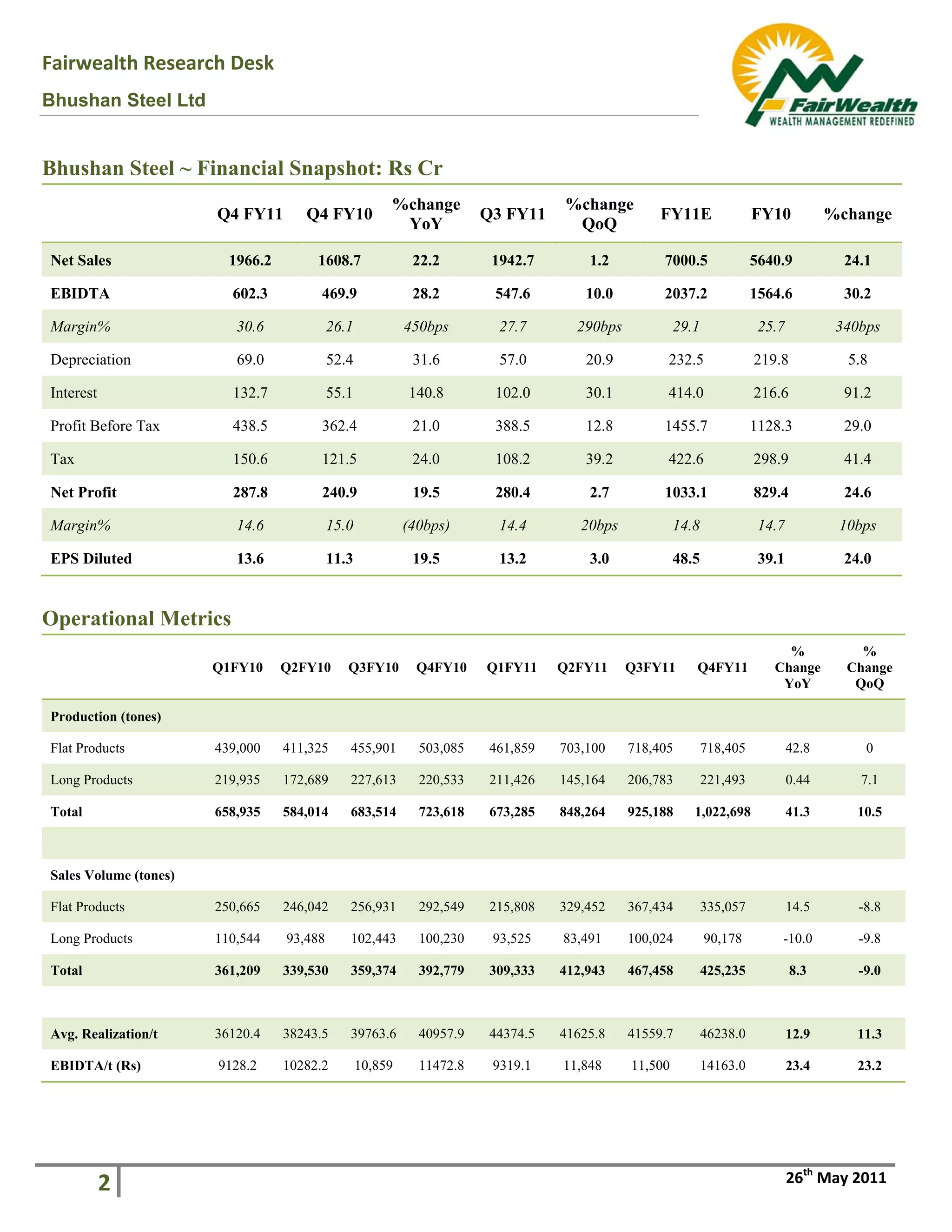

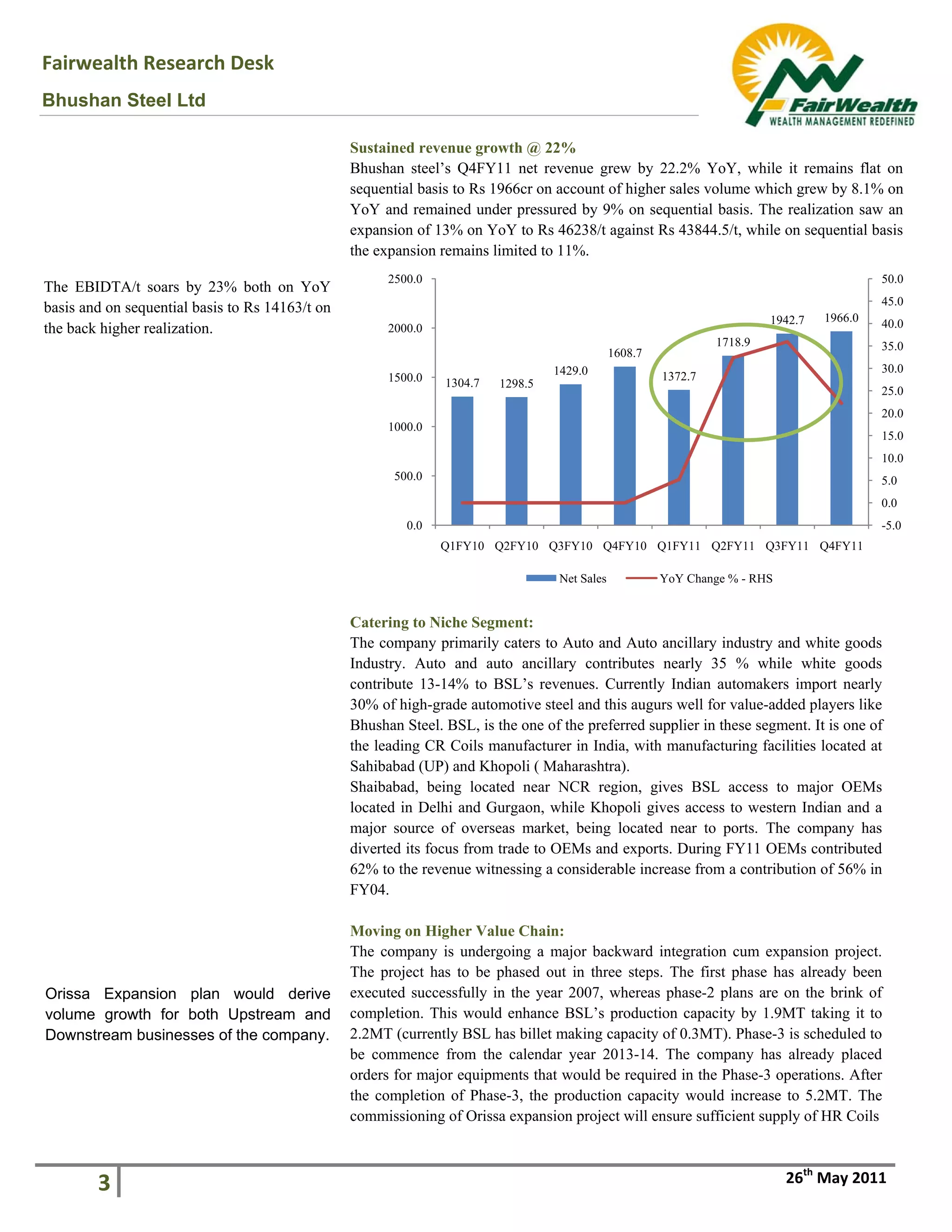

