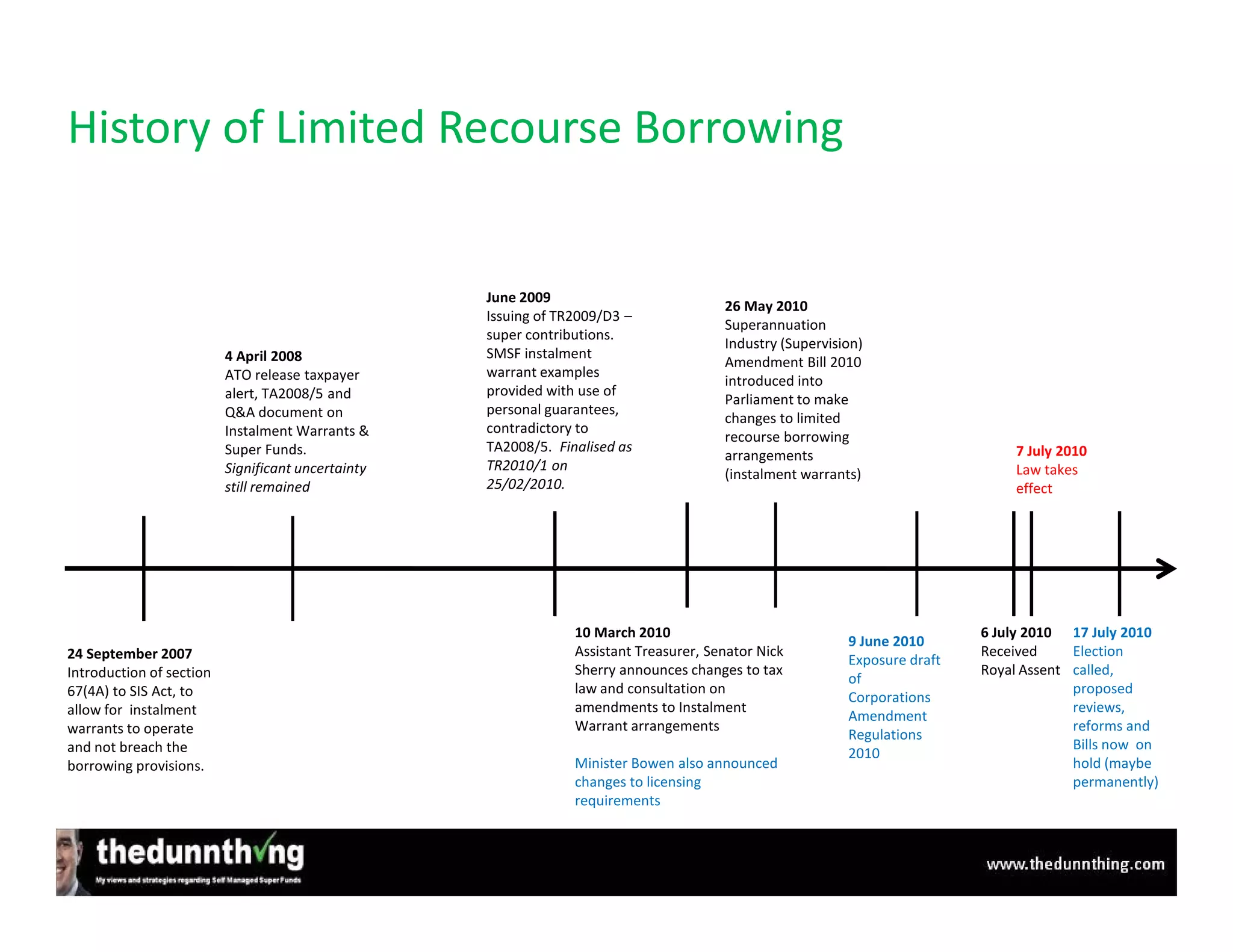

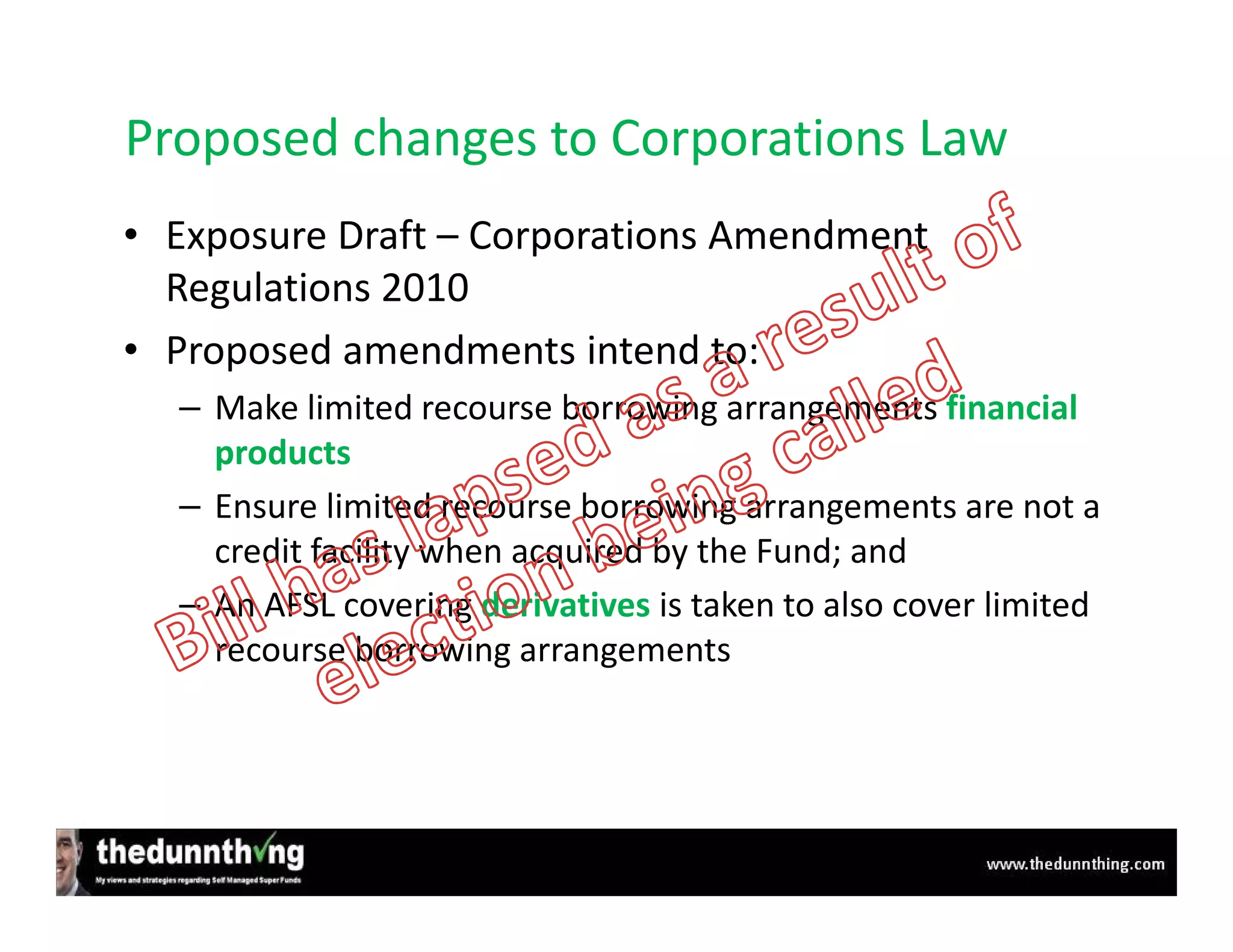

The document summarizes