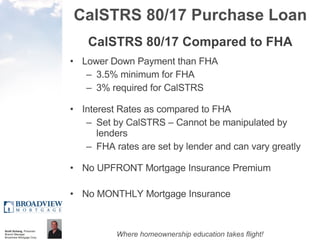

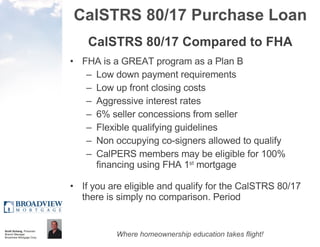

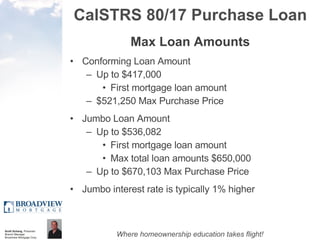

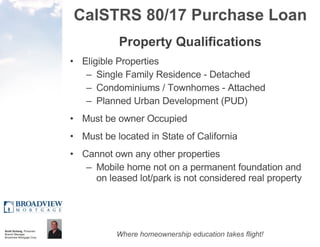

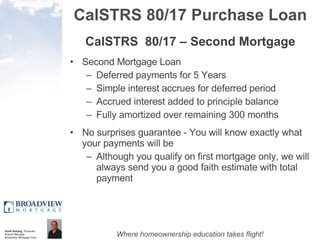

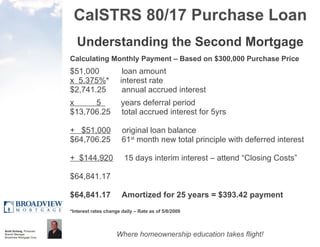

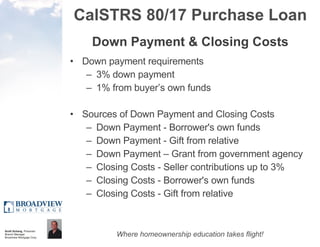

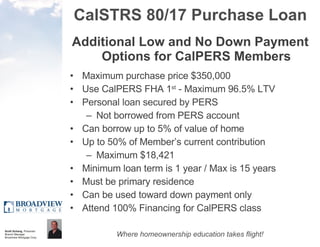

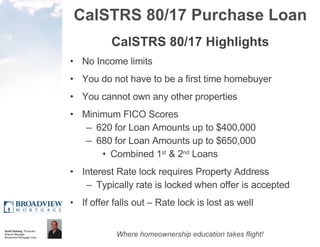

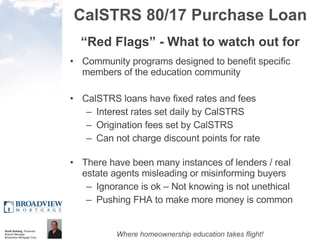

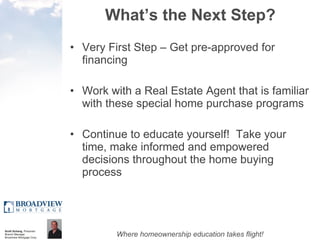

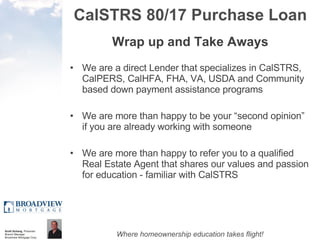

The document provides an overview of CalSTRS 80/17 Purchase Loan program, which allows eligible California public school employees to purchase a home with 3% down and deferred payment on the second loan. It discusses eligibility requirements, loan structure, property qualifications, costs, and "red flags" to watch out for. Upcoming homebuyer education classes are also promoted.