Case Week 7 Carrie Miller

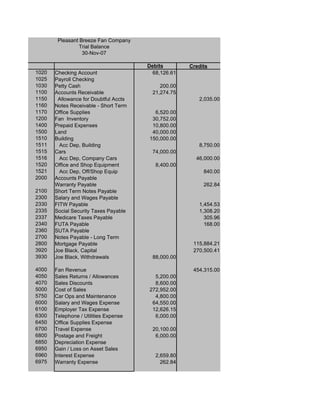

- 1. Pleasant Breeze Fan Company Trial Balance 30-Nov-07 Debits Credits 1020 Checking Account 68,126.61 1025 Payroll Checking 1030 Petty Cash 200.00 1100 Accounts Receivable 21,274.75 1150 Allowance for Doubtful Accts 2,035.00 1160 Notes Receivable - Short Term 1170 Office Supplies 6,520.00 1200 Fan Inventory 30,752.00 1400 Prepaid Expenses 10,800.00 1500 Land 40,000.00 1510 Building 150,000.00 1511 Acc Dep, Building 8,750.00 1515 Cars 74,000.00 1516 Acc Dep, Company Cars 46,000.00 1520 Office and Shop Equipment 8,400.00 1521 Acc Dep, Off/Shop Equip 840.00 2000 Accounts Payable Warranty Payable 262.84 2100 Short Term Notes Payable 2300 Salary and Wages Payable 2330 FITW Payable 1,454.53 2335 Social Security Taxes Payable 1,308.20 2337 Medicare Taxes Payable 305.96 2340 FUTA Payable 168.00 2360 SUTA Payable 2700 Notes Payable - Long Term 2800 Mortgage Payable 115,884.21 3920 Joe Black, Capital 270,500.41 3930 Joe Black, Withdrawals 88,000.00 4000 Fan Revenue 454,315.00 4050 Sales Returns / Allowances 5,200.00 4070 Sales Discounts 8,600.00 5000 Cost of Sales 272,952.00 5750 Car Ops and Maintenance 4,800.00 6000 Salary and Wages Expense 64,550.00 6100 Employer Tax Expense 12,626.15 6300 Telephone / Utilities Expense 6,000.00 6450 Office Supplies Expense 6700 Travel Expense 20,100.00 6800 Postage and Freight 6,000.00 6850 Depreciation Expense 6950 Gain / Loss on Asset Sales 6960 Interest Expense 2,659.80 6975 Warranty Expense 262.84

- 2. 901,824.15 901,824.15

- 3. Pleasant Breeze Fan Company Worksheet 31-Dec-07 Trial Balance Adjustments Adj. Trial Balance Income Statement Balance Sheet Debits Credits Debits Credits Debits Credits Debits Credits Debits Credits 1020 Checking Account 69,741.41 69741.41 69741.41 1025 Payroll Checking 0.00 0.00 0.00 1030 Petty Cash 200.00 200.00 200.00 1100 Accounts Receivable 20,912.50 2318.75 18593.75 18593.75 1150 Allowance for Doubtful Accts 2,035.00 2318.75 818.38 534.63 534.63 1160 Notes Receivable - Short Term 3,237.50 3237.50 3237.50 1170 Office Supplies 6,520.00 6445.00 75.00 75.00 1200 Fan Inventory 18,744.42 308.00 18436.42 18436.42 1400 Prepaid Expenses 10,800.00 3900.00 6900.00 6900.00 1500 Land 40,000.00 40000.00 40000.00 1510 Building 150,000.00 150000.00 150000.00 1511 Acc Dep, Building 8,750.00 3500.00 12250.00 12250.00 1515 Cars 78,000.00 78000.00 78000.00 1516 Acc Dep, Company Cars 38,720.00 7990.00 46710.00 46710.00 1520 Office and Shop Equipment 8,400.00 8400.00 8400.00 1521 Acc Dep, Off/Shop Equip 840.00 3024.00 3,864.00 3,864.00 2000 Accounts Payable 8,370.00 8,370.00 8,370.00 2010 Warranty Payable 262.84 506.29 769.13 769.13 2100 Short Term Notes Payable 2300 Salary and Wages Payable 3685.68 3,685.68 3,685.68 2330 Federal Income Tax Payable 414.65 414.65 414.65 2335 Social Security Tax Payable 550.56 550.56 550.56 2337 Medicare Tax Payable 128.76 128.76 128.76 2340 FUTA Payable 182.40 6.00 188.40 188.40 2360 SUTA Payable 72.00 30.00 102.00 102.00 2700 Notes Payable - Long Term 25,200.00 25,200.00 25,200.00 2800 Mortgage Payable 115,636.32 115,636.32 115,636.32 3920 Joe Black, Capital 270,500.41 270,500.41 270,500.41 3930 Joe Black, Withdrawals 96,000.00 96000.00 96000.00 4000 Fan Revenue 493,016.25 493,016.25 493016.25 4020 Interest Revenue 144.68 3.60 148.28 148.28 4050 Sales Returns / Allowances 5,445.00 5445.00 5445.00 4070 Sales Discounts 9,095.25 9095.25 9095.25 5000 Cost of Sales 300,402.00 308.00 300710.00 300710.00 5750 Car Ops and Maintenance 4,800.00 4800.00 4800.00 6000 Salary and Wages Expense 82,900.00 4439.99 87339.99 87339.99 6100 Employer Tax Expense 14,116.33 375.66 14491.99 14491.99 6300 Telephone / Utilities Expense 6,710.00 6710.00 6710.00 6450 Office Supplies Expense 168.00 6445.00 6613.00 6613.00 6700 Travel Expense 21,195.00 21195.00 21195.00

