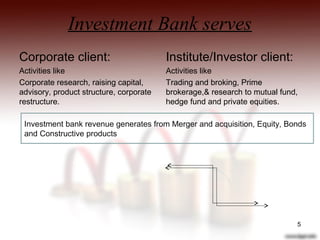

Investment banks perform several key functions: they advise corporations on mergers and acquisitions and help raise capital through arranging debt and equity financing; they engage in trading and market making activities for both their own accounts and on behalf of clients; and they provide research on markets, economies, and industries. Investment banks generate revenue primarily from fees earned through mergers and acquisitions advisory work, trading and underwriting of equity and debt instruments, and fees from products constructed for investors.