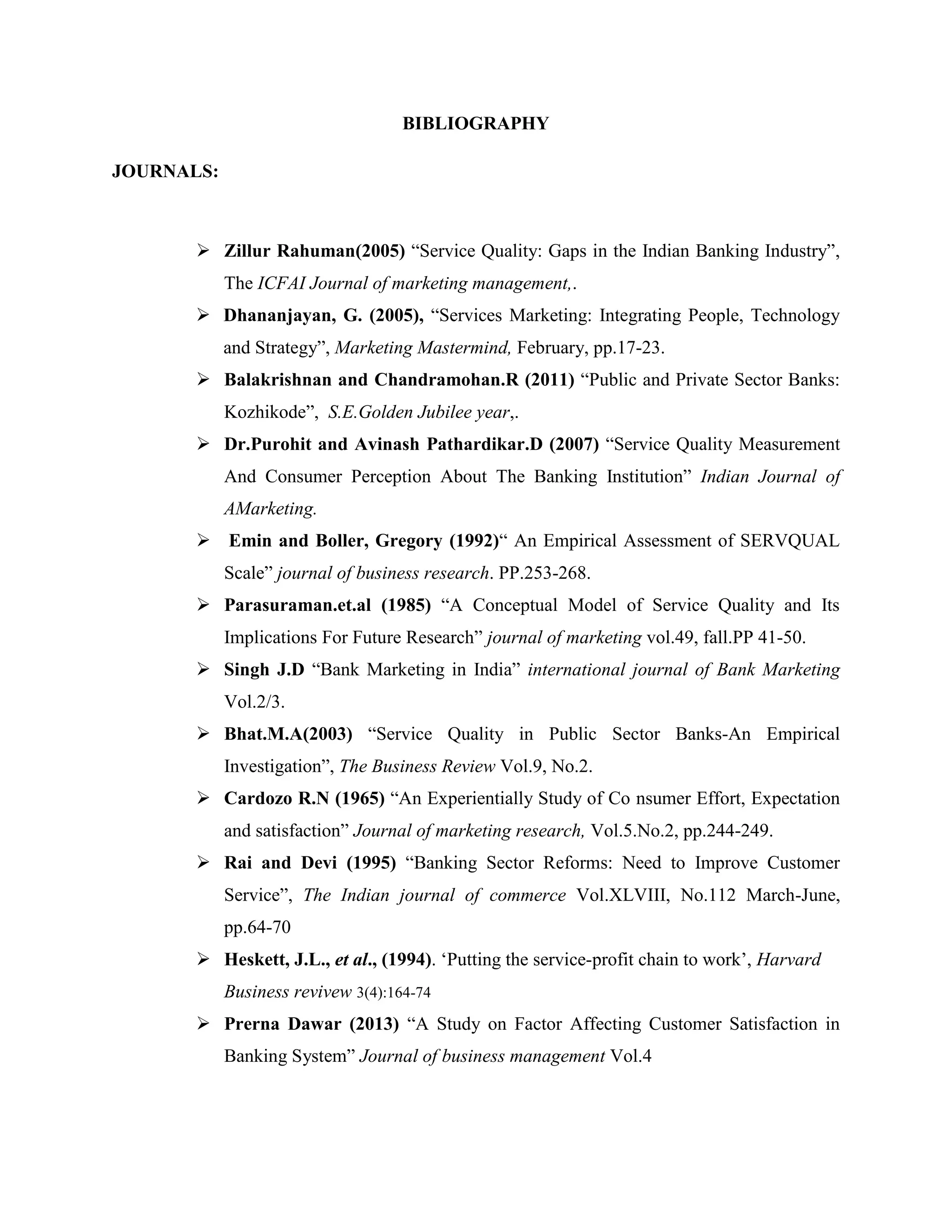

This document contains a bibliography and questionnaire for a study on banking services and customer satisfaction in the new private banking sector, specifically related to ICICI Bank in Coimbatore City. The bibliography lists several journal articles, books, and websites related to topics of banking, service quality, customer satisfaction and research methodology. The questionnaire contains 25 questions on customer demographics, account details, service quality assessments, problems faced, satisfaction levels and opinions regarding a specific bank.