proposed changes to limited recourse borrowing arrangements for self-managed superannuation funds in Australia. Key points include:

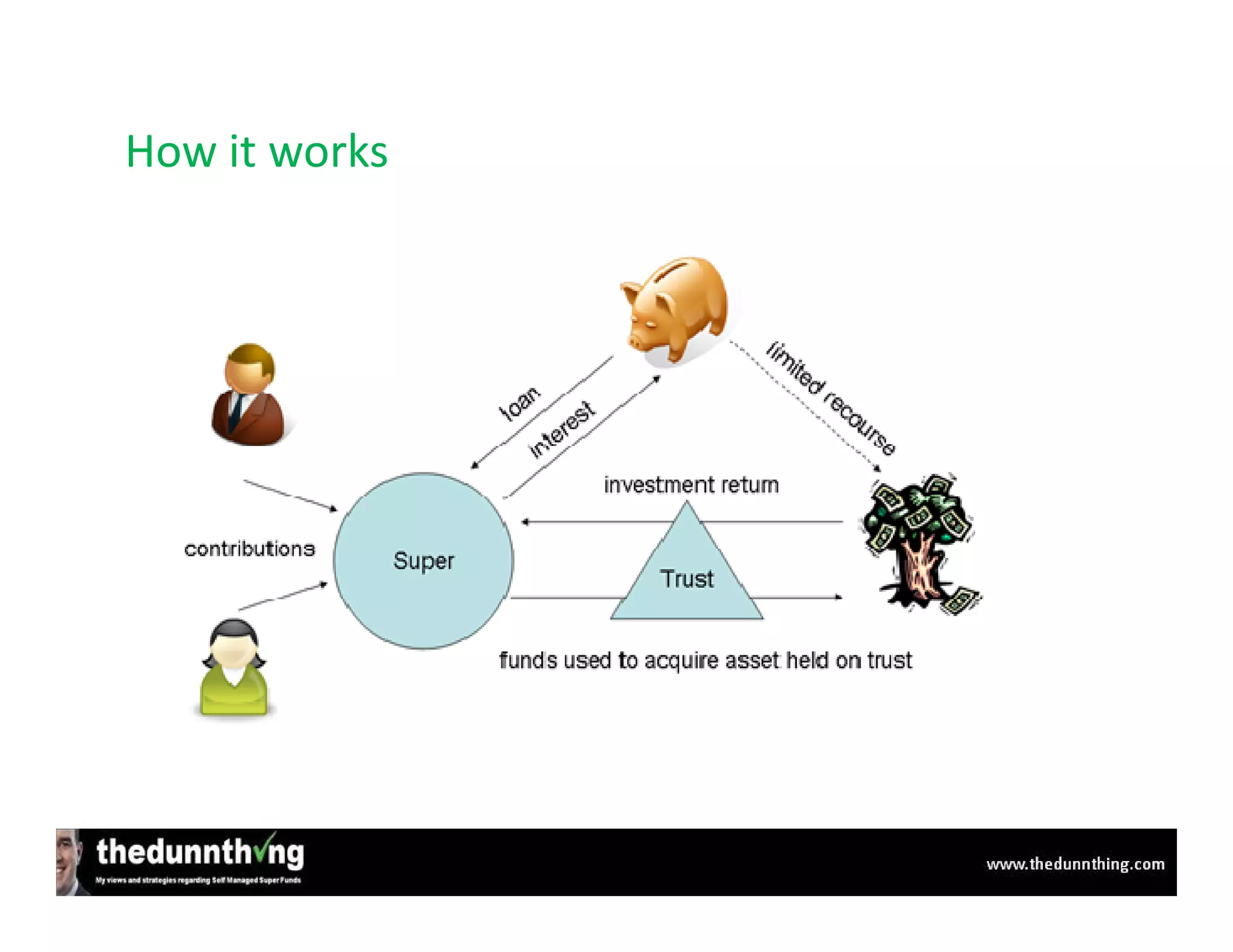

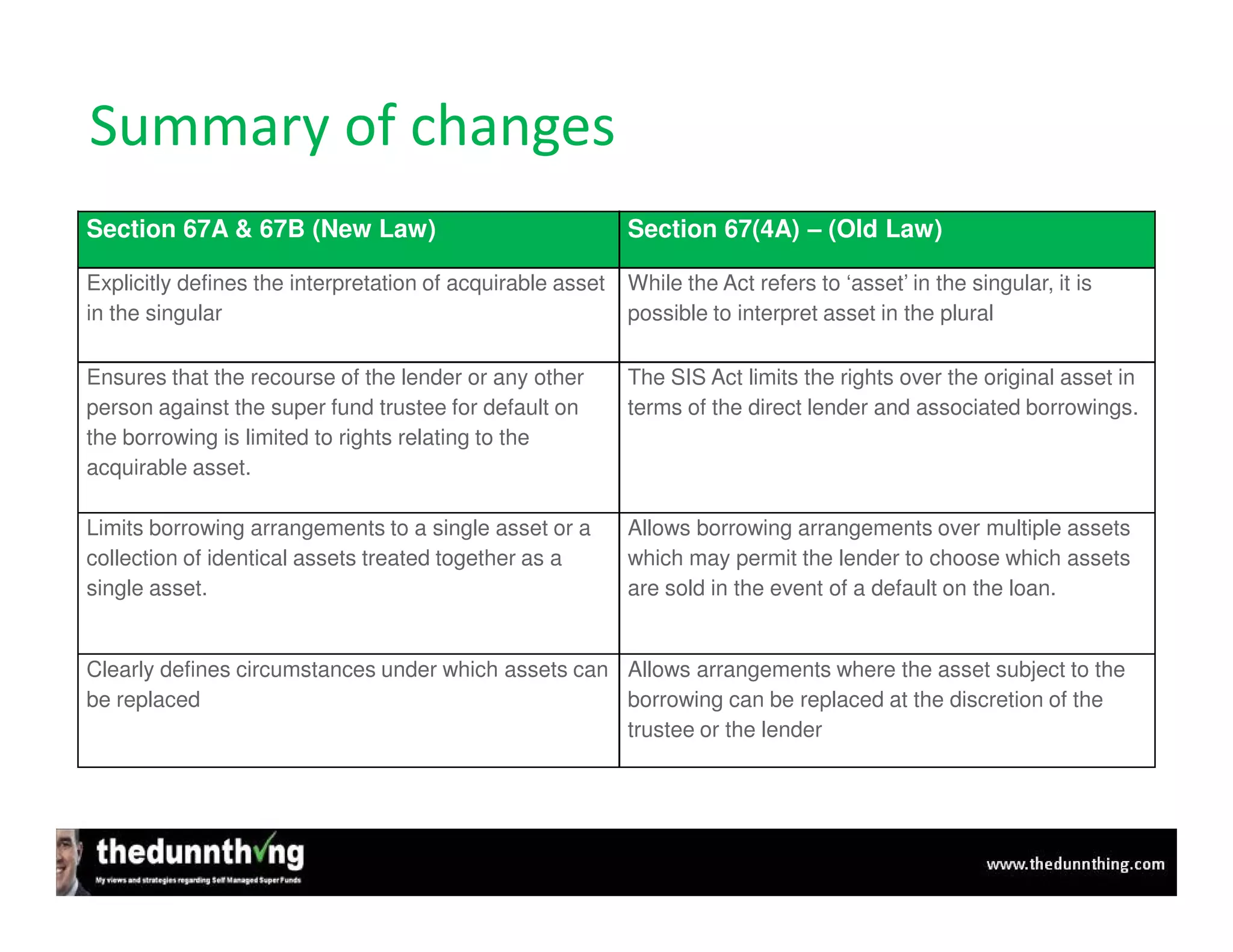

