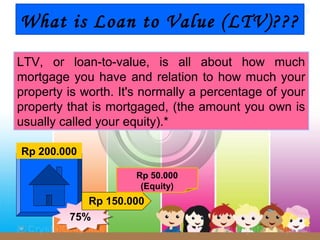

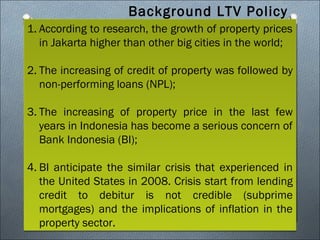

BCA had anticipated Bank Indonesia's loan to value (LTV) policy. The BCA president director said the bank understood BI's policy given current economic conditions. For expensive areas, BCA set higher down payments than BI's minimum of 30%, such as 50%. BCA had also anticipated a credit slowdown by budgeting a 20% increase compared to 37% the previous year. The LTV policy aims to control property sector credit growth and improve credit quality by increasing down payment requirements.