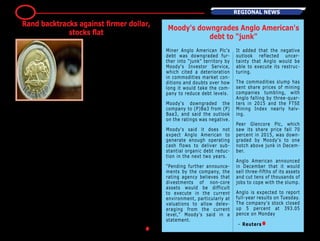

Zimbabwe has fully paid off its debt to Zambia owed for the Central African Power Corporation (CAPCO), allowing work to commence on the $3 billion Batoka Hydro Power Project, expected to generate 2,400 megawatts. The project aims to address Zimbabwe's power shortages, with an agreement reached between Zimbabwe and Zambia. Additionally, Premier African Minerals announced financing for its RHA Tungsten Mine from a local bank, demonstrating confidence in the project.