The document summarizes key lessons from a study tour of Thailand's automotive industry:

1) Thai OEMs and suppliers showed variable adherence to World Class Manufacturing standards, though some incremental advantages exist due to lower costs.

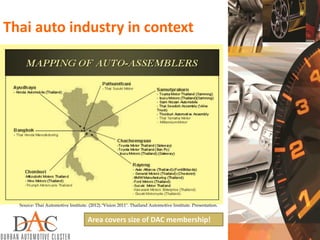

2) Specialization is enabled by large scale of operations, with single plants and suppliers benefiting from multiple assembly plants and CKD production.

3) Labour market flexibility allows firms to recover costs and manage demand variations through extended shifts and overtime pay.

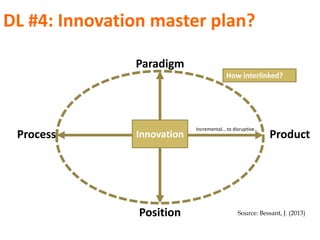

The document questions how South Africa can realize similar scale economies, operating models, and innovation strategies to strengthen competitiveness.

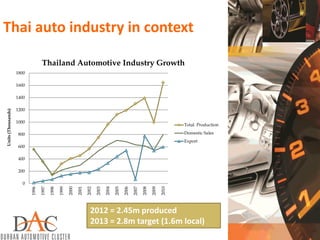

![Thai auto industry in context

Source: Board of investment. (2013). [Online] Available: www.boi.go.th.](https://image.slidesharecdn.com/barnesdacagm070813-130812034424-phpapp01/85/Barnes-dac-agm-07-08-13-7-320.jpg)