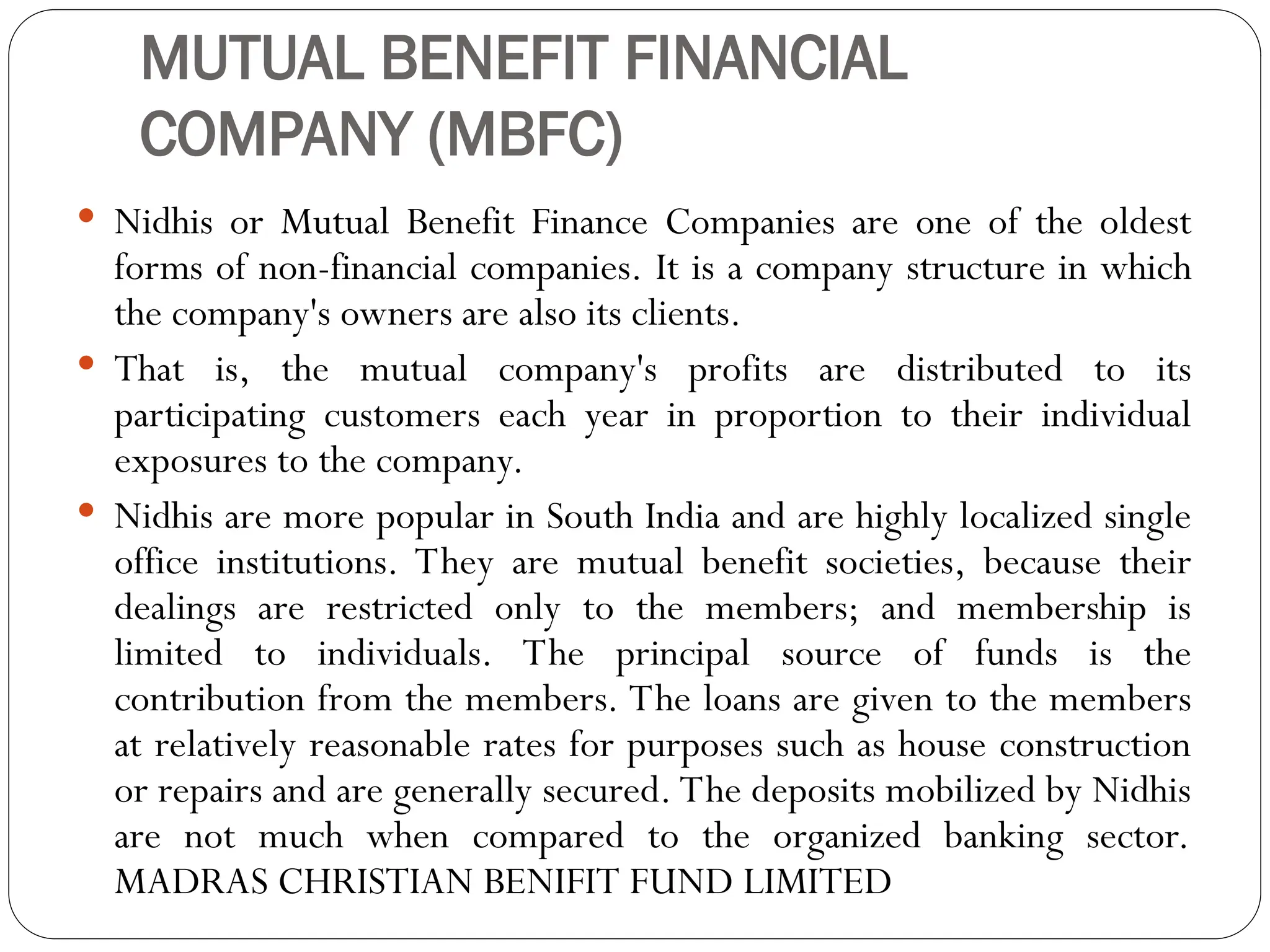

Non-Banking Financial Companies (NBFCs) are financial intermediaries registered under the Companies Act, 1956, involved in lending, leasing, and investing in securities among other activities. Key features include mandatory RBI registration, limitations on accepting public deposits, and restrictions on interest rates and incentives for depositors. NBFCs differ from banks in their regulations, lending practices, and deposit insurance, providing financial services to individuals and SMEs lacking access to traditional banking.