This document provides an overview of the Limited Liability Partnership Act of 2008 in India. It discusses key features of LLPs such as having limited liability like companies but flexibility of management like partnerships. The document outlines the incorporation process for new LLPs including reserving a name, filing incorporation documents, and receiving a registration certificate. It also describes the contents and purpose of an LLP agreement, provisions around an LLP's name and making changes to its name. In summary, the document serves as an introductory guide to the Limited Liability Partnership Act and the process for establishing an LLP in India.

![BUSINESS LAWS

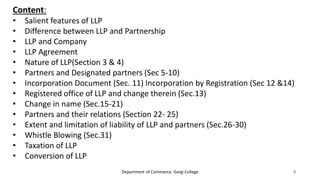

B.Com: Semester 2 Paper BC 2.2 (CBCS)

[B.COM (P)- Ist year Section A,B,C ]

Gargi College, University of Delhi

Unit 4-

The Limited liability Partnership Act,2008

Department of Commerce, Gargi College 1](https://image.slidesharecdn.com/business-laws-llp-bcom-prog-231027091313-98fb3f5b/85/Business-Laws-LLP-BCOM-Prog-Sem-2-pdf-1-320.jpg)