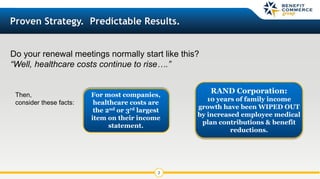

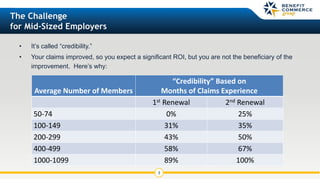

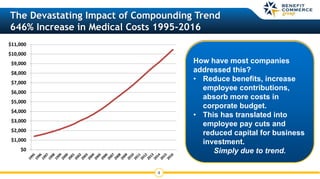

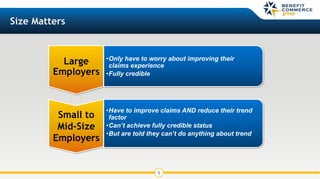

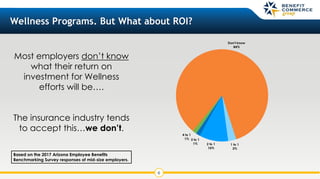

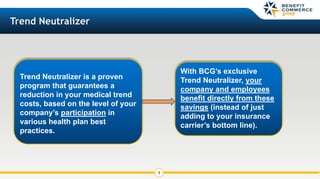

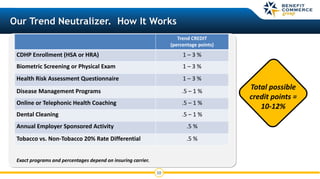

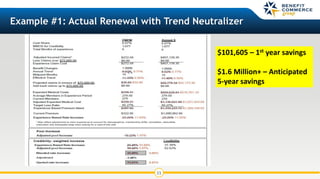

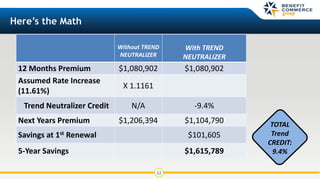

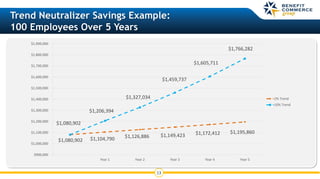

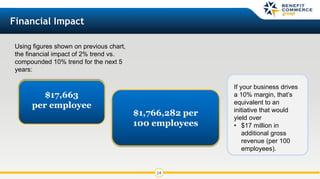

The document discusses a health plan strategy called 'trend neutralizer' designed to reduce medical trend costs for mid-sized employers through various health best practices. It highlights the economic burden of rising healthcare costs and presents a model demonstrating potential savings achieved by implementing this strategy, including guaranteed returns on wellness programs. Case studies indicate that companies using this approach have successfully saved millions, underscoring the program's effectiveness.