Embed presentation

Downloaded 12 times

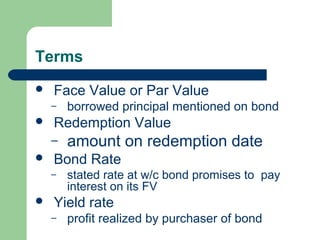

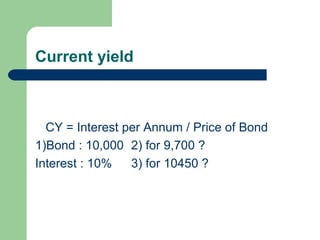

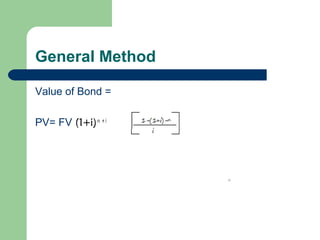

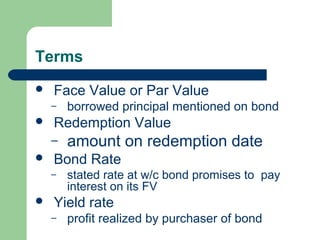

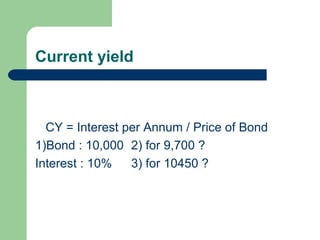

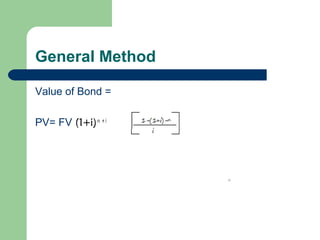

Bonds are certificates that promise to pay the holder a specified sum of money (face value or par value) plus interest at a stated rate. This document discusses key bond terms like redemption value, bond rate, and yield rate. It provides an example of how to calculate current yield based on annual interest and price of the bond. Finally, it poses a problem asking the value of a $1000, 6% bond with semi-annual coupons that will be redeemed at par in 15 years.