- 4. 6800 Postage and Freight 6,157.00 6157.00 6157.00 6850 Depreciation Expense 3,250.00 14514.00 17764.00 17764.00 6950 Gain / Loss on Asset Sales 2,970.00 2970.00 2970.00 6960 Interest Expense 3,142.65 530.12 3672.77 3672.77 6975 Professional & Bank Service Fees 560.00 560.00 560.00 7000 Warranty Expense 262.84 506.29 769.13 769.13 963,729.90 963,729.90 1165 Interest Receivable 3.60 3.60 3.60 2020 Interest Payable 530.12 530.12 530.12 7020 Insurance Expense 2700.00 2700.00 2700.00 7030 Warehouse Expense 1200.00 1200.00 1200.00 7040 Bad Debt Expense 818.38 818.38 818.38 34159.79 34159.79 982599.19 982599.19 493011.51 493164.53 489587.68 489434.66 153.02 153.02 493164.53 493164.53 489587.68 489587.68

- 5. General Journal for Pleasant Breeze Fan Company REQUIREMENT #1: Prepare journal entries to record the December transactions in the General Journal below. General Journal Date Description(Account Name) Debit Credit 1-Dec Merchandise Inventory 980.00 Accounts Payable, Grand Blanc Fans 980.00 P.O. # 0512-001 1-Dec Merchandise Inventory 1848.00 Accounts Payable, Columbia Products 1848.00 P.O. # 0512-002 1-Dec Merchandise Inventory 3570.00 Accounts Payable, Santa Ana Gales Fans 3570.00 P.O. # 0512-003 1-Dec Merchandise Inventory 1100.00 Accounts Payable, Juarez Light Products 1100.00 P.O. # 0512-004 1-Dec Mortgage Payable 247.89 Interest Expense 482.85 Checking Account 730.74 Mortgage Payment 3-Dec Accounts Receivable, Remodeler's Supply 7840.00 Sales 7840.00 Costs of Sales 5690.00 Merchandise Inventory 5690.00 4-Dec Accounts Payable, Columbia Products 294.00 Accounts Payable, Juarez Light Products 55.00 Merchandise Inventory 349.00 Inventory Received - Short Count 5-Dec Telephone / Utilities Expense 710.00 Checking Account 710.00 $500 for utilities, $210 for Nov phone 7-Dec Payroll entries will be completed in Week 2. You will fund the payroll check account with a check and record it to this journal as a total. Payroll Checking 5760.41 Checking Account 5760.41 Entry made in Week 2 - leave 8-Dec Accounts Receivable, Builder's Warehouse 13685.00 Sales 13685.00 Costs of Sales 9855.00 Merchandise Inventory 9855.00 8-Dec Depreciation Expense - Toyota 3250.00 Accum Dep - Toyota 3250.00 Depreciate Toyota to day of trade Accum Dep - Toyota 10530.00 Gain / Loss on Asset Sales 2970.00 Checking Account 10500.00 Toyota Camry 24000.00 Record sale of Toyota

- 6. Company Cars - 2006 Honda 28000.00 Checking Account 2800.00 Notes Payable 25200.00 Purchase of Honda with down payment and note 9-Dec Accounts Receivable, Helpful Hardware Chain 10456.25 Sales 10456.25 Costs of Sales 7350.00 Merchandise Inventory 7350.00 Record credit sale to Helpful Hardware 10-Dec Accounts Payable. Grand Blanc Fans 980.00 Merchandise Inventory 9.80 Checking Account 970.20 Payment for PO 0512-001 12-Dec Merchandise Inventory 7600.00 Accounts Payable, Juarez Light Products 7600.00 P.O. # 0512-005 14-Dec Accounts Receivable, Bowery Super Warehouse 6720.00 Sales 6720.00 Costs of Sales 4695.00 Merchandise Inventory 4695.00 Record Sale to Bowery Super Warehouse 15-Dec Checking Account 7683.20 Sales Discounts 156.80 Accounts Receivable, Remodeler's Supply 7840.00 Invoice 12-0101 15-Dec FITW Payable 1454.53 Social Security Taxes Payable 1308.20 Medicare Taxes Payable 305.96 Checking Account 3068.69 Pay Nov Payroll Taxes 15-Dec Accounts Payable, Columbia Products 1554.00 Merchandise Inventory 31.08 Checking Account 1522.92 Payment for PO 0512-002 19-Dec Checking Account 13411.30 Sales Discounts 273.70

- 7. Accounts Receivable, Builder's Warehouse 13685.00 Received payment from Builder's Warehouse 20-Dec Accounts Payable, Santa Ana Gales Co. 3570.00 Merchandise Inventory 35.70 Checking Account 3534.30 Payment for PO 0512-003 22-Dec Payroll entries will be made on a separate journal page You will fund the payroll check account with a check and record it to this journal as a total. 22-Dec Payroll Checking 8622.08 Checking Account 8622.08 24-Dec Checking Account 10818.50 Accounts Receivable 10818.50 Invoice 11-24 23-Dec Sales Returns and Allowances 245.00 Accounts Receivable, Bowery Super Warehouse 245.00 Merchandise Inventory 140.00 Cost of Sales 140.00 Bowery Super Warehouse return - did not return light kits 26-Dec Checking Account 3172.75 Notes Receivable - Bowery 3237.50 Sales Discount 64.75 Accounts Receivable - Bowery Super Warehouse 6475.00 Bowery paid 1/2 of invoice and signed note for balance 30-Dec Professional Service Fees 400.00 Checking Account 400.00 31-Dec Accounts Payable, Juarez Light Products 1045.00 Checking Account 1045.00 Only received 95 on 12/1 shipment, 31-Dec Merchandise Inventory 770.00 Accounts Payable 770.00 Thomas Freight 31-Dec Travel Expense 430.00 Office Supplies Expense 110.00 Postage Expense 20.00 Checking Account 560.00 31-Dec Travel Expense 665.00 Postage Expense 137.00 Office Supplies Expense 58.00 Checking Account 860.00 31-Dec Joe Black, Drawing 8000.00 Checking Account 8000.00

