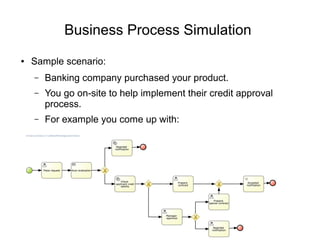

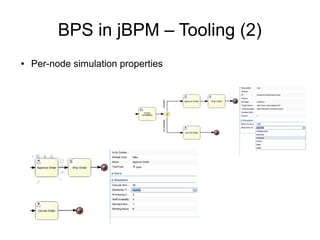

The document discusses using business process simulation to help optimize a banking company's credit approval process. Key steps include building a process model, then running simulations to answer questions about throughput, costs, resource needs, and how the process could handle increases in loan volume. The simulation software allows parameterizing process elements and generates event data. Results are analyzed to identify performance, quality, resource utilization, and inform continuous process improvements.