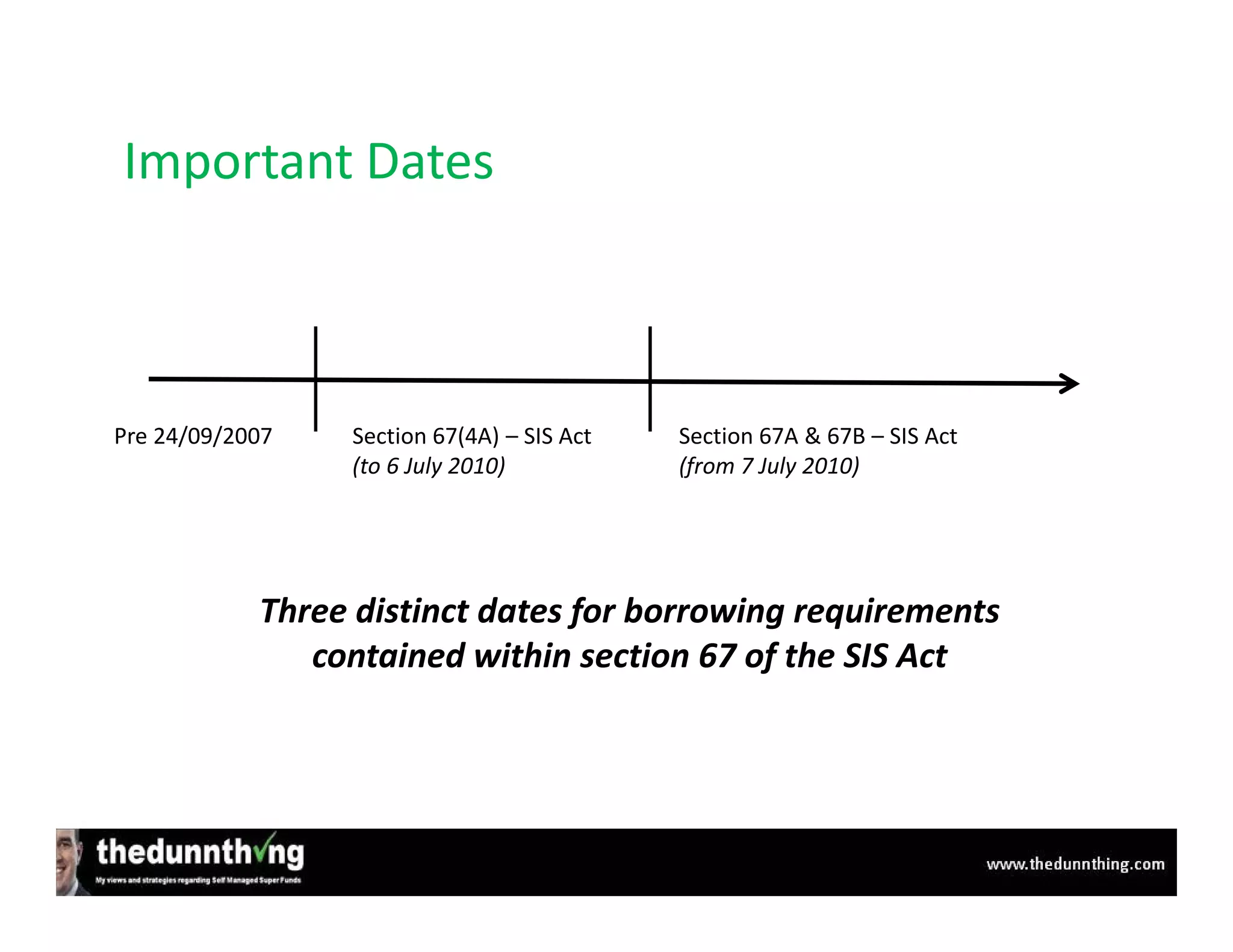

- Sections 67A and 67B were introduced to the Superannuation Industry Supervision Act to replace section 67(4A) and explicitly define limited recourse borrowing arrangements.

