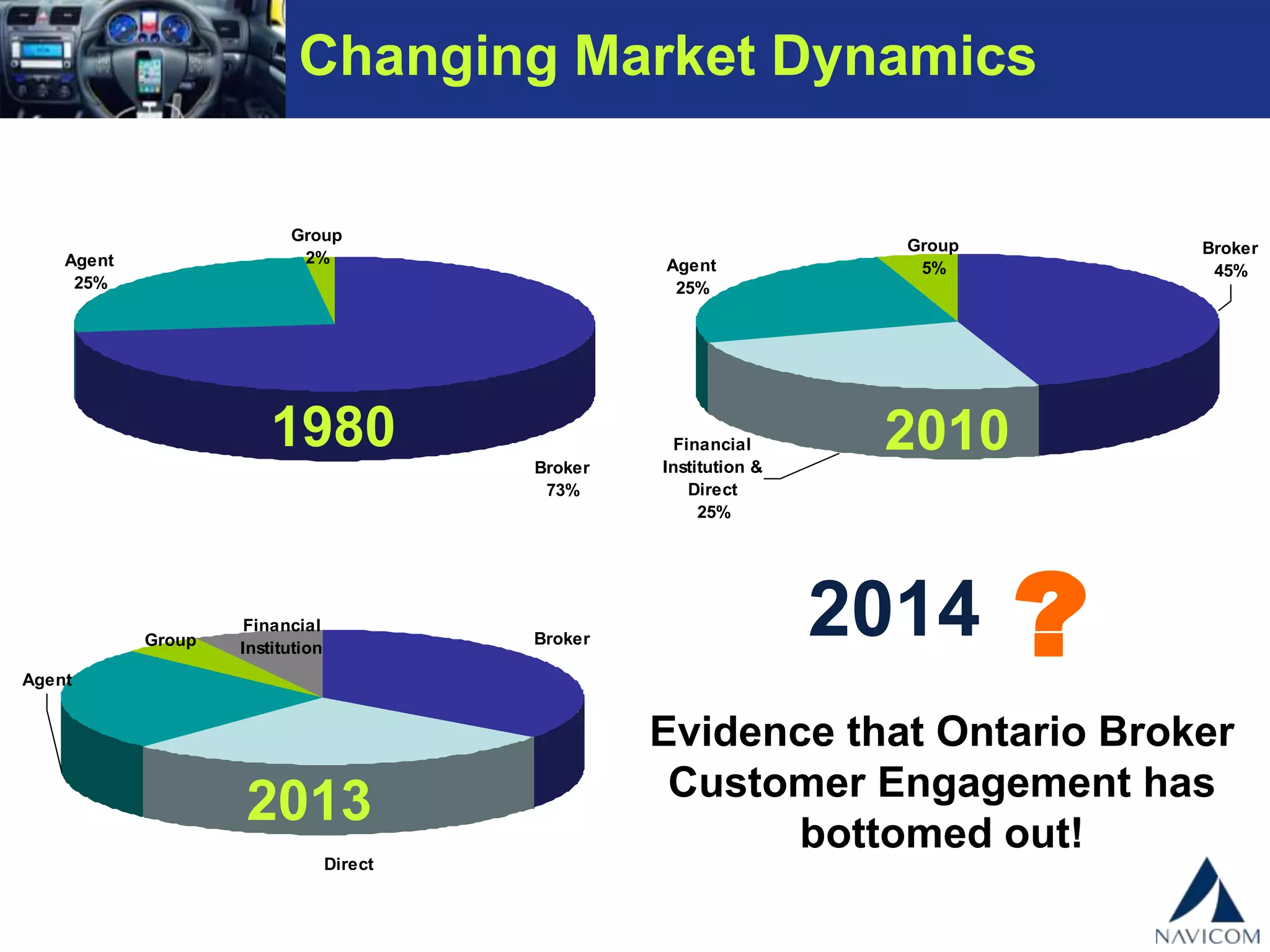

This document summarizes a panel discussion on how the insurance industry in Canada is changing in response to shifts in consumer expectations and behavior. The panelists, who represent different brokerages, discuss how their businesses have reinvented themselves to focus on personalized, digital customer experiences. They note barriers to change, the importance of innovation and collaboration, and how hiring practices and budgets now reflect a priority on technology over traditional marketing. The panel aims to provide guidance to other brokers on successfully adapting to remain relevant and competitive in the new industry landscape.