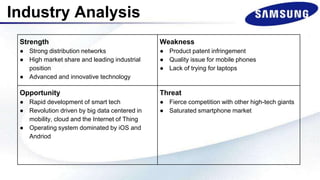

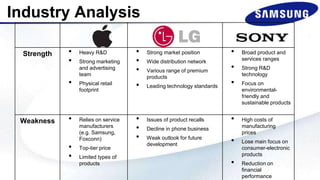

Samsung was founded in 1938 and began as an electronics company, first producing black-and-white TVs. It is now a global leader in smartphones, memory chips, and other electronics. Samsung has a 26.7% share of the US smartphone market and 30.4% globally. It faces intense competition from other technology giants and a saturated smartphone industry. To diversify, Samsung plans to expand into new product categories like in-car and wearable technology through innovation and customization.