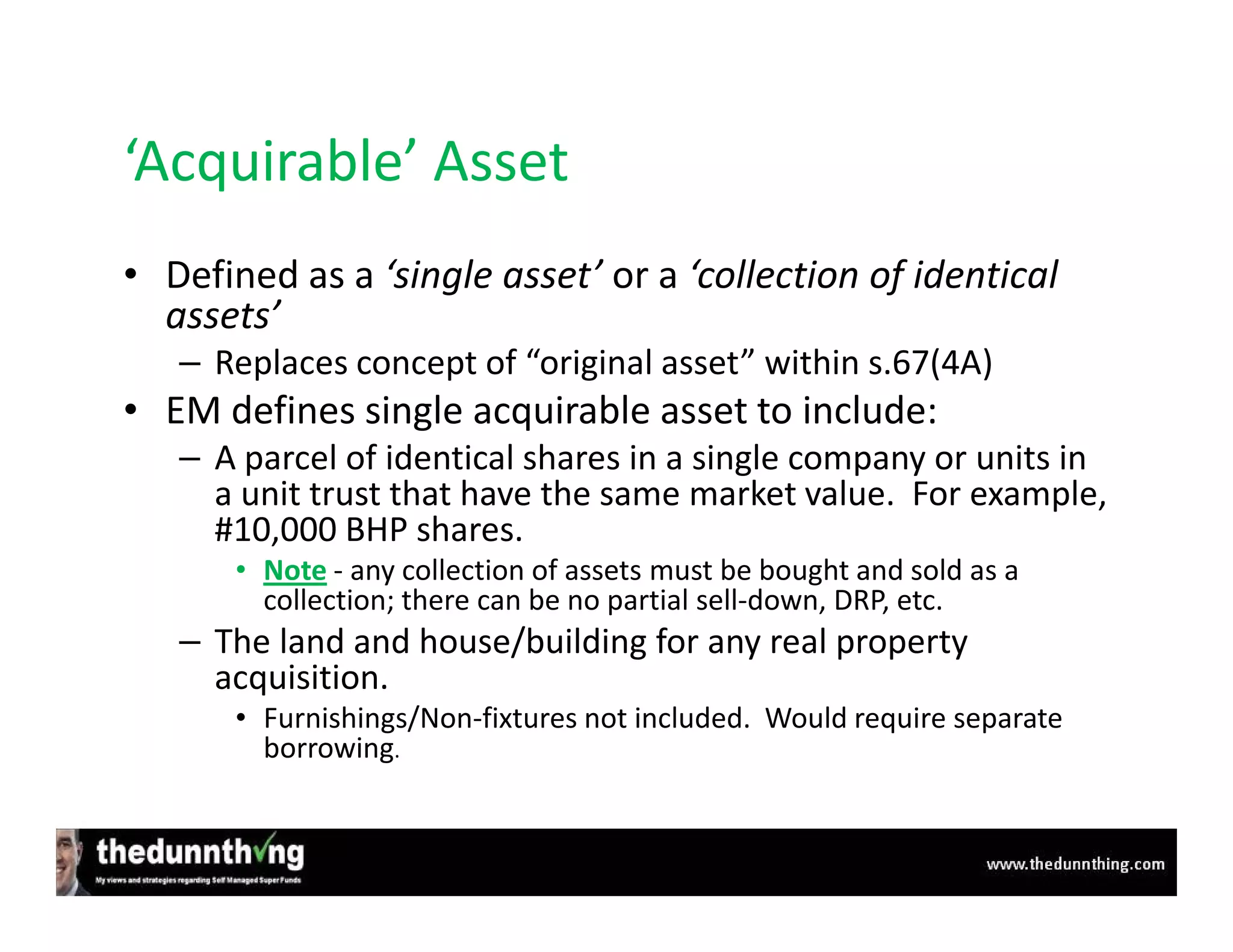

- Under the new law, borrowing must be for a single acquirable asset or collection of identical assets, limiting rights of recourse to just the acquirable asset(s).