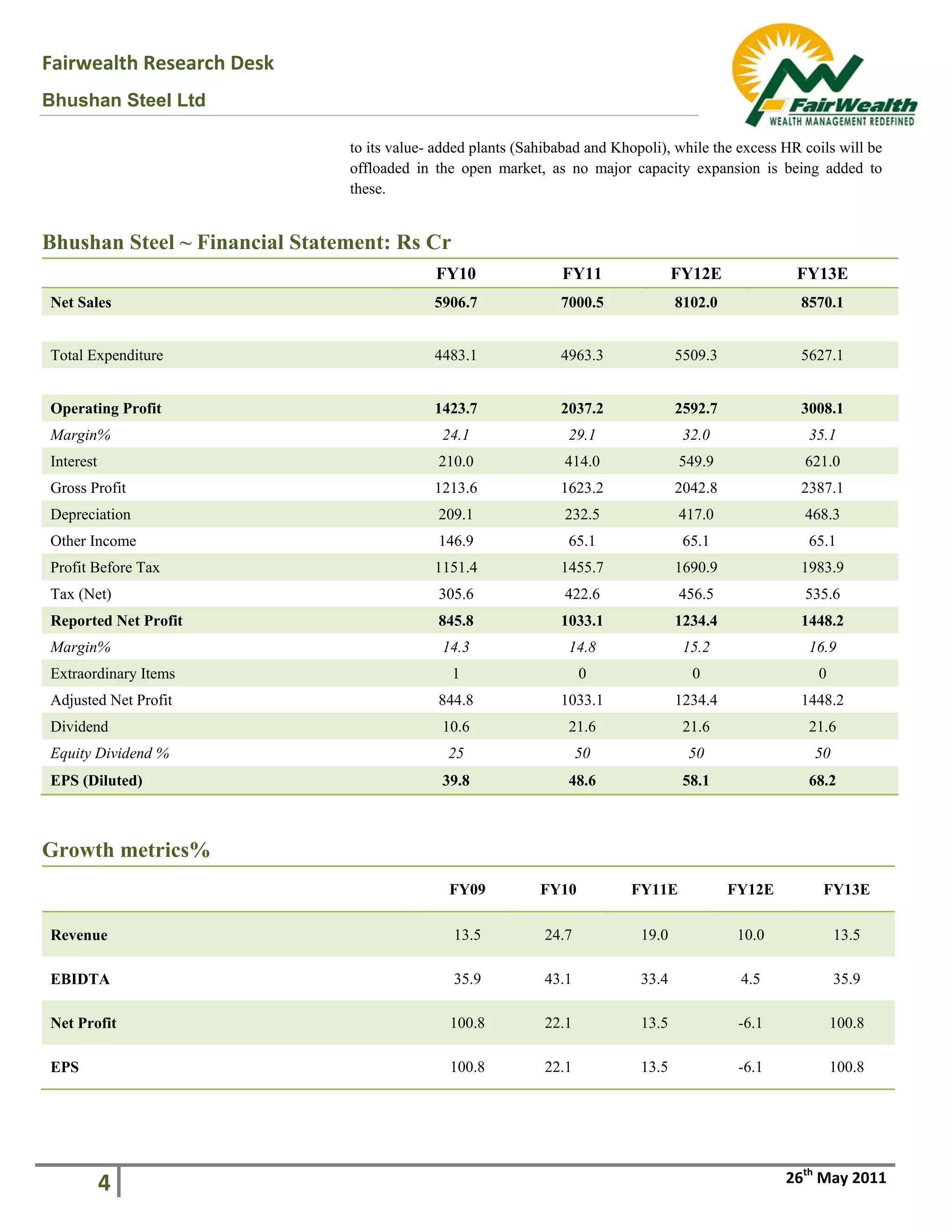

1) Bhushan Steel reported a 22% increase in net revenue for Q4FY11, driven by higher domestic sales and realization. Net profit increased 19.5% YoY.