- 8. Adjusting Entries General Journal Date Description(Account Name) Debit Credit 31-Dec Interest Expense 481.82 Interest Payable 481.82 Mortgage Interest 31-Dec Interest Expense 48.30 Interest Payable 48.30 Car Note Interest (ordinary interest) 31-Dec Interest Receivable 3.60 Interest Revenue 3.60 5 days interest on Bowry Note 31-Dec Insurance Expense 2700.00 Prepaid Expenses 2700.00 Insurance Adjustment 31-Dec Office Supplies Expense 6445.00 Office Supplies (Prepaid) 6445.00 Office Supplies Adjustment 31-Dec Warehouse Expenses 1200.00 Prepaid Expenses 1200.00 Forklift Rent 31-Dec Salary Expense 4439.99 Salaries Payable 3685.68 FITW Payable 414.65 Social Security Taxes Payable 275.28 Medicare Taxes Payable 64.38 Wages adjustment for second half of December- Wages 31-Dec Employer Tax Expense 375.66 Social Security Taxes Payable 275.28 Medicare Taxes Payable 64.38 FUTA Payable 6.00 SUTA Payable 30.00 Wages adjustment for second half of December- Employer Payroll Taxes Week 5 Entries INVENTORY CORRECTIONS 31-Dec Cost of Sales 308.00 Inventory 308.00 ACCOUNT RECEIVABLE ENTRIES 31-Dec Allowance for Bad Debt 2318.75 Accounts Receivable 2318.75 Write off Account 31-Dec Bad Debt Expense 818.38 Allowance for Bad Debt 818.38 Bad Debt Adjustment Week 6 Entries 31-Dec Warranty Expense 506.29

- 9. General Ledger In order by Account number. This column is the: This column is the: Balance Sheet Income Statement ASSETS: Account: Checking Account Account #: 1020 Account: Fan Revenue Account #: 4000 Balance Balance Date Explanation Debit Credit Debit Credit Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 68,126.61 11/30 Beg Bal 454,315.00 12/1 730.74 67,395.87 12/3 7,840.00 462,155.00 12/5 710.00 66,685.87 12/8 13,685.00 475,840.00 12/7 5,760.41 60,925.46 12/9 10,456.25 486,296.25 12/8 10,500.00 71,425.46 12/14 6,720.00 493,016.25 12/8 2,800.00 68,625.46 12/31 closing 493,016.25 0.00 12/10 970.20 67,655.26 0.00 12/15 7,683.20 75,338.46 12/15 3,068.69 72,269.77 12/15 1,522.92 70,746.85 Account: Interest Revenue Account #: 4010 12/19 13,411.30 84,158.15 Balance 12/20 3,534.30 80,623.85 Date Explanation Debit Credit Debit Credit 12/22 8,622.08 72,001.77 11/30 Beg Bal 0.00 12/24 10,818.50 82,820.27 12/31 144.68 144.68 12/26 3,172.75 85,993.02 12/31 Adjustment 3.60 148.28 12/30 400.00 85,593.02 12/31 closing 148.28 0.00 12/31 1,045.00 84,548.02 0.00 12/31 560.00 83,988.02 12/31 860.00 83,128.02 12/31 8,000.00 75,128.02 Account: Sales Returns and Allowances Account #: 4050 12/31 5,371.29 69,756.73 Balance 12/31 Interest on Checking 144.68 69,901.41 Date Explanation Debit Credit Debit Credit 12/31 Bank Service Fees 160.00 69,741.41 11/30 Beg Bal 5,200.00 69,741.41 12/23 245.00 5,445.00 69,741.41 12/31 closing 5,445.00 0.00 69,741.41 0.00 69,741.41 0.00 Account: Payroll Checking Account #: 1025 Balance Account: Sales Discounts Account #: 4070 Date Explanation Debit Credit Debit Credit Balance 11/30 Beg Bal 0.00 Date Explanation Debit Credit Debit Credit 12/10 5,760.41 5,760.41 11/30 Beg Bal 8,600.00 12/10 5,760.41 0.00 12/15 156.80 8,756.80 12/22 8,622.08 8,622.08 12/19 273.70 9,030.50 12/22 8,622.08 0.00 12/26 64.75 9,095.25 12/31 0.00 12/31 closing 9,095.25 0.00 0.00 0.00 Account: Cost of Sales Account #: 5000 Account: Petty Cash Account #: 1030 Balance

- 10. Balance Date Explanation Debit Credit Debit Credit Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 272,952.00 11/30 Beg Bal 200.00 12/3 5,690.00 278,642.00 200.00 12/8 9,855.00 288,497.00 200.00 12/9 7,350.00 295,847.00 12/14 4,695.00 300,542.00 12/23 140.00 300,402.00 Account: Accounts Receivable Account #: 1100 12/31 Adjustment 308.00 300,710.00 Balance 12/31 closing 300,710.00 0.00 Date Explanation Debit Credit Debit Credit 0.00 11/30 Beg Bal 21,274.75 12/3 7,840.00 29,114.75 12/8 13,685.00 42,799.75 Account: Car Ops and Maintenance Account #: 5750 12/9 10,456.25 53,256.00 Balance 12/14 6,720.00 59,976.00 Date Explanation Debit Credit Debit Credit 12/15 7,840.00 52,136.00 Beg Bal 4,800.00 12/19 13,685.00 38,451.00 12/31 4,800.00 0.00 12/23 245.00 38,206.00 0.00 12/24 10,818.50 27,387.50 12/26 6,475.00 20,912.50 12/31 Write-off Howell Construction 2,318.75 18,593.75 Account: Salary and Wages Expense Account #: 6000 18,593.75 Balance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 64,550.00 Account: Allowance for Doubtful Accounts Account #: 1150 12/7 7,250.00 71,800.00 Balance 12/22 11,100.00 82,900.00 Date Explanation Debit Credit Debit Credit 12/31 Adjusting Entry 4,439.99 87,339.99 11/30 Beg Bal 2035.00 12/31 87,339.99 0.00 12/31 Howell Construction 2,318.75 -283.75 0.00 12/31 Adjustment 818.38 534.63 534.63 Account: Employer Tax Expense Account #: 6100 Balance Account: Notes Receivable Account #: 1160 Date Explanation Debit Credit Debit Credit Balance 11/30 Beg Bal 12,626.15 Date Explanation Debit Credit Debit Credit 12/7 590.63 13,216.78 11/30 Beg Bal 0.00 12/22 899.55 14,116.33 12/26 3,237.50 3,237.50 12/31 Adjusting Entry 375.66 14,491.99 3,237.50 12/31 14,491.99 0.00 3,237.50 0.00 Account: Interest Receivable Account #: 1165 Account: Telephone Utilities Expense Account #: 6300 Balance Balance Date Explanation Debit Credit Debit Credit Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 0.00 11/30 Beg Bal 6,000.00 12/31 Adjustment 3.60 3.60 12/10 500.00 6,500.00 3.60 12/10 210.00 6,710.00 12/24 6,710.00 12/31 6,710.00 0.00

