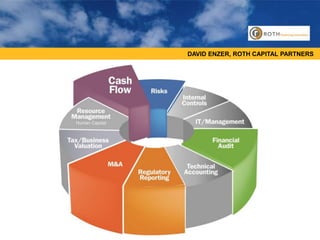

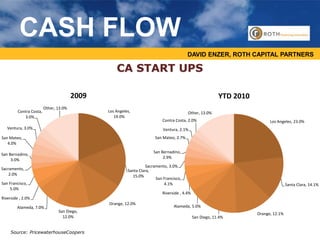

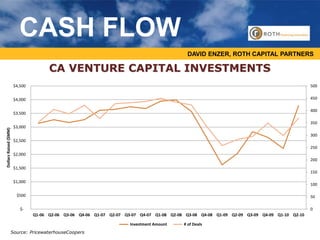

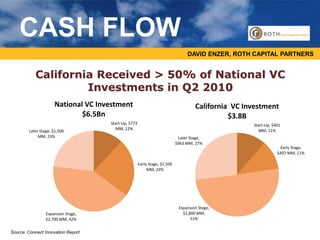

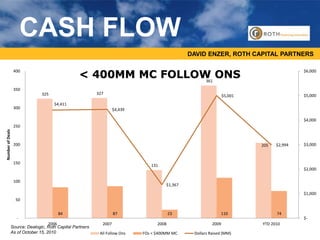

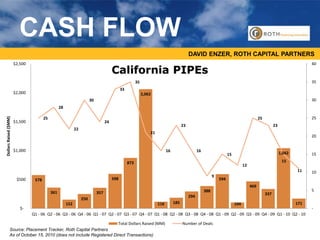

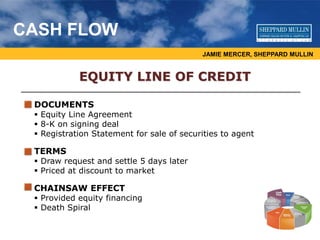

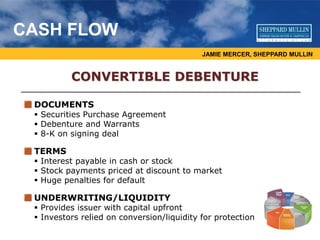

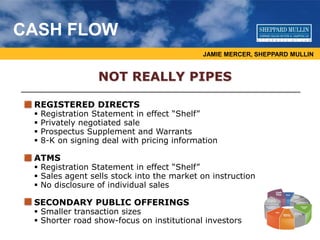

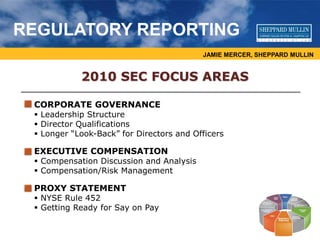

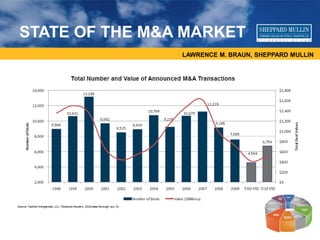

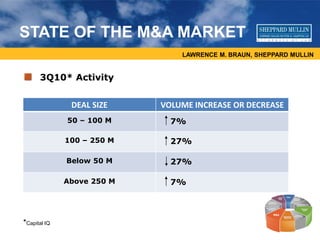

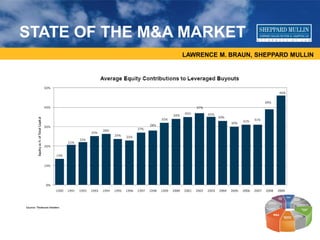

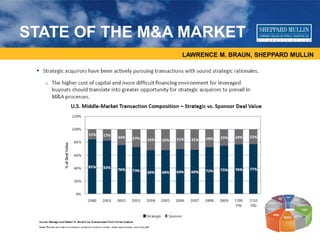

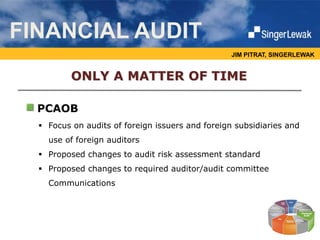

The document discusses a panel discussion on business risks and financing trends for California companies. The panelists include professionals from SingerLewak LLP, ROTH Capital Partners, and Sheppard Mullin law firm. Troy Snyder from SingerLewak discusses the top 10 business risks, including emerging markets, talent management, economic recovery concerns, access to credit, and increased regulation. David Enzer from ROTH Capital Partners reviews venture capital and financing trends in California. Jamie Mercer from Sheppard Mullin discusses recent trends in private investment in public equity (PIPE) deals and other financing structures. The panel then discusses regulatory reporting requirements and M&A activity.