The document outlines the judicial review related to the UK feed-in-tariff (FIT) scheme for solar photovoltaic generation, highlighting litigation on proposed tariff changes and their legality under the European Convention on Human Rights. Key cases examined include the impact of interference on claimants' rights to their possessions, specifically addressing the distinction between marketable goodwill and future income. The High Court and Court of Appeal rulings emphasized the unlawful nature of the proposed changes and the legitimate expectations created by prior assurances from the Department of Energy and Climate Change.

![3

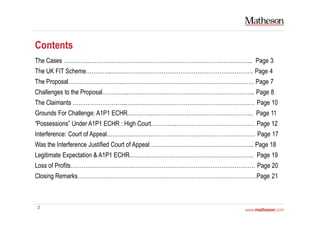

The Cases

Four Judgements:

The Queen on the Application of Homesun Holdings Limited, Friends of the Earth Limited &

Solar Century Holdings v Secretary of State for Energy & Climate Change [2011] EWHC

3575 (High Court, Mr. Justice Mitting).

The Secretary of State for Energy & Climate Change v Friends of the Earth & Others [2012]

EWCA Civ 28 (Court of Appeal, Lloyd LJ., Moses LJ., & Richards LJ).

Breyer Group plc & Others v Department of Energy & Climate Change; Free Power

for Schools LP v. Department of Energy & Climate Change; Homesun Holdings

Limited & Another v Department of Energy & Climate Change; Touch Solar Limited v

Department of Energy & Climate Change [2014] EWHC 2257 (QB) (High Court, Mr.

Justice Coulson).

The Department of Energy & Climate Change v Breyer Group PLC & Others [2015]

EWCA Civ 408 (Court of Appeal, Lord Dyson, MR., Richards LJ., and Ryder LJ.).](https://image.slidesharecdn.com/breyergroupplcandothers2015-150528135500-lva1-app6891/85/Breyer-Group-PLC-and-Others-2015-3-320.jpg)