- 11. Account: Office Supplies Account #: 1170 0.00 Balance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 6,520.00 Account: Office Supplies Expense Account #: 6450 12/31 Adjustment 6,445.00 75.00 Balance 75.00 Date Explanation Debit Credit Debit Credit 75.00 11/30 Beg Bal 0.00 75.00 12/31 168.00 168.00 12/31 Adjusting Entry 6,445.00 6,613.00 12/31 6,613.00 0.00 Account: Fan Inventory Account #: 1200 0.00 Balance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 30,752.00 Account: Travel Expense Account #: 6700 12/1 980.00 31,732.00 Balance 12/1 1,848.00 33,580.00 Date Explanation Debit Credit Debit Credit 12/1 3,570.00 37,150.00 11/30 Beg Bal 20,100.00 12/1 1,100.00 38,250.00 12/31 1,095.00 21,195.00 12/3 5,690.00 32,560.00 12/31 21,195.00 0.00 12/4 349.00 32,211.00 0.00 12/8 9,855.00 22,356.00 0.00 12/9 7,350.00 15,006.00 12/10 9.80 14,996.20 12/12 7,600.00 22,596.20 Account: Postage and Freight Account #: 6800 12/14 4,695.00 17,901.20 Balance 12/15 31.08 17,870.12 Date Explanation Debit Credit Debit Credit 12/20 35.70 17,834.42 11/30 Beg Bal 6,000.00 12/23 140.00 17,974.42 12/31 157.00 6,157.00 12/31 770.00 18,744.42 12/31 6,157.00 0.00 12/31 Adjustment 308.00 18,436.42 0.00 18,436.42 18,436.42 18,436.42 Account: Depreciation Expense Account #: 6850 Balance Date Explanation Debit Credit Debit Credit Account: Prepaid Expenses Account #: 1400 11/30 Beg Bal 0.00 Balance 12/8 3,250.00 3,250.00 Date Explanation Debit Credit Debit Credit 12/31 Adjusting Entry 14,514.00 17,764.00 11/30 Beg Bal 10,800.00 12/31 17,764.00 0.00 12/31 Adjustment 3,900.00 6,900.00 0.00 6,900.00 6,900.00 6,900.00 Account: Gain/Loss on Sale of Assets Account #: 6950 Balance Date Explanation Debit Credit Debit Credit Account: Land Account #: 1500 11/30 Beg Bal 0.00 Balance 12/7 2,970.00 2,970.00 Date Explanation Debit Credit Debit Credit 12/31 2,970.00 0.00 11/30 Beg Bal 40,000.00 0.00 40,000.00 0.00

- 12. 40,000.00 40,000.00 Account: Interest Expense Account #: 6960 Balance Account: Building Account #: 1510 Date Explanation Debit Credit Debit Credit Balance 11/30 Beg Bal 2,659.80 Date Explanation Debit Credit Debit Credit 12/1 482.85 3,142.65 11/30 Beg Bal 150,000.00 12/31 Adjusting Entry 530.12 3,672.77 150,000.00 12/31 3,672.77 0.00 150,000.00 0.00 150,000.00 Account: Professional & Bank Service Fees Account #: 6975 Account: Accum Dep - Building Account #: 1511 Balance Balance Date Explanation Debit Credit Debit Credit Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 0.00 11/30 Beg Bal 8750.00 12/31 400.00 400.00 12/31 Adjustment 3,500.00 12250.00 12/31 160.00 560.00 12250.00 12/31 560.00 0.00 12250.00 0.00 Account: Company Cars Account #: 1515 Account: Warranty Expense Account #: 7000 Balance Balance Date Explanation Debit Credit Debit Credit Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 74,000.00 11/30 Beg Bal 262.84 12/8 24,000.00 50,000.00 12/31 Adjustment 506.29 769.13 12/8 28,000.00 78,000.00 12/31 769.13 0.00 78,000.00 0.00 0.00 78,000.00 Account: Insurance Expense Account #: 7020 Account: Accum Dep - Company Cars Account #: 1516 Balance Balance Date Explanation Debit Credit Debit Credit Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 0.00 11/30 Beg Bal 46000.00 12/31 Adjustment 2,700.00 2,700.00 12/8 3,250.00 49250.00 12/31 2,700.00 0.00 12/8 10,530.00 38720.00 0.00 12/31 Adjustment 7,990.00 46710.00 46710.00 Account: Warehouse Expense Account #: 7030 Balance Account: Office and Shop Equip Account #: 1520 Date Explanation Debit Credit Debit Credit Balance 11/30 Beg Bal 0.00 Date Explanation Debit Credit Debit Credit 12/31 Adjustment 1,200.00 1,200.00 11/30 Beg Bal 8,400.00 12/31 1,200.00 0.00 8,400.00 0.00 8,400.00 8,400.00 8,400.00 Account: Bad Debt Expense Account #: 7040

