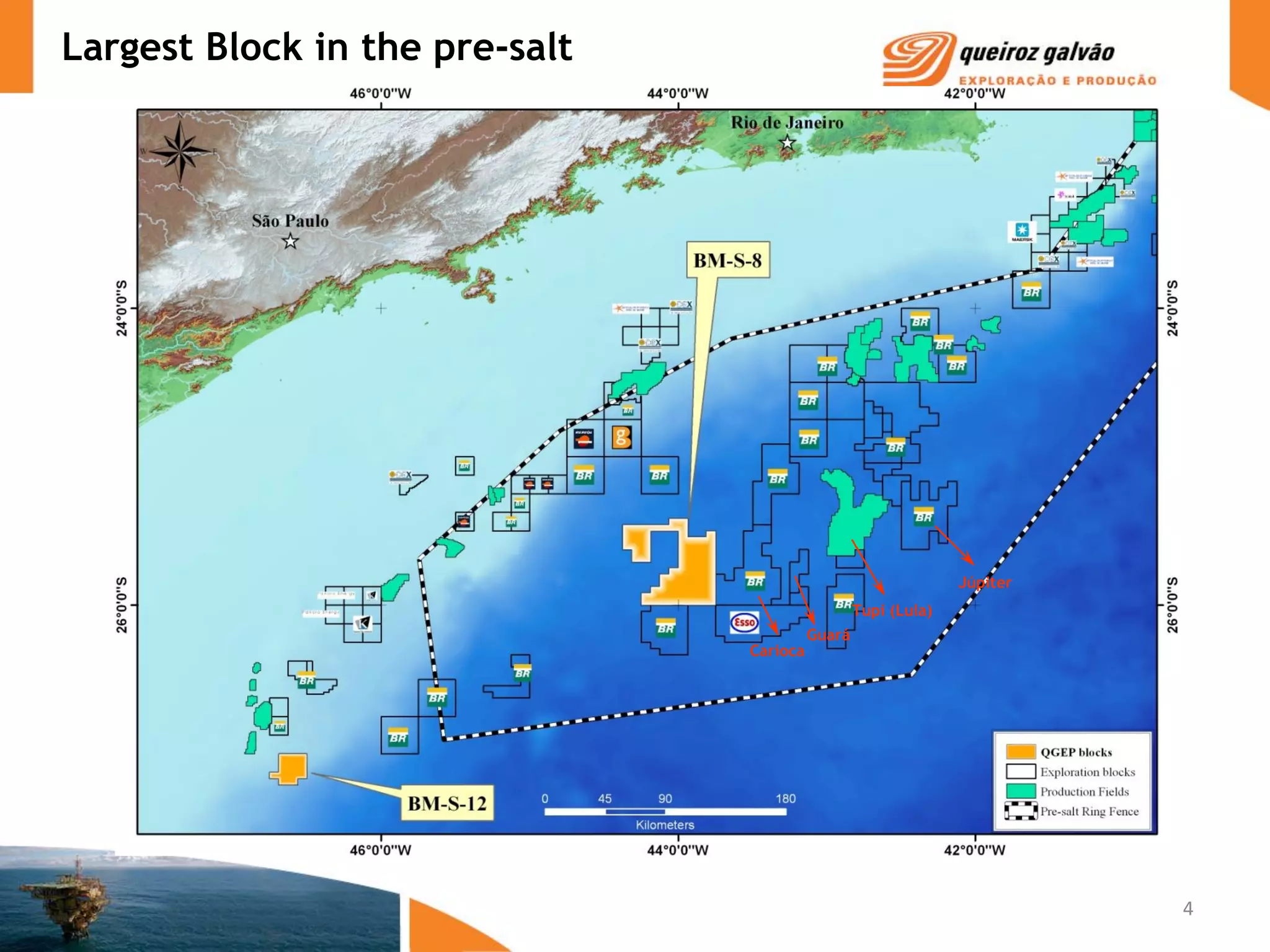

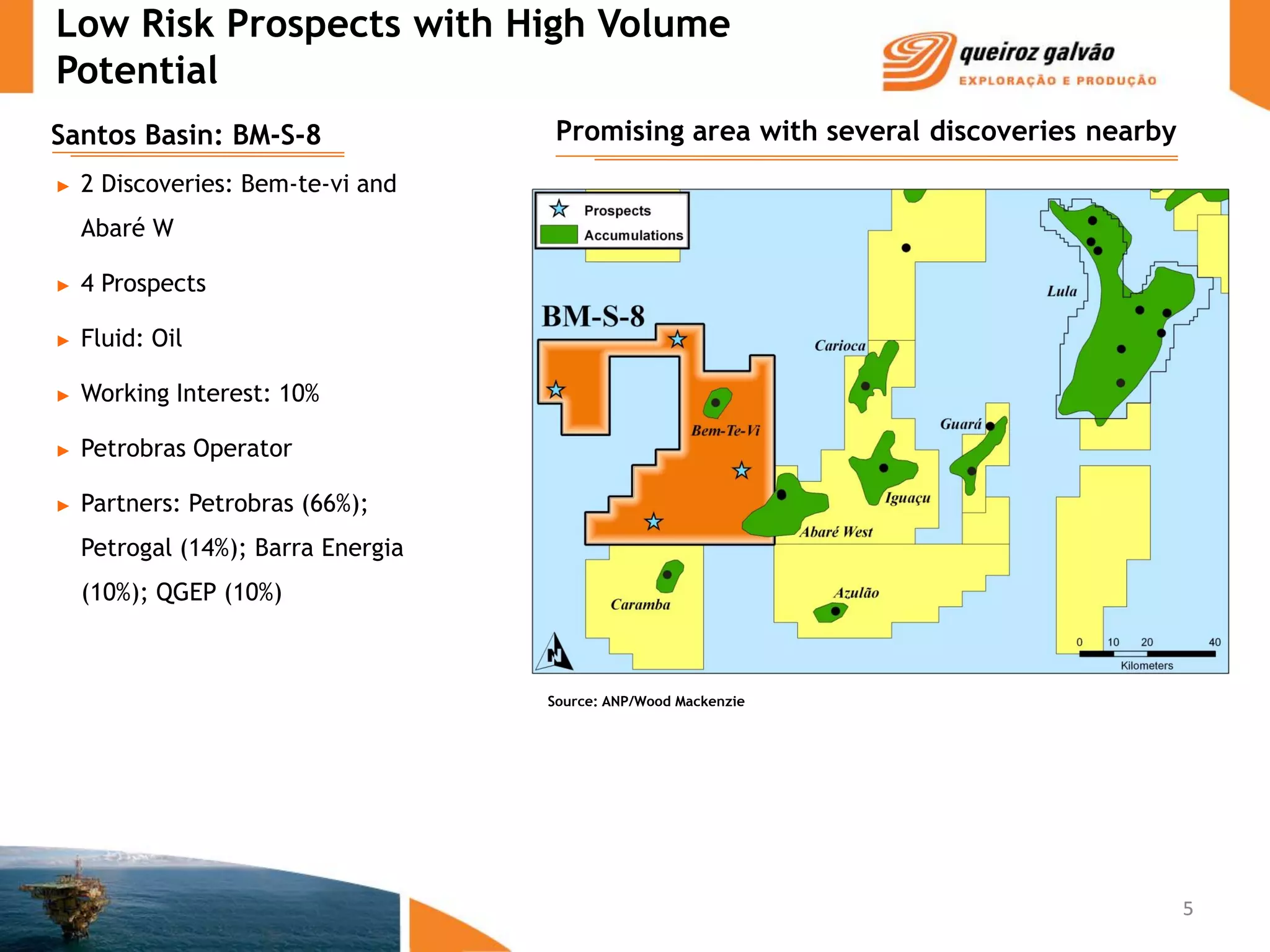

