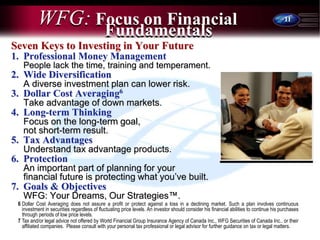

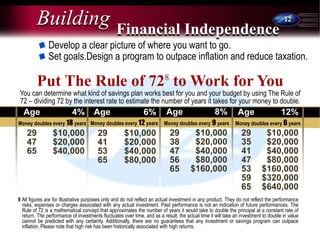

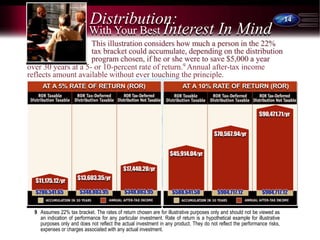

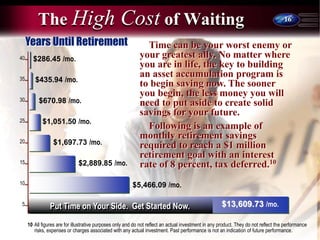

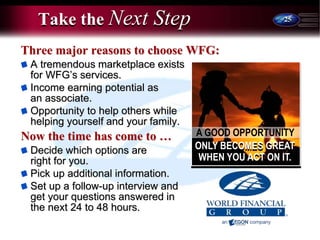

This document provides information about World Financial Group (WFG), including who they are, their mission and vision, strategic alliances, products offered, how to build income through WFG, and options to become a client or business owner. Key details include:

- WFG is a financial services company made up of an insurance agency and mutual fund dealer that offers products like mutual funds, insurance, and retirement plans.

- Their mission is to help families achieve financial independence and their vision is to build the world's best financial services organization.

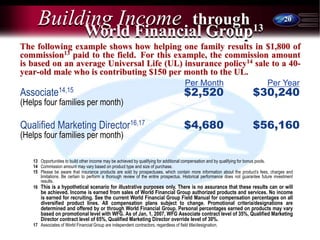

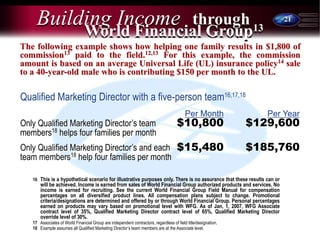

- Associates can build income by helping families and receiving commissions, with examples showing potential monthly earnings ranging from $2,520 to $15,480.

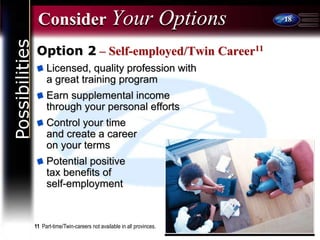

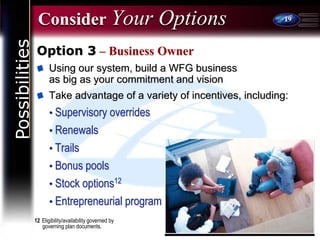

- Options