- 13. Balance Date Explanation Debit Credit Debit Credit Account: Accum Dep - Office and Shop Equip Account #: 1521 11/30 Beg Bal 0.00 Balance 12/31 Adjustment 818.38 818.38 Date Explanation Debit Credit Debit Credit 12/31 818.38 0.00 11/30 Beg Bal 840.00 0.00 12/31 Adjustment 3,024.00 3864.00 3864.00 Account: Income Summary Account #: 3864.00 Balance 3864.00 Date Explanation Debit Credit Debit Credit 12/31 revenue 493,164.53 493,164.53 12/31 expenses 493,011.51 153.02 LIABILITIES: 12/31 net income 153.02 0.00 Account: Accounts Payable Account #: 2000 0.00 0.00 Balance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 0.00 12/1 980.00 980.00 12/1 1,848.00 2828.00 12/1 3,570.00 6398.00 12/1 1,100.00 7498.00 12/4 294.00 7204.00 12/4 55.00 7149.00 12/10 980.00 6169.00 12/12 7,600.00 13769.00 12/15 1,554.00 12215.00 12/20 3,570.00 8645.00 12/31 1,045.00 7600.00 12/31 770.00 8370.00 8370.00 8370.00 8370.00 8370.00 Account: Warranty Payable Account #: 2010 Balance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 262.84 12/31 Adjustment 506.29 769.13 769.13 Account: Interest Payable Account #: 2020 Bal ance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 0.00 12/31 Adjustment 530.12 530.12 530.12

- 14. Account: Short Term Notes Payable Account #: 2100 Balance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 0.00 0.00 0.00 0.00 0.00 Account: Salary and Wages Payable Account #: 2300 Balance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 0.00 12/7 5,760.41 5760.41 12/7 5,760.41 0.00 12/22 8,622.08 8622.08 12/22 8,622.08 0.00 12/31 Adjusting Entry 3,685.68 3685.68 12/31 3685.68 3685.68 Account: Federal Income Taxes Payable Account #: 2330 Balance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 1454.53 12/7 934.96 2389.49 12/15 1,454.53 934.96 12/22 1,628.77 2563.73 12/31 2,563.73 0.00 12/31 Adjusting Entry 414.65 414.65 414.65 Account: Social Security Taxes Payable Account #: 2335 Balance ` Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 1308.20 12/7 899.00 2207.20 12/15 1,308.20 899.00 12/22 1,376.40 2275.40 12/31 2,275.40 0.00 12/31 Adjusting Entry 550.56 550.56 550.56 Account: Medicare Taxes Payable Account #: 2337 Balance

- 15. Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 305.96 12/7 210.26 516.22 12/15 305.96 210.26 12/22 321.90 532.16 12/31 532.16 0.00 12/31 Adjusting Entry 128.76 128.76 128.76 Account: FUTA Payable Account #: 2340 Balance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 168.00 12/7 6.00 174.00 12/22 8.40 182.40 12/31 Adjusting Entry 6.00 188.40 188.40 Account: SUTA Payable Account #: 2360 Balance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 0.00 12/10 30.00 30.00 12/22 42.00 72.00 12/31 Adjusting Entry 30.00 102.00 102.00 Account: L/T Notes Payable Account #: 2700 Balance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 0.00 12/1 25,200.00 25200.00 25200.00 25200.00 25200.00 Account: Mortgage Payable Account #: 2800 Balance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 115884.21 12/1 247.89 115636.32

- 16. 115636.32 115636.32 115636.32 Owners Equity: Account: Joe Black, Capital Account #: 3920 Balance Date Explanation Debit Credit Debit Credit 11/30 Beg Bal 270500.41 *** when u close the Income summary out you are going 12/31 net income 153.02 270653.43 to close it out to the capital acct (or retained earnings) you 12/31 closing withdrawls 96,000.00 174653.43 will list a credit entry here to match the debit entry from 174653.43 the income summary. 174653.43

- 17. Accounts Receivable Subsidiary Ledgers Customer: Howell Construction Balance Date Explanation Debit Credit Debit Credit 6/19 2318.75 2318.75 12/31 Write-Off 2318.75 0.00 0.00 0.00 Customer: Helpful Hardware Chain Balance Date Explanation Debit Credit Debit Credit 11/23 8137.50 8137.50 12/9 10456.25 18593.75 18593.75 18593.75 18593.75 Customer: Remodeler's Supply Balance Date Explanation Debit Credit Debit Credit 10/28 10818.50 10818.50 12/3 7840.00 18658.50 12/15 7840.00 10818.50 12/24 10818.50 0.00 0.00 Customer: Bowery Super Warehouse Balance Date Explanation Debit Credit Debit Credit 12/14 6720.00 6720.00 12/23 245.00 6475.00 12/26 6475.00 0.00 0.00 0.00 0.00 Customer: Builders Warehouse Balance Date Explanation Debit Credit Debit Credit 12/8 13685.00 13685.00 12/19 13685.00 0.00 0.00 0.00

- 18. Accounts Payable Subsidiary Ledgers Vendor: Grand Blanc Fans Balance Date Explanation Debit Credit Debit Credit 12/1 980.00 980.00 12/10 980.00 0.00 0.00 0.00 Vendor: Columbia Products Balance Date Explanation Debit Credit Debit Credit 12/1 1848.00 1848.00 12/4 294.00 1554.00 12/15 1554.00 0.00 0.00 Vendor: Santa Ana Gales Fans Balance Date Explanation Debit Credit Debit Credit 12/1 3570.00 3570.00 12/20 3570.00 0.00 0.00 0.00 Vendor: Juarez Light Products Balance Date Explanation Debit Credit Debit Credit 12/1 1100.00 1100.00 12/4 55.00 1045.00 12/12 7600.00 8645.00 12/31 1045.00 7600.00 7600.00 7600.00 Vendor: Thomas Freight Balance Date Explanation Debit Credit Debit Credit 12/31 770.00 770.00 770.00 770.00