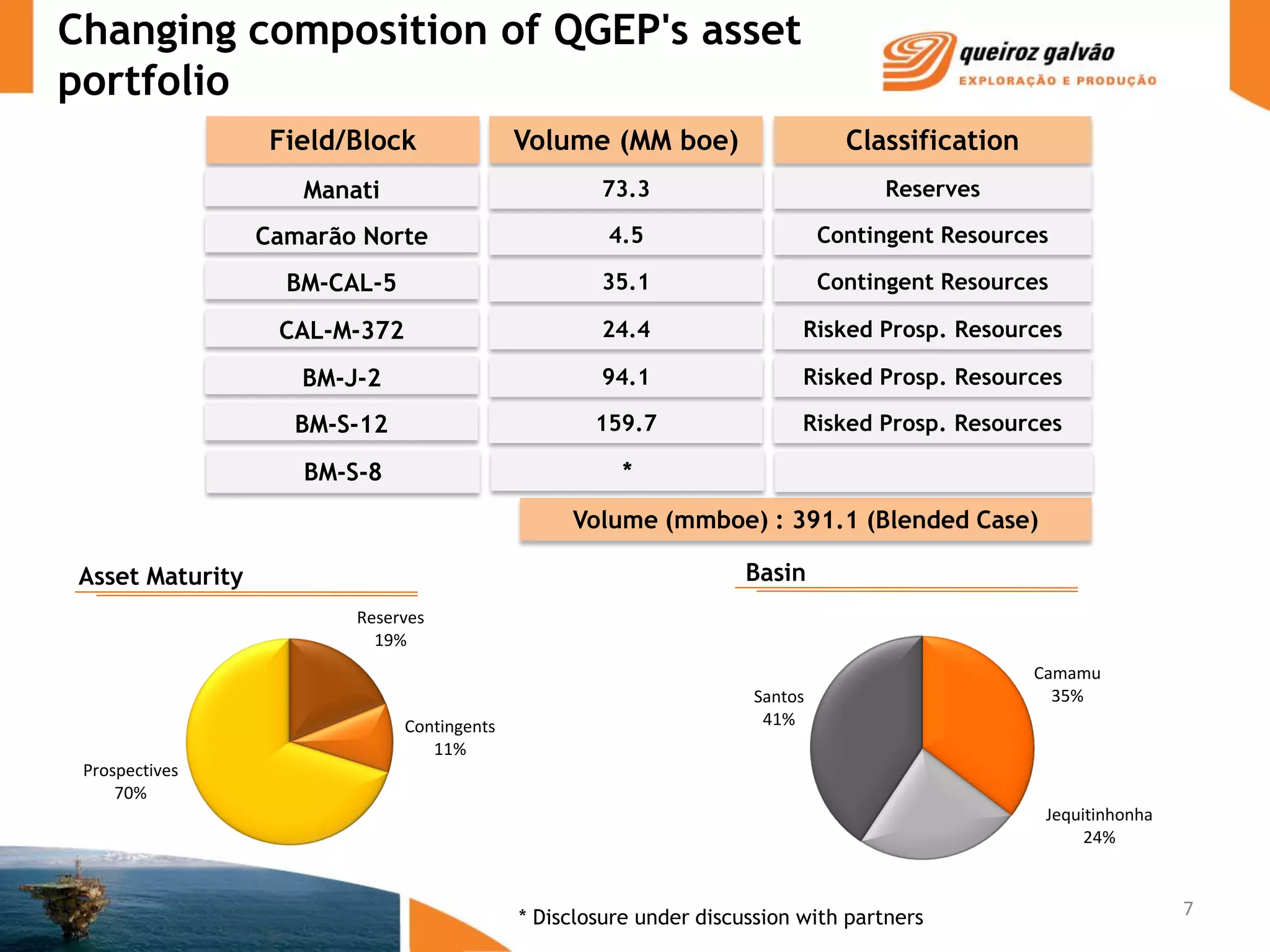

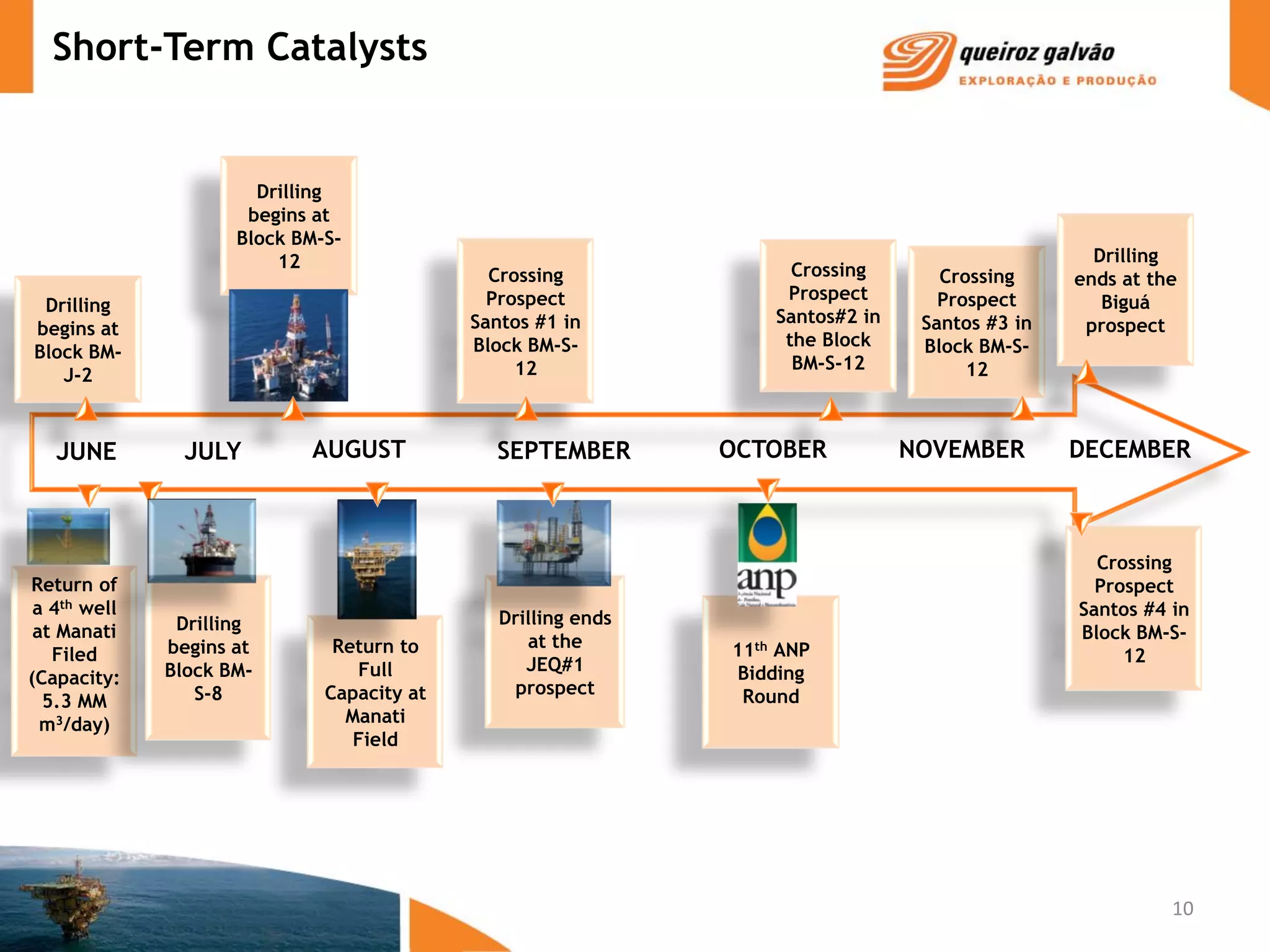

1) QGEP acquired a 10% stake in the BM-S-8 offshore block in the prolific Santos Basin near several oil and gas discoveries, subject to regulatory approval.

