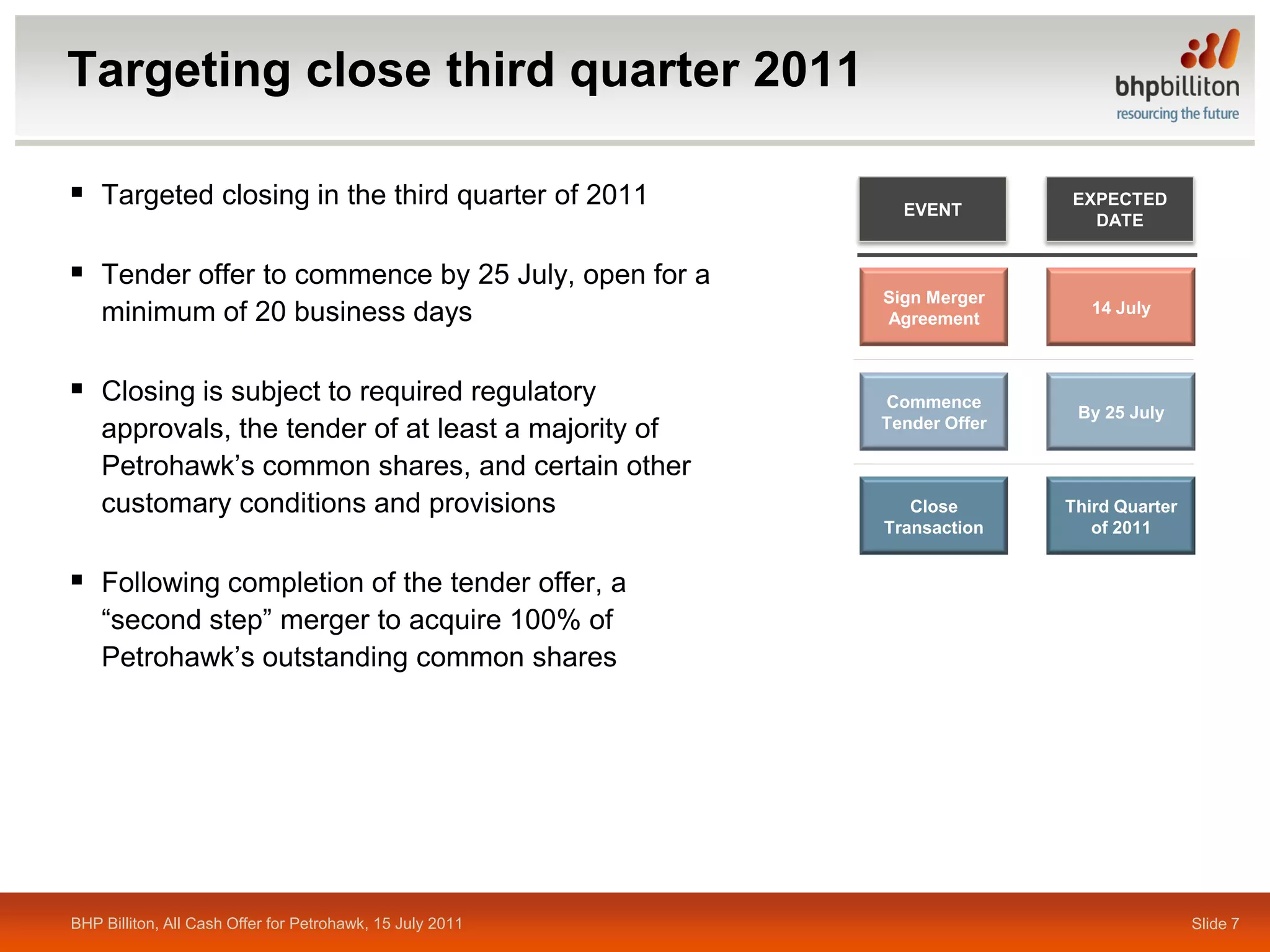

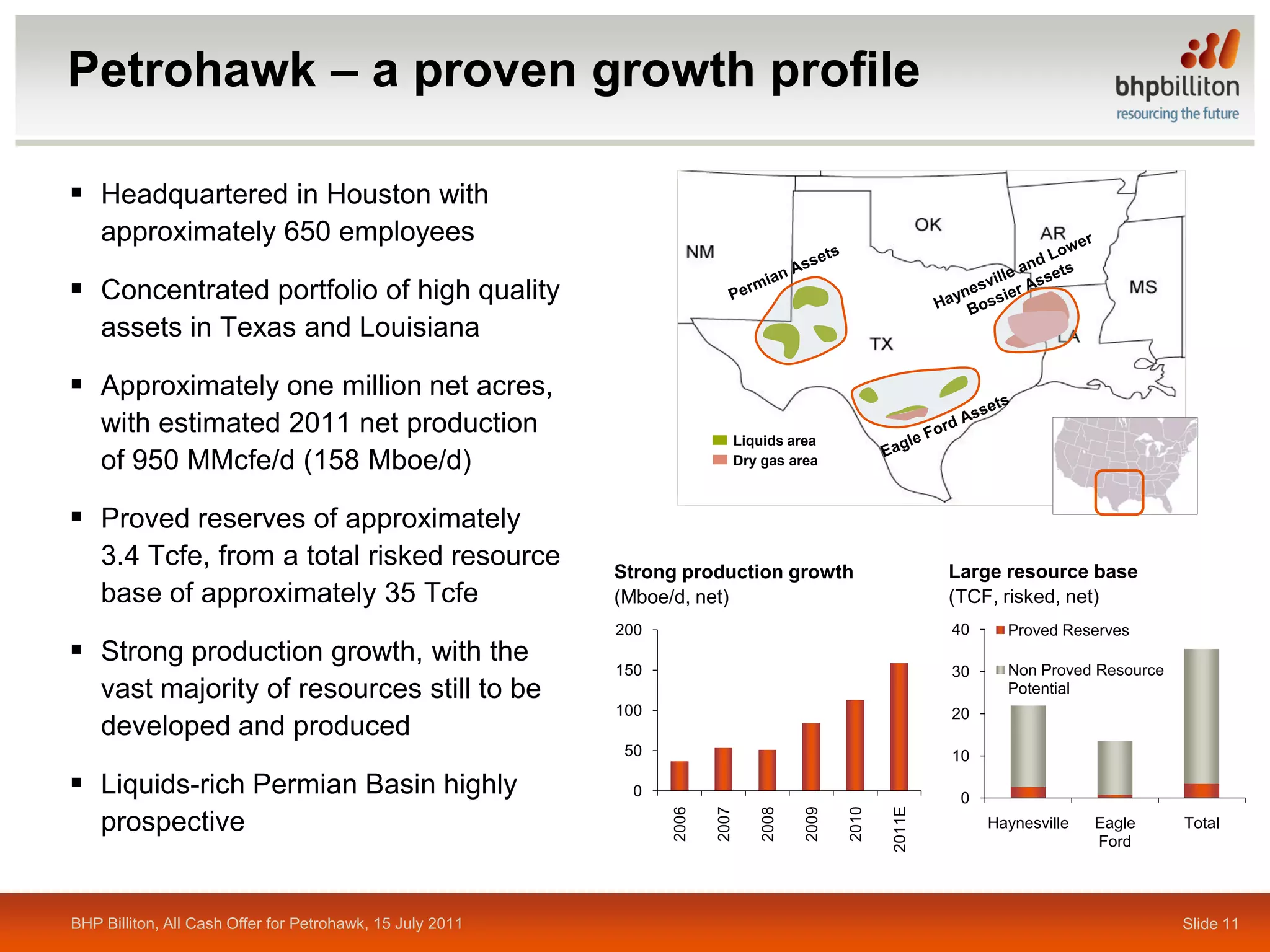

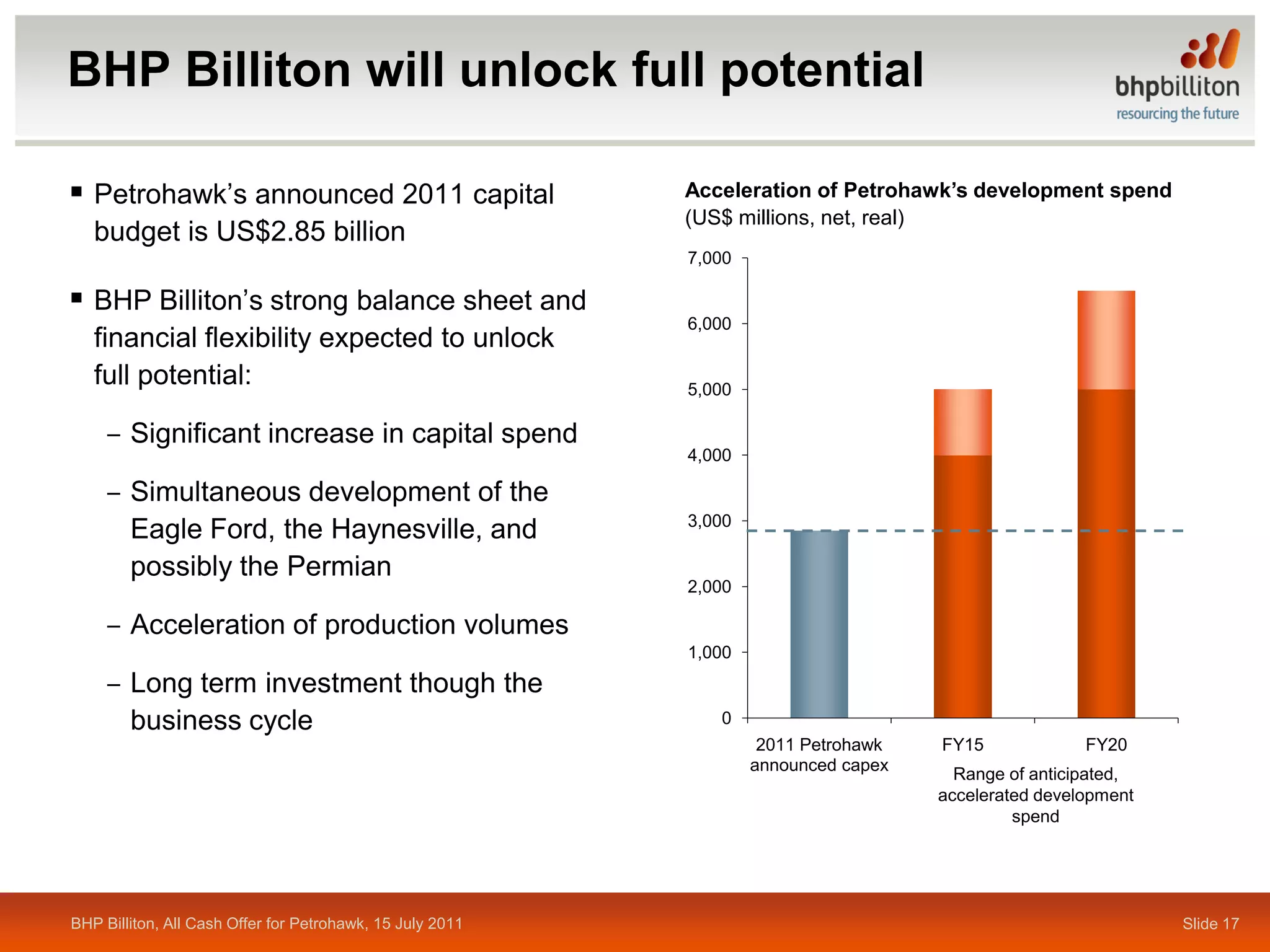