- 19. Mortgage Amortization Schedule Beginning Principal: $125,000.00 Interest Rate: 0.05 Payment Amount: ($730.74) Payment Running Pay # Amount Interest Principal Balance Jul, 2004 $125,000.00 Aug $730.74 520.83 209.90 124,790.10 Sep $730.74 519.96 210.78 124,579.32 Oct $730.74 519.08 211.66 124,367.66 Nov $730.74 518.20 212.54 124,155.12 Dec $730.74 517.31 213.42 123,941.70 Jan, 2005 $730.74 516.42 214.31 123,727.38 Feb $730.74 515.53 215.21 123,512.18 Mar $730.74 514.63 216.10 123,296.07 Apr $730.74 513.73 217.00 123,079.07 May $730.74 512.83 217.91 122,861.16 Jun $730.74 511.92 218.82 122,642.34 Jul $730.74 511.01 219.73 122,422.62 Aug $730.74 510.09 220.64 122,201.97 Sep $730.74 509.17 221.56 121,980.41 Oct $730.74 508.25 222.49 121,757.92 Nov $730.74 507.32 223.41 121,534.51 Dec $730.74 506.39 224.34 121,310.17 Jan, 2006 $730.74 505.46 225.28 121,084.89 Feb $730.74 504.52 226.22 120,858.67 Mar $730.74 503.58 227.16 120,631.51 Apr $730.74 502.63 228.11 120,403.41 May $730.74 501.68 229.06 120,174.35 Jun $730.74 500.73 230.01 119,944.34 Jul $730.74 499.77 230.97 119,713.37 Aug $730.74 498.81 231.93 119,481.44 Sep $730.74 497.84 232.90 119,248.54 Oct $730.74 496.87 233.87 119,014.67 Nov $730.74 495.89 234.84 118,779.83 Dec $730.74 494.92 235.82 118,544.01 Jan, 2007 $730.74 493.93 236.80 118,307.20 Feb $730.74 492.95 237.79 118,069.41 Mar $730.74 491.96 238.78 117,830.63 Apr $730.74 490.96 239.78 117,590.85 May $730.74 489.96 240.78 117,350.08 Jun $730.74 488.96 241.78 117,108.30 Jul $730.74 487.95 242.79 116,865.51 Aug $730.74 486.94 243.80 116,621.71 Sep $730.74 485.92 244.81 116,376.90 Oct $730.74 484.90 245.83 116,131.07 Nov $730.74 483.88 246.86 115,884.21 Dec $730.74 482.85 247.89 115,636.32

- 20. PAYROLL REGISTER for December 7. Cumul EARNINGS TAXES Employee YTD Other Net Name Earnings Regular Commission Other Gross FITW Soc Sec Medicare Deductions Pay Fred Smythe 10150 1000 3650 4650 644.28 288.30 67.43 3650.00 Stan Redstone 34500 1250 600 1850 255.28 114.70 26.83 1453.19 Jan Brown 0 750 750 35.40 46.50 10.88 657.23 Emma Black 16500 0.00 7250.00 934.96 449.50 105.13 0.00 5760.41 PAYROLL REGISTER for Dec 22 Cumul EARNINGS TAXES Employee YTD Other Net Name Earnings Regular Commission Other Gross FITW Soc Sec Medicare Deductions Pay Fred Smythe 14800 1000 900 1900 118.05 117.80 27.55 1636.60 Stan Redstone 36350 1250 3600 4850 1050.20 300.70 70.33 3428.77 Jan Brown 750 750 300 1050 82.90 65.10 15.23 886.78 Emma Black 16500 3300 3300 377.62 204.60 47.85 2669.94 8100.00 11100.00 1628.77 688.20 160.95 0.00 8622.08 INDIVIDUAL PAYROLL RECORD FOR: INDIVIDUAL PAYROLL RECORD FOR: Fred Smythe Hired: 10/1/2007 Pay Period Regular Commission Other Gross FITW Soc Sec Medicare Deductions Pay Earnings Oct 1 - Oct 31 2000.00 2500.00 4500.00 606.78 279.00 65.25 3548.97 4500.00 Nov 1 - Nov 30 2000.00 3650.00 5650.00 894.28 350.30 81.93 4323.50 10150.00 Dec 7 1000.00 3650.00 4650.00 644.28 288.30 67.43 3650.00 14800.00 Dec 22 1000.00 900.00 1900.00 118.05 117.80 27.55 1636.60 16700.00 6000.00 9800.00 900.00 16700.00 2263.39 1035.40 242.15 0.00 13159.06

- 21. INDIVIDUAL PAYROLL RECORD FOR: Stan Redstone Other Cumulative Pay Period Regular Commission Other Gross FITW Soc Sec Medicare Deductions Pay Earnings Jan 1 - Sep 30 22500.00 8550.00 31050.00 4036.50 1925.10 450.23 24638.18 31050.00 Oct 1 - Oct 31 2500.00 950.00 3450.00 448.50 213.90 50.03 2737.58 34500.00 Nov 1 - Nov 30 2500.00 900.00 3400.00 442.00 210.80 49.30 2697.90 37900.00 Dec 7 1250.00 600.00 1850.00 255.28 114.70 26.83 1453.19 39750.00 Dec 22 1250.00 3600.00 4850.00 1050.20 300.70 70.33 0.00 3428.77 44600.00 30000.00 11000.00 3600.00 44600.00 6232.48 2765.20 646.70 0.00 INDIVIDUAL PAYROLL RECORD FOR: Emma Black Other Cumulative Pay Period Regular Commission Other Gross FITW Soc Sec Medicare Deductions Pay Earnings Jan 1 - Sep 30 13500.00 13500.00 1064.24 837.00 195.75 11403.01 13500.00 Oct 1 - Oct 31 1500.00 1500.00 118.25 93.00 21.75 1267.00 15000.00 Nov 1 - Nov 30 1500.00 1500.00 118.25 93.00 21.75 1267.00 16500.00 Dec 7 16500.00 Dec 22 3300.00 3300.00 377.62 204.60 47.85 2669.94 19800.00 16500.00 0.00 3300.00 19800.00 1678.36 1227.60 287.10 0.00