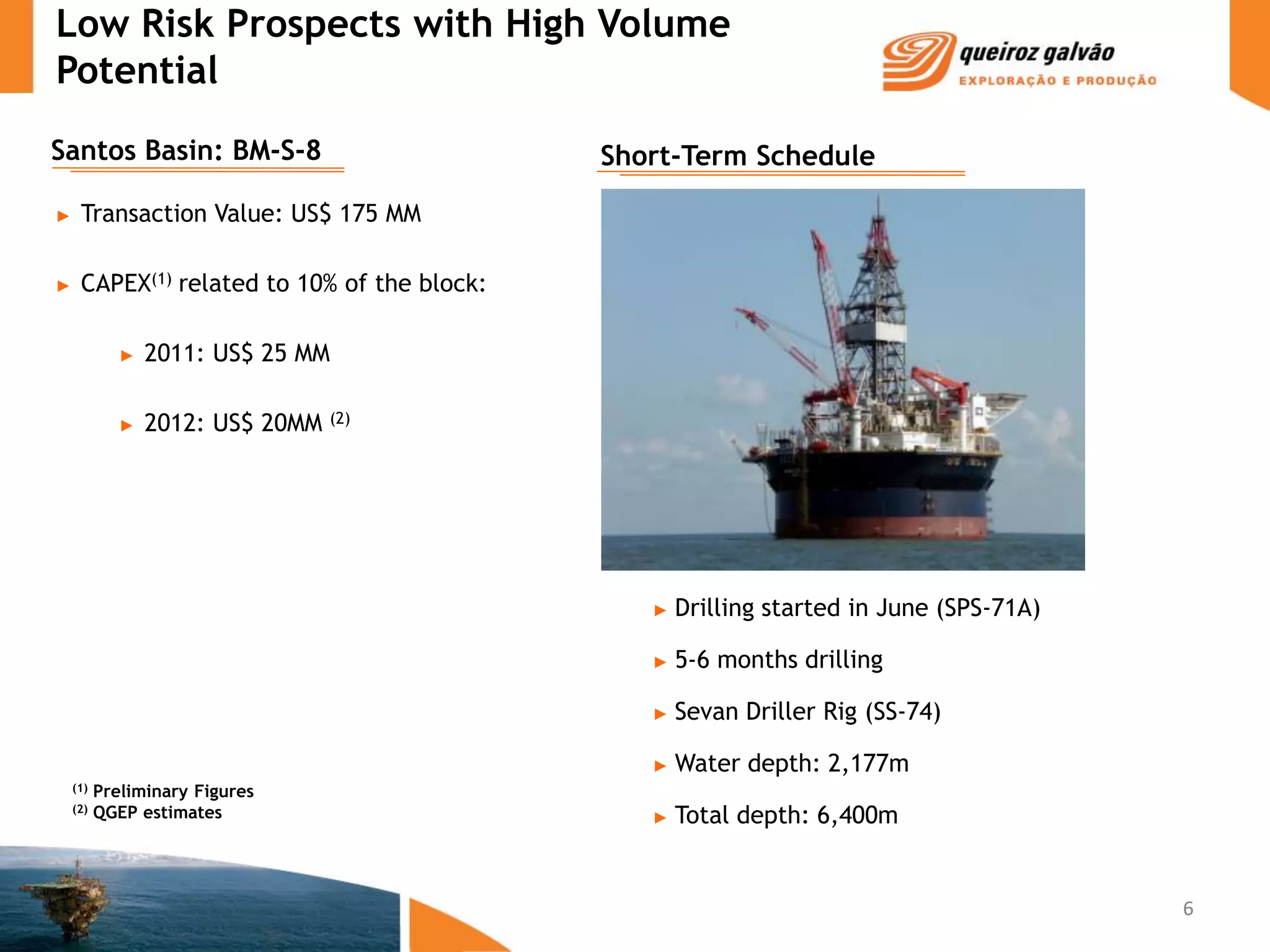

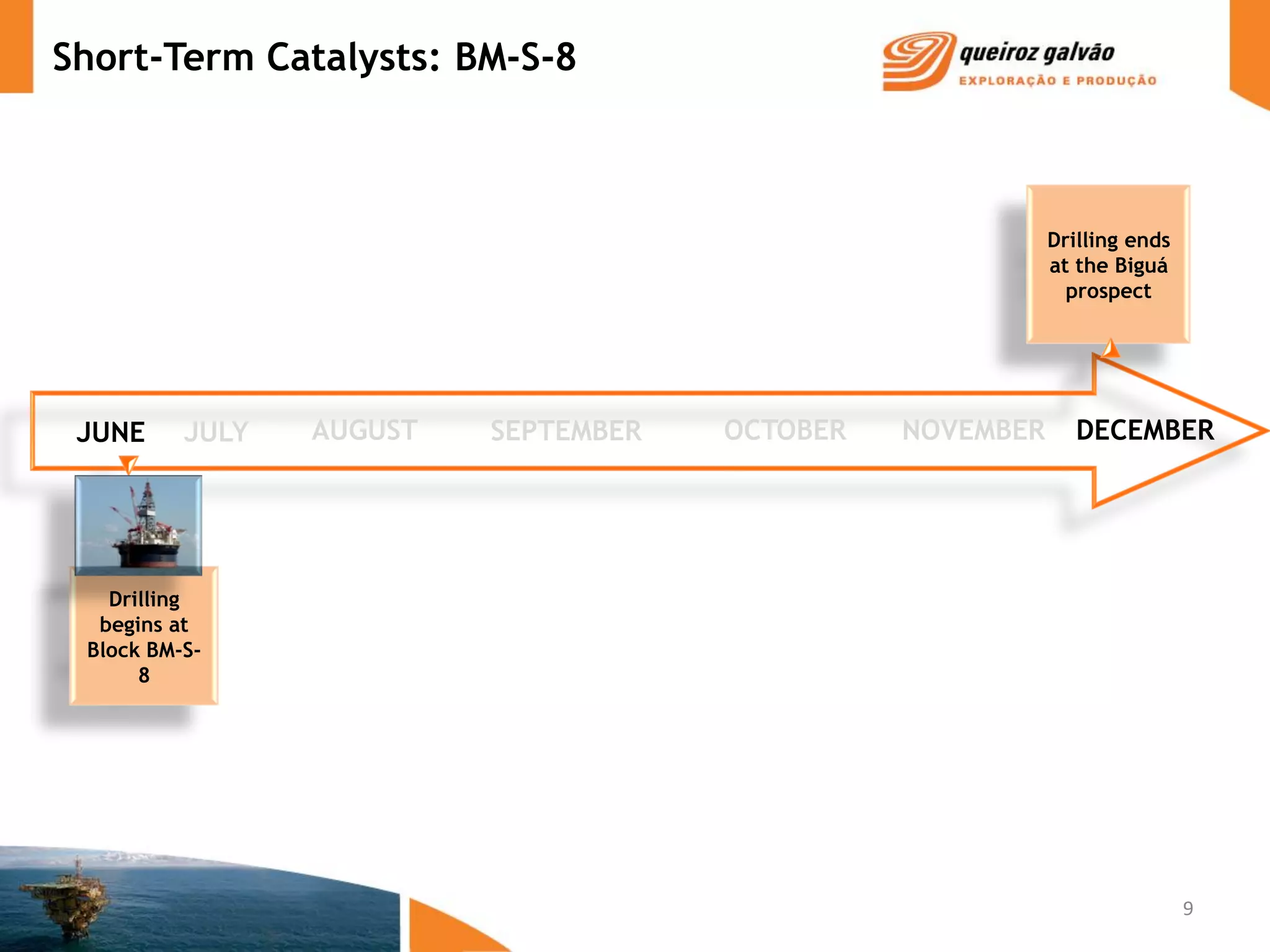

2) The block contains 4 low-risk prospects with the potential for high oil volumes. Drilling is scheduled to begin in June 2011 to test these prospects.

3) The acquisition increases QGEP's portfolio of assets and provides short-term catalysts as drilling results are announced over the next 6 months.