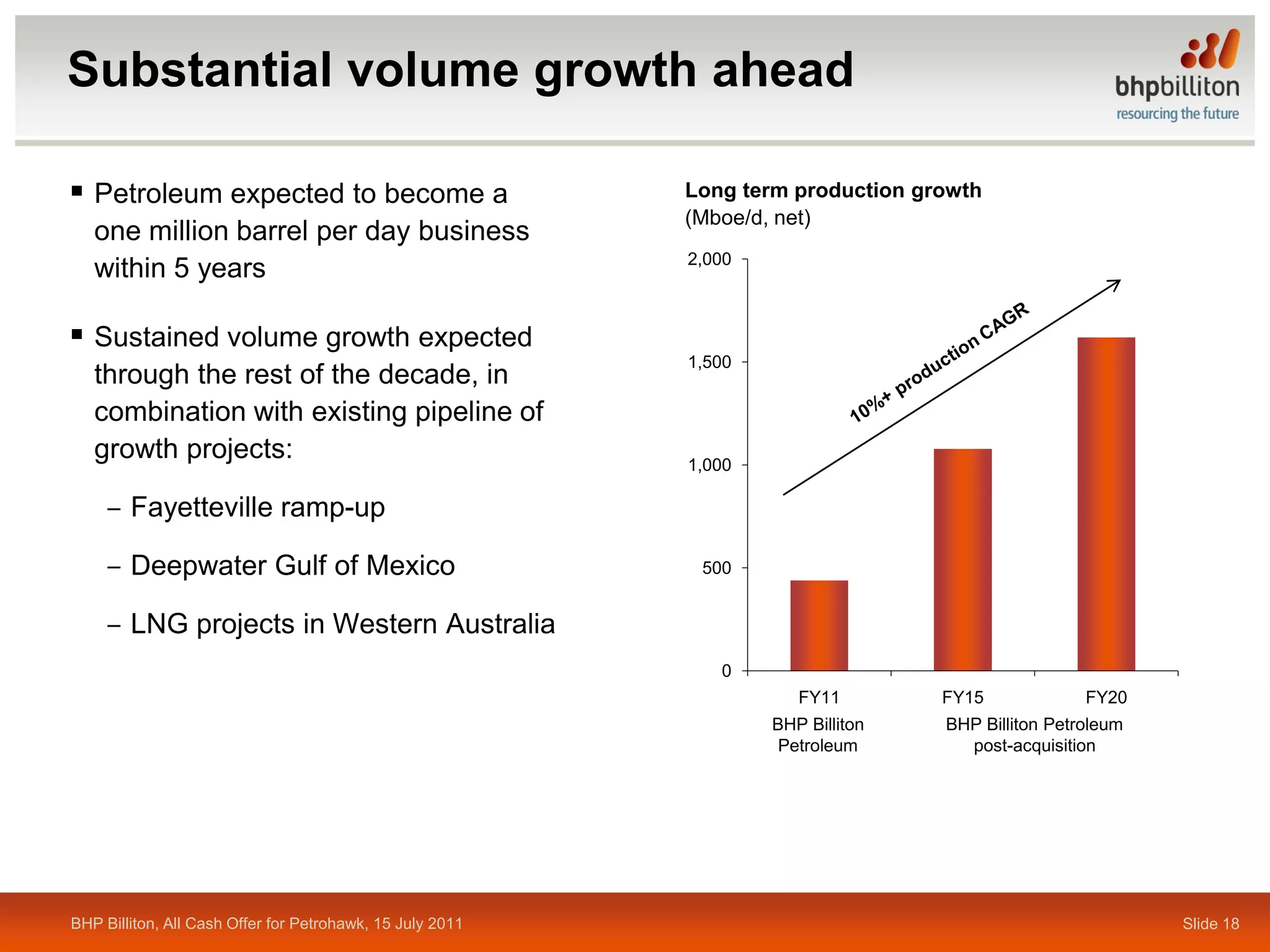

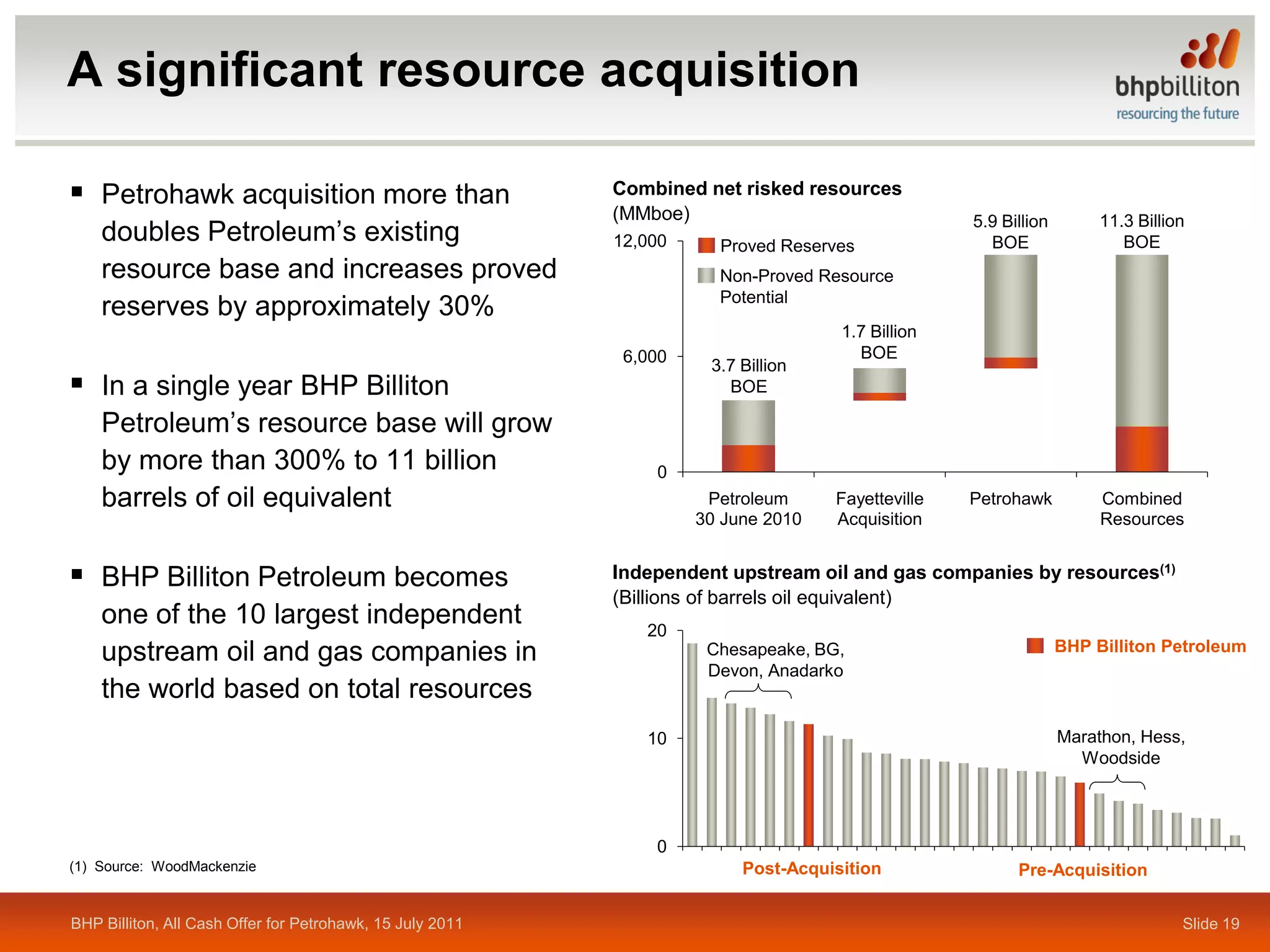

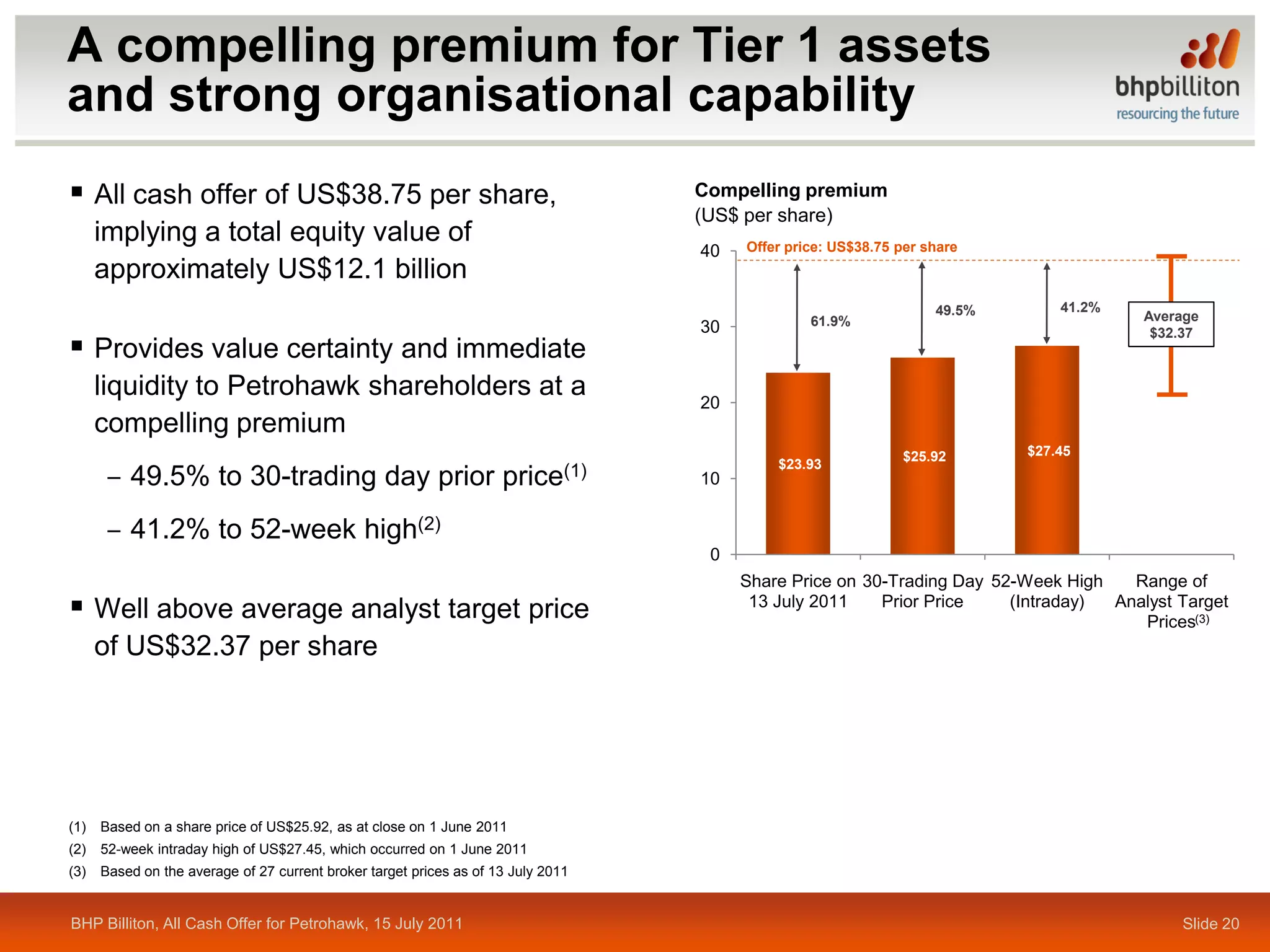

BHP Billiton is making an all-cash offer to acquire Petrohawk Energy Corporation for approximately $15.1 billion including debt. The offer price of $38.75 per share represents a 49.5% premium to Petrohawk's stock price prior to the announcement. The acquisition would add over 1 million net acres and 35 trillion cubic feet of natural gas resources to BHP Billiton's portfolio. BHP Billiton expects the transaction to close in the third quarter of 2011 pending regulatory approvals and a majority of Petrohawk shareholders tendering their shares.