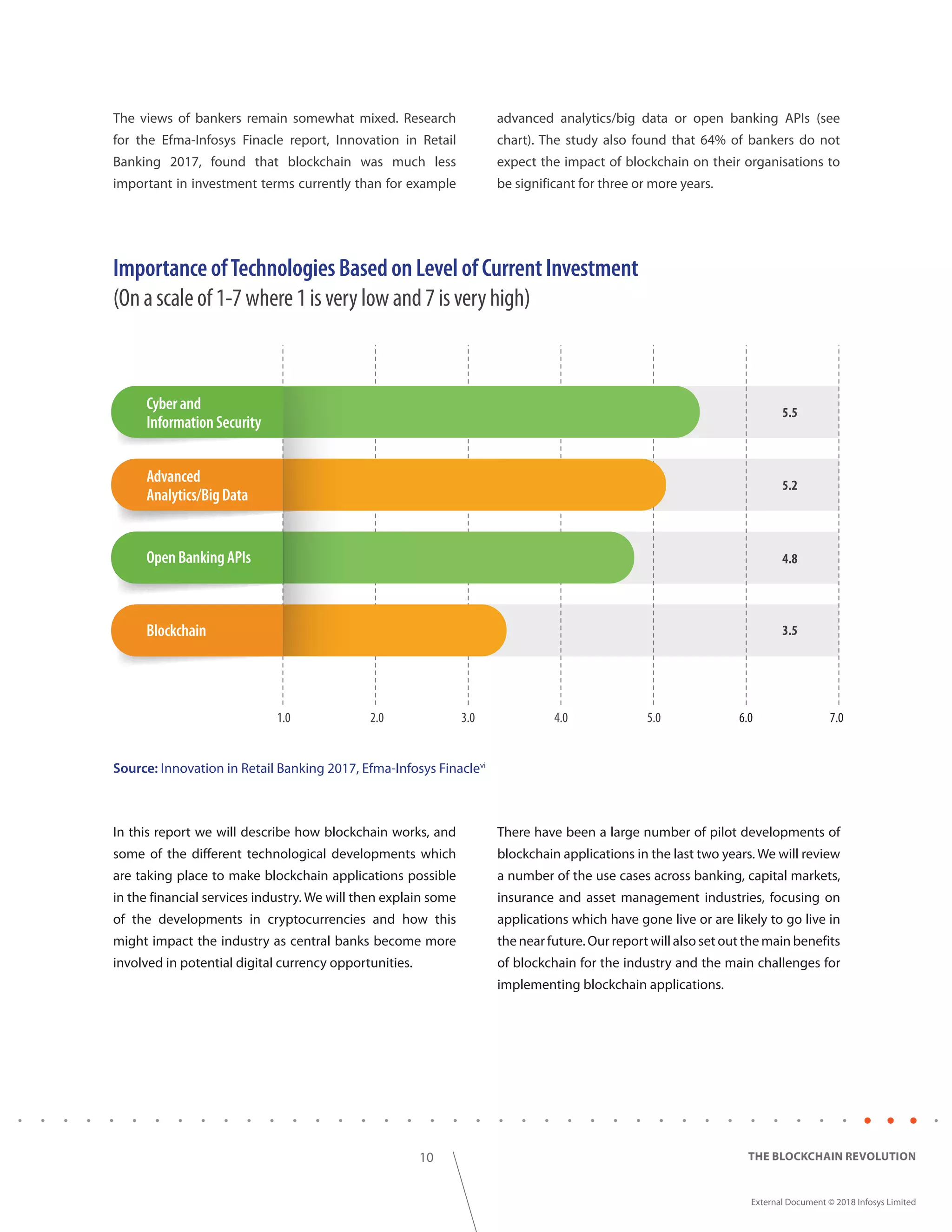

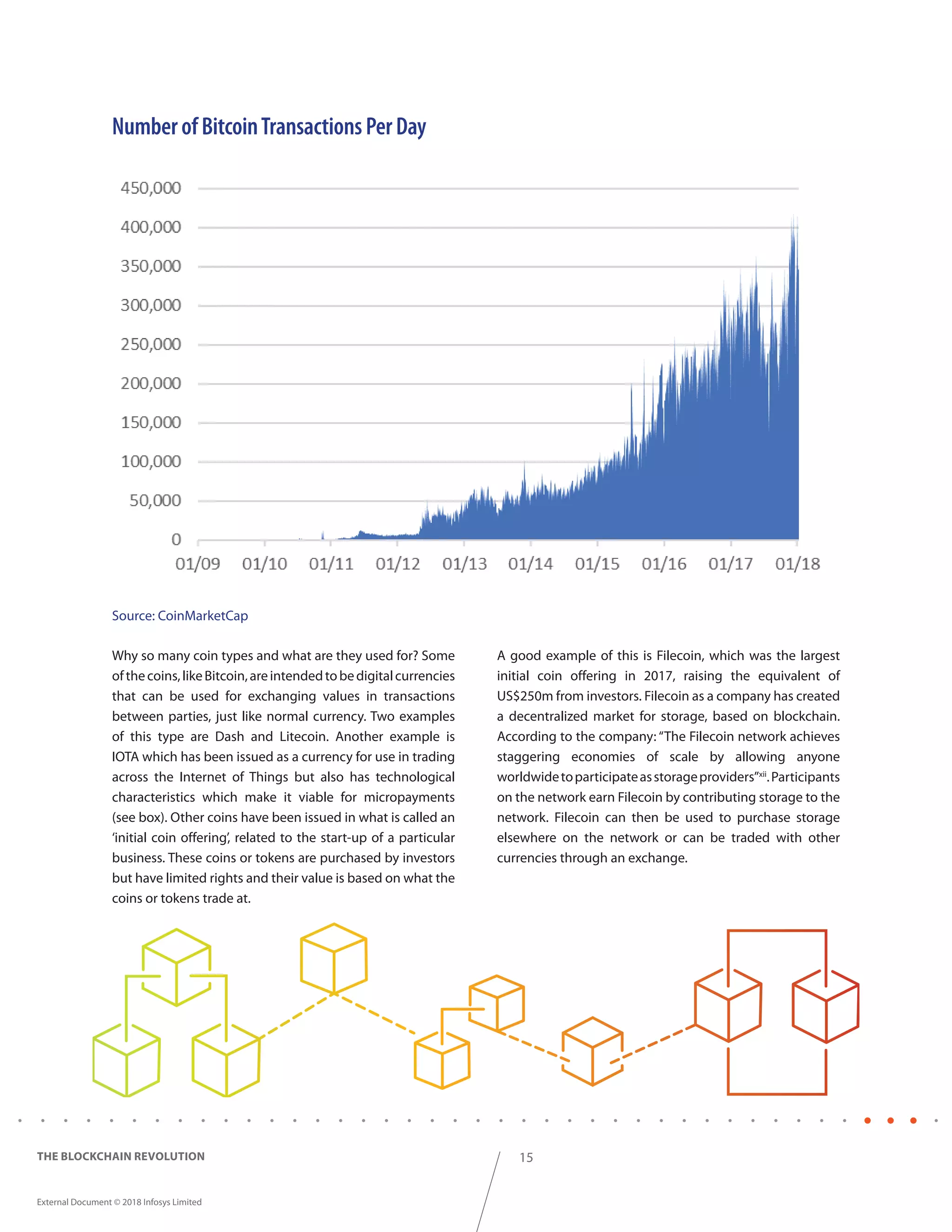

The document discusses how blockchain and distributed ledger technology will transform financial services. It provides an executive summary of blockchain applications proliferating across financial services industries like banking, capital markets, insurance, and asset management. It also highlights benefits like cost savings and barriers to adoption like management understanding.