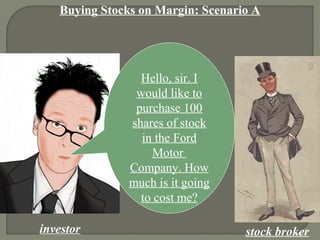

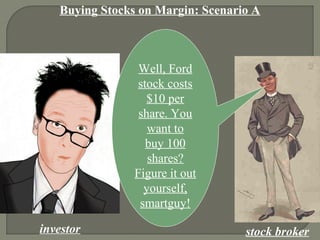

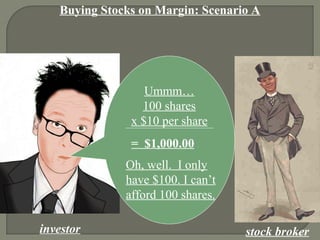

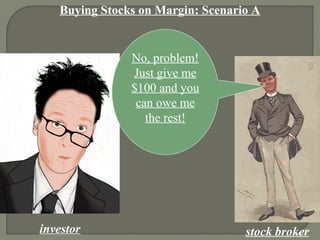

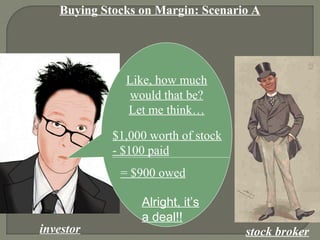

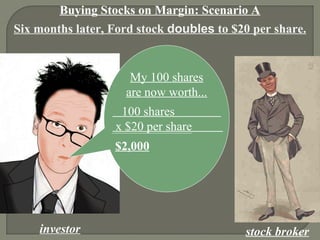

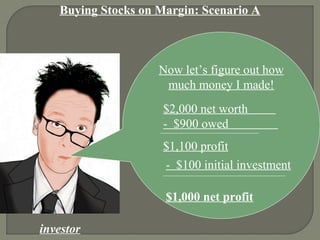

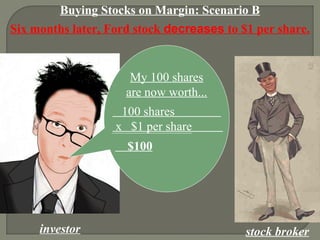

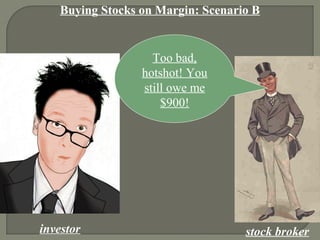

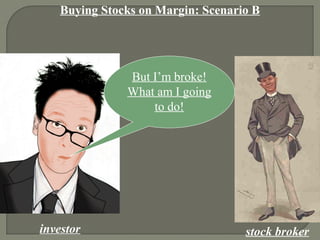

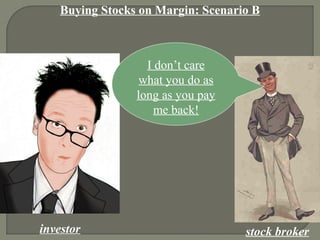

The document outlines the concept of buying stocks on margin through two scenarios involving a stock broker and an investor. In the first scenario, the investor profits significantly from the rise in stock prices, while in the second scenario, the investor suffers losses and still owes money despite the decrease in stock value. This highlights the risks and rewards of margin trading in the stock market.