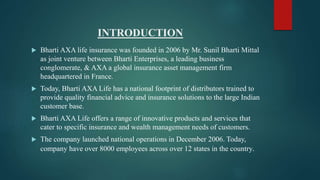

Bharti AXA Life Insurance, a joint venture founded in 2006 between Bharti Enterprises and AXA, provides a variety of insurance and wealth management products to Indian customers. The company has over 8000 employees and plans to become one of the top five insurance providers while leveraging its local expertise and aiming for sustainable growth. With strengths in brand value and market opportunities, the company also faces challenges from competition and regulatory factors.

![LIFE JOURNEYABOUT JOINT VENTURE (JV)

2006 – Started as JV between Bharti Group [74%] and AXA Group

[26%].

2015 – FDI cap changed: AXA stake increased to [49%] and Bharti:

[51%].

2017 - Bharti Group takes lead in JV opreations .

2019 – Banca Partnership with Karnataka Bank.

2020 – 5 years strategic roadmap agreed between shareholders.](https://image.slidesharecdn.com/bhartiaxappt-240614100525-b3c411d4/85/BHARTI-AXA-PPT-1-pptx-final-detailed-view-4-320.jpg)