- 22. INDIVIDUAL PAYROLL RECORD FOR: Jan Brown Hired: 12/1/07 Pay Period Regular Commission Other Gross FITW Soc Sec Medicare Deductions Pay Earnings Jan 1 - Sep 30 Oct 1 - Oct 31 Nov 1 - Nov 30 Dec 7 750.00 750.00 35.40 46.50 10.88 657.23 750.00 Dec 22 750.00 300.00 1050.00 82.90 65.10 15.23 886.78 1800.00 1500.00 0.00 300.00 1800.00 118.30 111.60 26.10 0.00 INDIVIDUAL PAYROLL RECORD FOR: Joe Black SS# 573-38-4729 Other Cumulative Pay Period Regular Commission Other Gross FITW Soc Sec Medicare Deductions Pay Earnings Jan 1 - Sep 30 Oct 1 - Nov 30 Week 3 Payroll Summary - Quarterly Summary of earnings and tax for 4th quarter. Pay Period Regular Commission Other Gross FITW Soc Sec Medicare FUTA SUTA Smythe 6000.00 9800.00 900.00 16700.00 2263.39 1035.40 242.15 56.00 280.00 Stan Redstone 7500.00 2450.00 3600.00 13550.00 2195.98 840.10 196.48 0.00 Emma Black 3000.00 0.00 3300.00 6300.00 614.12 390.60 91.35 0.00 Jan Brown 1500.00 0.00 300.00 1800.00 118.30 111.60 26.10 8.40 30.00 18000.00 12250.00 8100.00 38350.00 5191.79 2377.70 556.08 64.40 310.00 Week 4

- 23. PAYROLL REGISTER for Adjusting Entry (In Practice the indivdiual records would be updated. Not required for this case) Cumul EARNINGS TAXES Employee YTD Other Net Name Earnings Regular Commission Other Gross FITW Soc Sec Medicare Deductions Pay

- 24. Payroll Journal for Pleasant Breeze Fan Company REQUIREMENT #1: Prepare journal entries to record the December 22 payroll transactions in the Journal below. 1. Prepare the payroll forms 2. Total the paychecks for the payday. 3. In the general journal prepare a journal entry to fund the payroll checking account. General Journal Date Description(Account Name) Debit Credit 7-Dec Salary / Wages Expense 7250.00 Fed Income Tax With Payable 934.96 Social Security Taxes Payable 449.50 Medicare Taxes Payable 105.13 Salary / Wages Payable 5760.41 Record payroll Payroll Checking 5760.41 Checking 5760.41 Transfer cash to payroll checking acct. Salary / Wages Payable 5760.41 Payroll Checking 5760.41 Issue paychecks Employer Tax Expense 590.63 Social Security Taxes Payable 449.50 Medicare Taxes Payable 105.13 FUTA Payable 6.00 SUTA Payable 30.00 Record employer tax liabilities 22-Dec Salary / Wages Expense 11100.00 Fed Income Tax With Payable 1628.77 Social Security Taxes Payable 688.20 Medicare Taxes Payable 160.95 Salary / Wages Payable 8622.08 Record payroll Payroll Checking 8622.08 Checking 8622.08 Transfer cash to payroll checking acct. Salary / Wages Payable 8622.08 Payroll Checking 8622.08 Issue paychecks Employer Tax Expense 899.55 Social Security Taxes Payable 688.20 Medicare Taxes Payable 160.95 FUTA Payable 8.40 SUTA Payable 42.00 Record employer tax liabilities

- 25. REQUIREMENT: Complete the bank reconciliation and aging analysis on the forms below. Use the journal provided to make any necessary entries for the bank reconciliationand aging analysis. Pleasant Breeze Fan Company Bank Reconciliation Month Ended December 31, 2007 Bank Balance: $81,538.16 Book Balance: $69,756.73 Additions: Additions: Deposit in Transit 3,172.75 Interest Earned 144.68 Total Additions 3,172.75 144.68 Subtractions: Subtractions: Check # 1509 970.20 Service Charge 160.00 Check # 1512 3,534.30 Check # 1514 1,045.00 Check # 1515 560.00 Check # 1516 860.00 Check # 1517 8,000.00 Total Subractions 14,969.50 160.00 Adjusted Cash Balance $69,741.41 Adjusted Cash Balance $69,741.41 BANK RECONCILATION ENTRIES General Journal Date Descrip(Acct Name) Debit Credit 31-Dec Cash 144.68 Interest Revenue 144.68 31-Dec Service Charges 160.00 Cash 160.00 DON'T FORGET TO UPDATE YOUR LEDGER BALANCES AND THE WORKSHEET FOR THESE JOURNAL ENTRIES. Pleasant Breeze Fan Company Aging of Accounts Receivable Month Ended December 31, 2007

