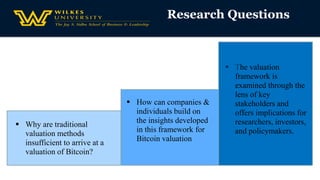

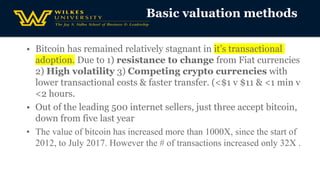

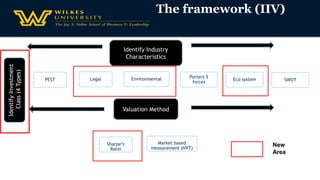

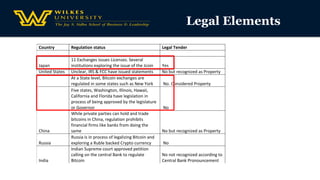

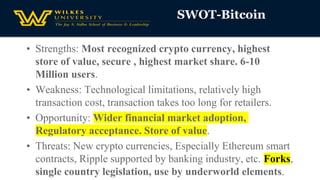

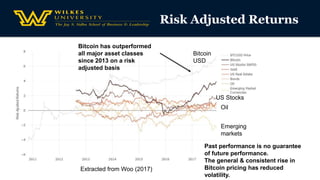

The document analyzes the financial valuation framework for Bitcoin, exploring its potential as an investment and the various challenges it faces, including regulatory and technological issues. It highlights that traditional valuation methods are inadequate for Bitcoin due to its unique characteristics and the volatility of its market. The research proposes a framework to help stakeholders understand Bitcoin's valuation, considering factors like legal regulations, market dynamics, and technological advancements.