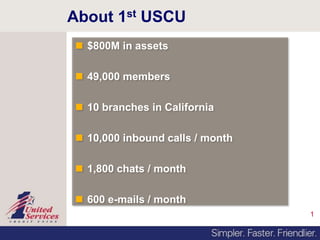

The document discusses a credit union with $800 million in assets and 49,000 members, facing challenges in service delivery and adapting to a younger demographic. To improve performance and member satisfaction, they implemented Fonolo’s call-back software, resulting in significant reductions in abandoned calls and generating $3.2 million in new loans. Feedback from agents and members indicates high satisfaction with the new system's ease of use.