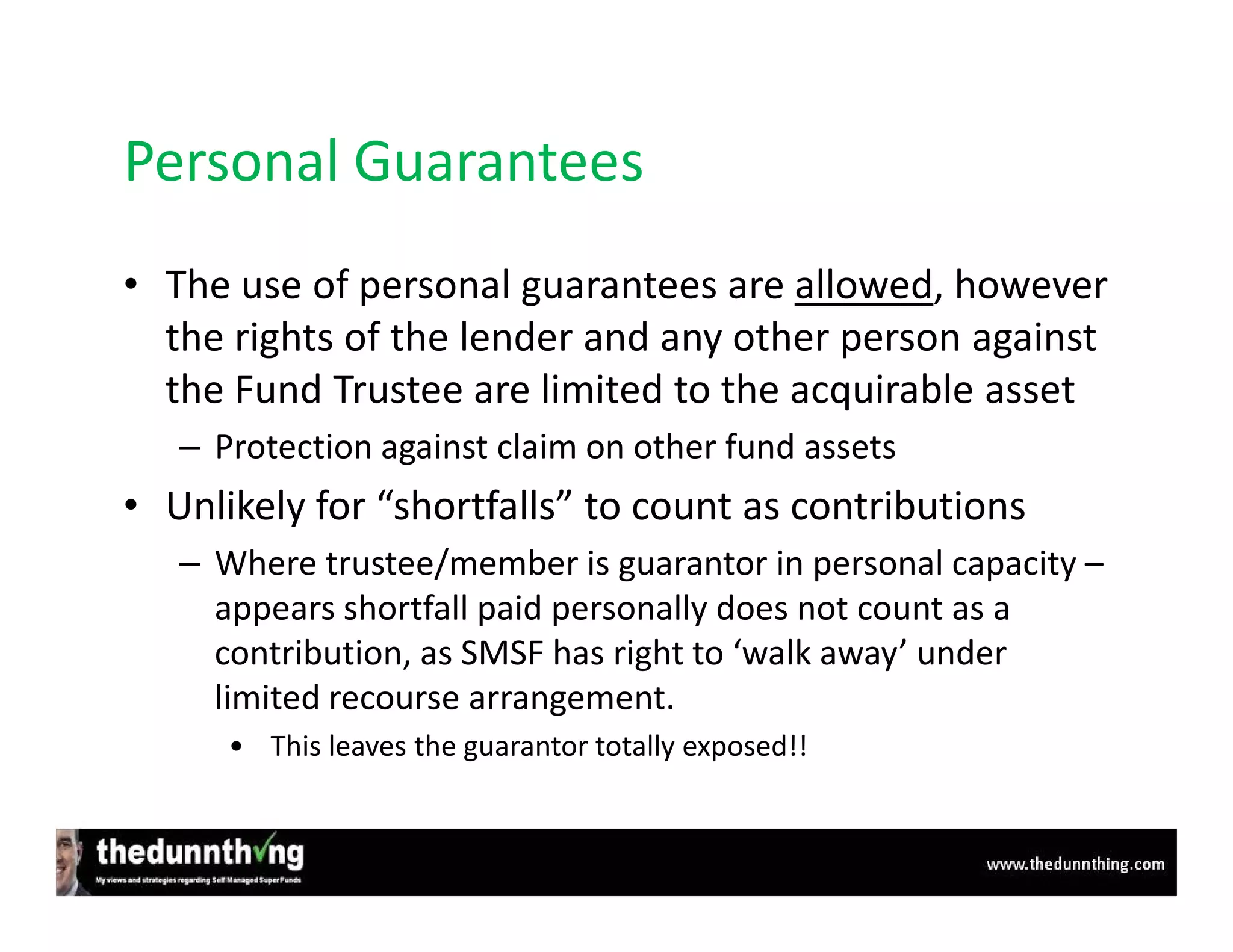

- Personal guarantees are allowed but rights of the lender are still limited to the acquirable asset(s), protecting other fund assets.