- 26. Gentle Breeze Inventory Summary Purchased Sold Beginning Ending Date Quantity Cost Quantity Cost Units Balance Gentle Breeze 5320.00 1225.00 Beg Bal 152 35.00 152 5320.00 Tropical Wind 10752.00 4998.00 1-Dec 28 35.00 180 6300.00 Santa Ana 9180.00 2907.00 3-Dec 26 35.00 154 5390.00 Light Kits 5500.00 8613.00 8-Dec 70 35.00 84 2940.00 17743.00 9-Dec 25 35.00 59 2065.00 Other Perpetual Inventory Items: 14-Dec 30 35.00 29 1015.00 Thomas Freight 770.00 26-Dec -4 35.00 33 1155.00 Purchase Discounts -9.80 Correct Inventory 33 1155.00 -31.08 31-Dec 2 35.00 35 1225.00 -35.70 Total Other Items 693.42 Tropical Wind Total Inventory 30752.00 18436.42 Purchased Sold Date Quantity Cost Quantity Cost Units Balance Beg Bal 256 42.00 256 10752.00 1-Dec 44 42.00 300 12600.00 3-Dec 85 42.00 215 9030.00 4-Dec -7 42.00 208 8736.00 8-Dec 55 42.00 153 6426.00 14-Dec 30 42.00 123 5166.00 Correct Inventory 123 5166.00 31-Dec 4 42.00 119 4998.00 Santa Ana Purchased Sold Date Quantity Cost Quantity Cost Units Balance Beg Bal 180 51.00 180 9180.00 1-Dec 70 51.00 250 12750.00 8-Dec 60 51.00 190 9690.00 9-Dec 100 51.00 90 4590.00 14-Dec 30 51.00 60 3060.00 Correct Inventory 60 3060.00 31-Dec 3 51.00 57 2907.00 Light Kits Purchased Sold Date Quantity Cost Quantity Cost Units Balance 30-Nov 500 11.00 500 5500.00 1-Dec 100 11.00 600 6600.00 3-Dec 110 11.00 490 5390.00 4-Dec -5 11.00 485 5335.00 8-Dec 185 11.00 300 3300.00 9-Dec 125 11.00 175 1925.00 12-Dec 800 9.50 975 9525.00 14-Dec 90 9.50 885 8670.00 Correct Inventory 8670.00 31-Dec 6 9.50 879 8613.00 Journal any necessary changes on the Adjusting Entries Journal Any corrections use the active cost layer for the cost at December 31.

- 27. Financial Records for Depreciation Tax Records for Depreciation Asset: Land Depreciation Method: Asset: Land Depreciation Method: Est. Useful Life: Est. Useful Life: Cost: 40000 Expect Salvage: Cost: 40000 Expect Salvage: Date in Depreciation Accumulated Book Date in Depreciation Accumulated Book Service Expense Depreciation Value Service Expense Depreciation Value 7/1/2004 40,000.00 7/1/2004 40,000.00 Asset: Building Depreciation Method: Straight line Asset: Building Depreciation Method: Mid Month Convention Est. Useful Life: 39 Est. Useful Life: 39 Cost: 150000 Expect Salvage: 13500 Cost: 150000 Expect Salvage: 13500 Date in Depreciation Accumulated Book Date in Depreciation Accumulated Book Service Expense Depreciation Value Service Expense Depreciation Value 7/1/2004 150,000.00 7/1/2004 150,000.00 12/31/2004 1,750.00 1,750.00 148,250.00 12/31/2004 1,765.50 1,765.50 148,234.50 12/31/2005 3,500.00 5,250.00 144,750.00 12/31/2005 3,846.00 5,611.50 144,388.50 12/31/2006 3,500.00 8,750.00 141,250.00 12/31/2006 3,846.00 9,457.50 140,542.50 12/31/2007 3,500.00 12,250.00 137,750.00 12/31/2007 3,846.00 13,303.50 136,696.50 Asset: 2004 Toyota Depreciation Method: Units Est. Useful Life: 120000 miles Cost: 24000 Salvage: 8400 Date in Depreciation Accumulated Book Service Expense Depreciation Value 12/6/2004 24,000.00 12/31/2004 260.00 260.00 23,740.00 12/31/2005 3,900.00 4,160.00 19,580.00 12/31/2006 3,120.00 7,280.00 16,720.00 12/8/2007 3,250.00 10,530.00 13,470.00 Asset: 2005 Nissan Depreciation Method: Units Est. Useful Life: 120000 miles Cost: 25000 Salvage: 7000 Date in Depreciation Accumulated Book Service Expense Depreciation Value 12/1/2005 25,000.00 12/31/2005 450.00 450.00 24,550.00 12/31/2006 4,800.00 5,250.00 19,750.00 12/31/2007 2,400.00 7,650.00 17,350.00 Asset: 2006 PT Cruiser Depreciation Method: Units Est. Useful Life: 100000 Cost: 25000 Salvage: 5000 Date in Depreciation Accumulated Book Service Expense Depreciation Value 12/18/2006 25,000.00 12/31/2007 4,400.00 4,400.00 20,600.00 Asset: 2007 Honda Depreciation Method: Units Asset: 2007 Honda Depreciation Method: MACRS Half Year Est. Useful Life: 120000 miles Est. Useful Life: 5 Cost: 28000 Expect Salvage: 11200 Cost: 28000 Expect Salvage: 11200 Date in Depreciation Accumulated Book Date in Depreciation Accumulated Book Service Expense Depreciation Value Service Expense Depreciation Value 12/8/2007 28,000.00 12/8/2007 28,000.00 12/31/2007 1,190.00 1,190.00 26,810.00 12/31/2007 3,060.00 3,060.00 24,940.00 Asset: Office/Shop Equip Depreciation Method: DDB Asset: Office/Shop Equip Depreciation Method: MACRS Half Year Est. Useful Life: 5 Est. Useful Life: 5 Cost: 8400 Salvage: 2000 Cost: 8400 Salvage: 2000 Date in Depreciation Accumulated Book Date in Depreciation Accumulated Book Service Expense Depreciation Value Service Expense Depreciation Value 9/26/2006 8,400.00 9/26/2006 8,400.00 12/31/2006 840.00 840.00 7,560.00 12/31/2006 1,680.00 1,680.00 6,720.00 12/31/2007 3,024.00 3,864.00 3,696.00 12/31/2007 2,688.00 4,368.00 4,032.00