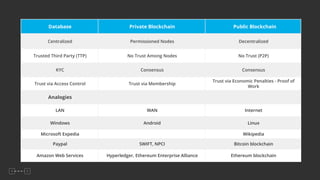

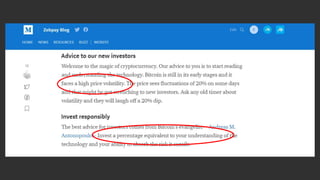

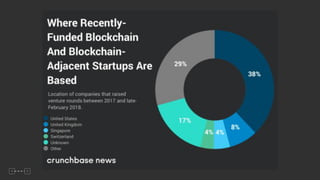

The document discusses blockchain technology, including concepts of private and public blockchains, and their respective use cases. It encompasses case studies, challenges of virtual currencies (VCs), and the importance of regulatory framework for VCs, emphasizing that they should be treated like other financial instruments. Additionally, it presents historical data and trends related to market growth and taxation in the cryptocurrency space.