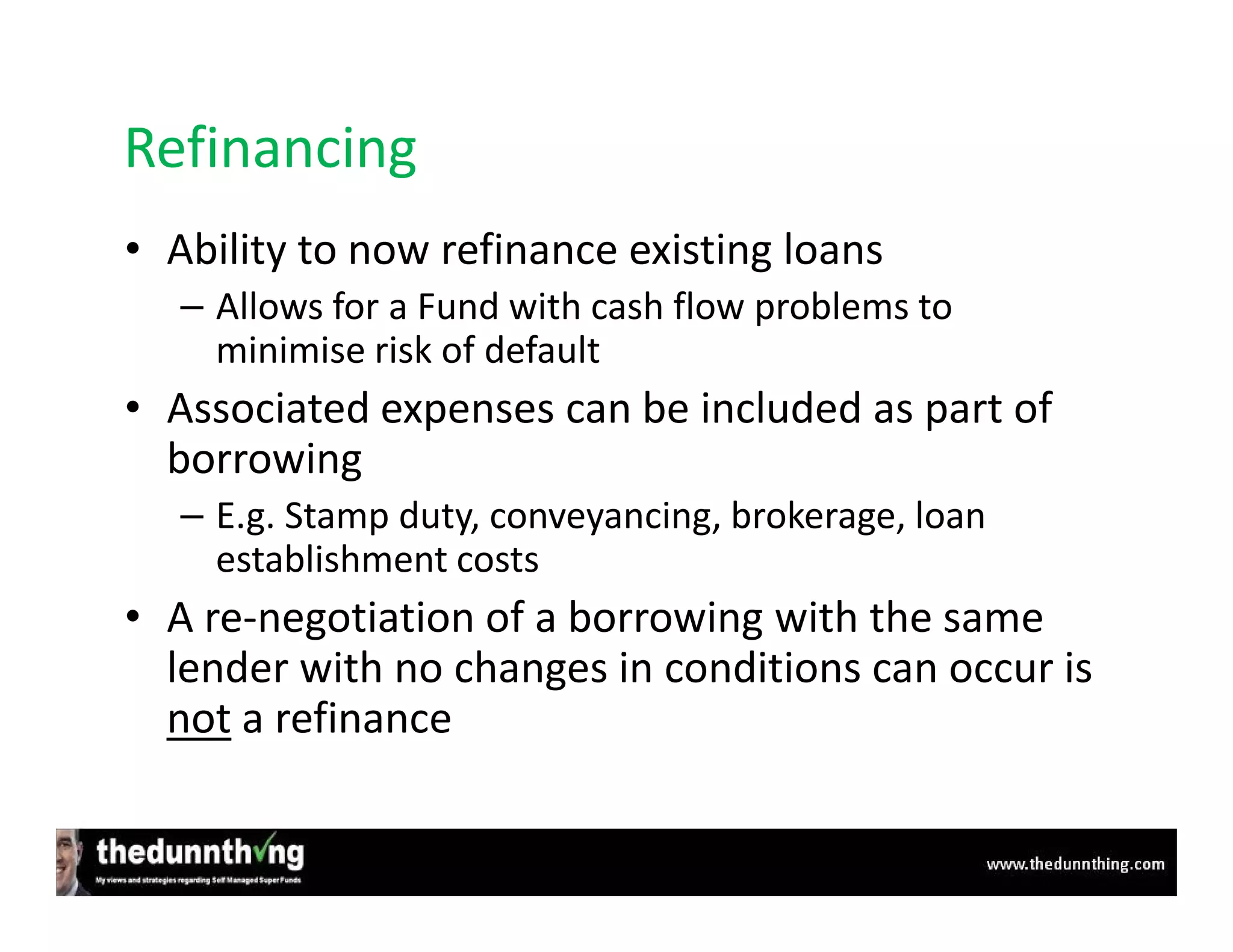

- The new law allows for refinancing and replacement