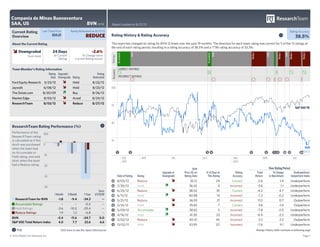

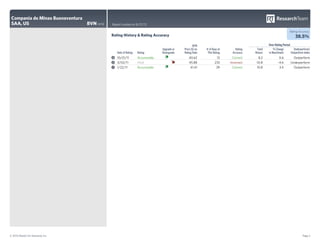

The ResearchTeam has downgraded its rating on Compania de Minas Buenaventura SAA (BVN) from Hold to Reduce. The rating is based on an analysis of ratings from multiple research providers compiled by the ResearchTeam. Over the past 19 months, the ResearchTeam has correctly predicted the direction of BVN's stock price based on its ratings only 38.5% of the time. BVN's stock price is down 2.6% in the 24 days since the ResearchTeam issued its current Reduce rating.