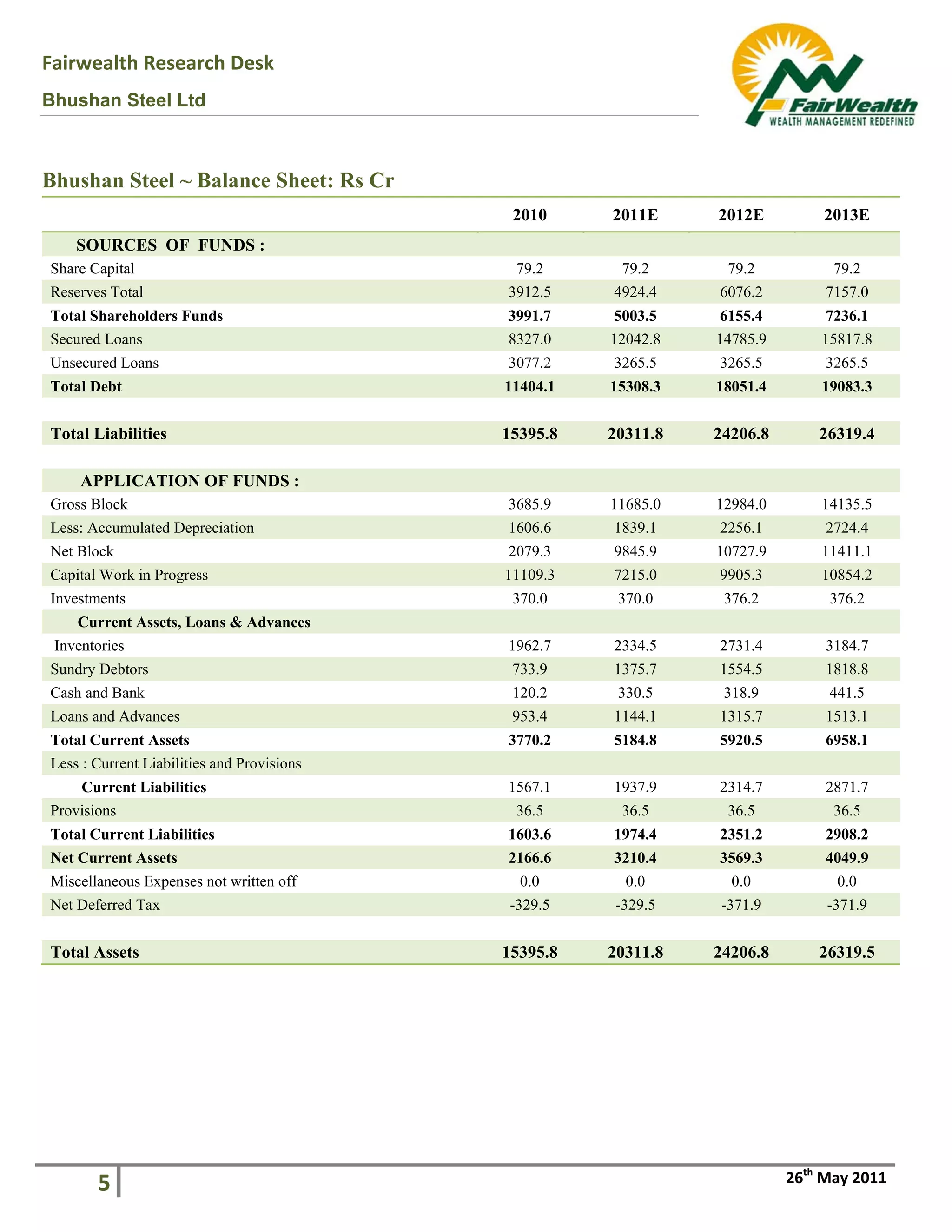

2) The company caters to the automotive and appliance sectors, with automotive accounting for 35% of revenue. It is moving up the value chain with a major expansion project.

3) The analyst recommends buying the stock with a 12-month target price of Rs 507, a 17% upside, based on improved operating efficiency and positioning in niche segments.