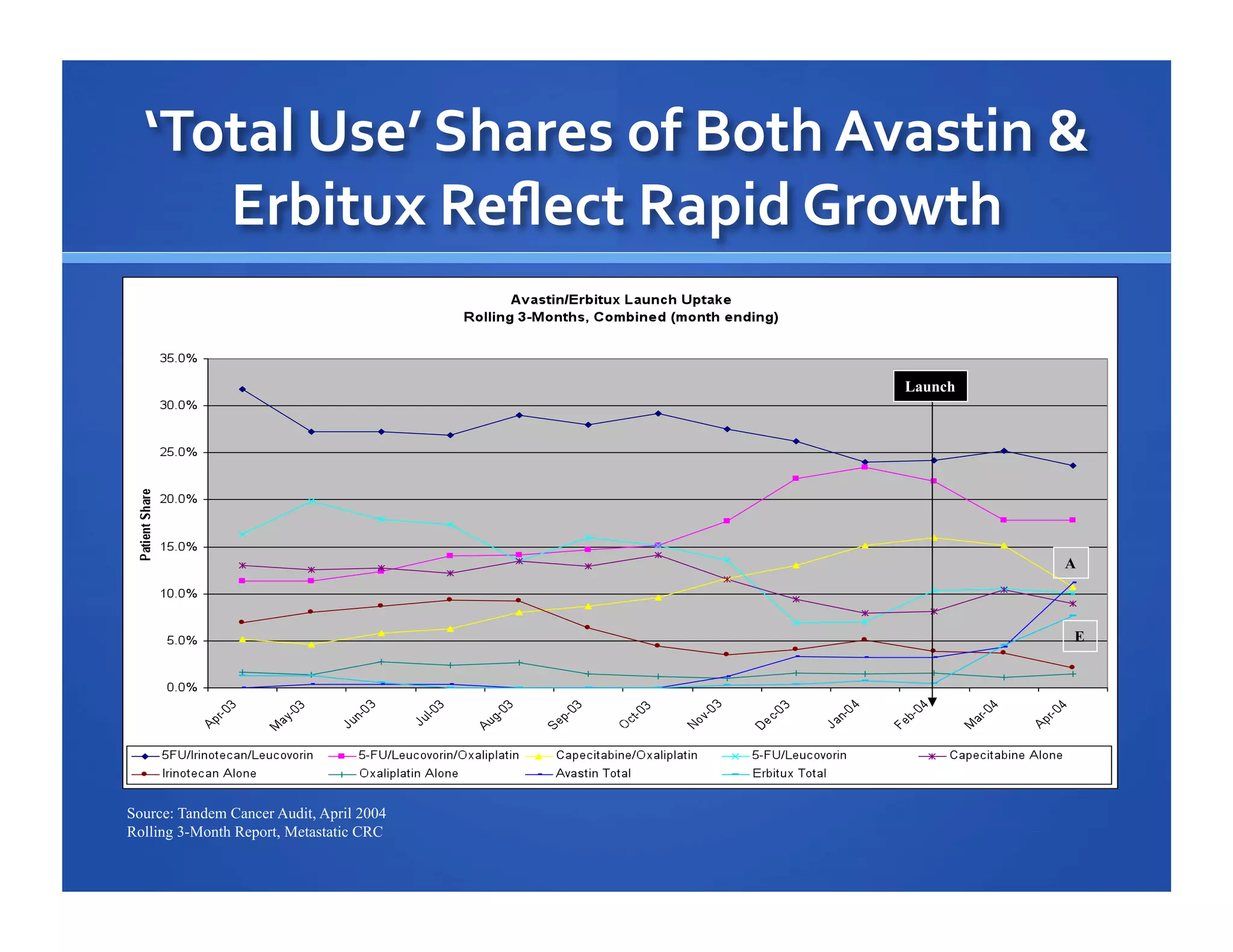

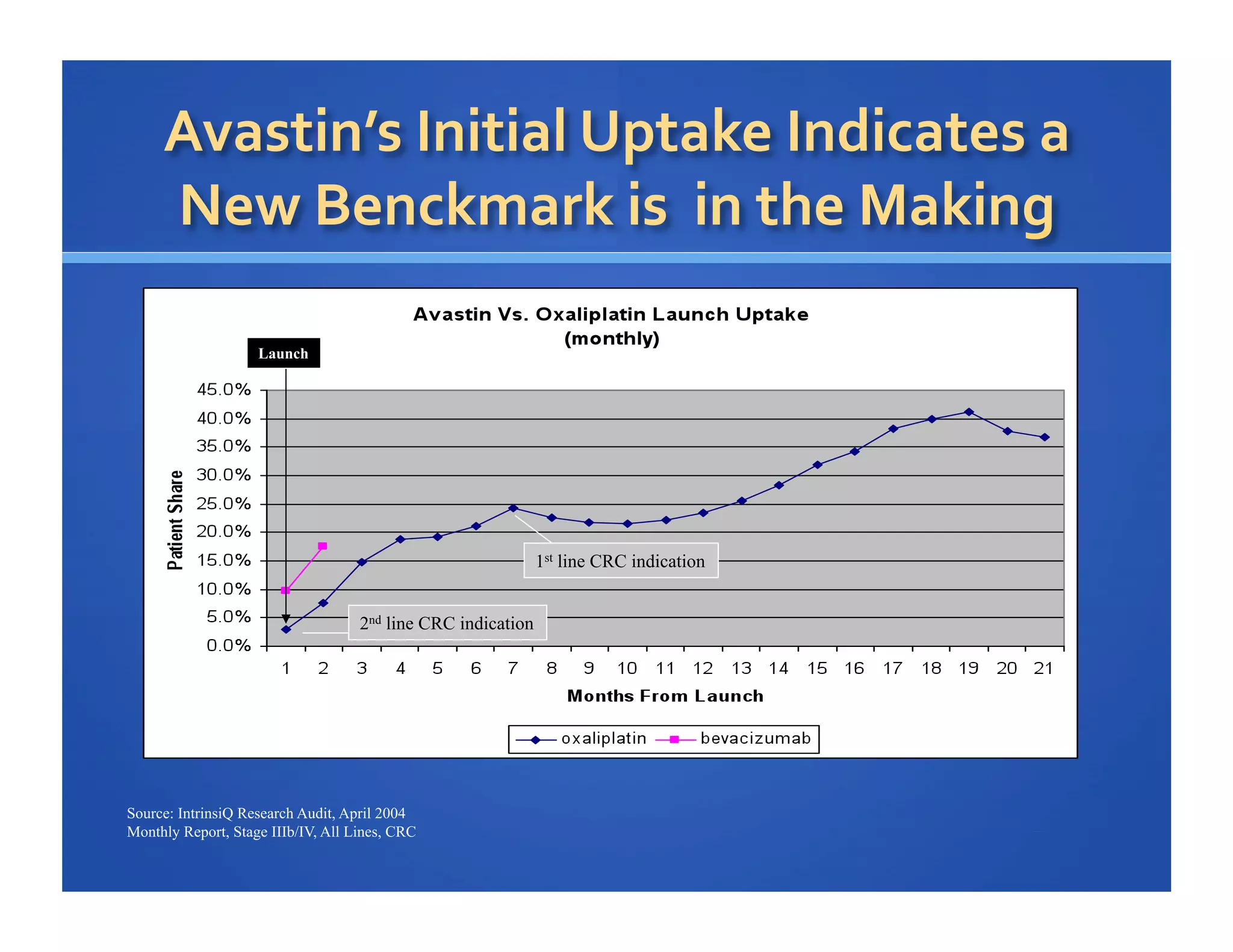

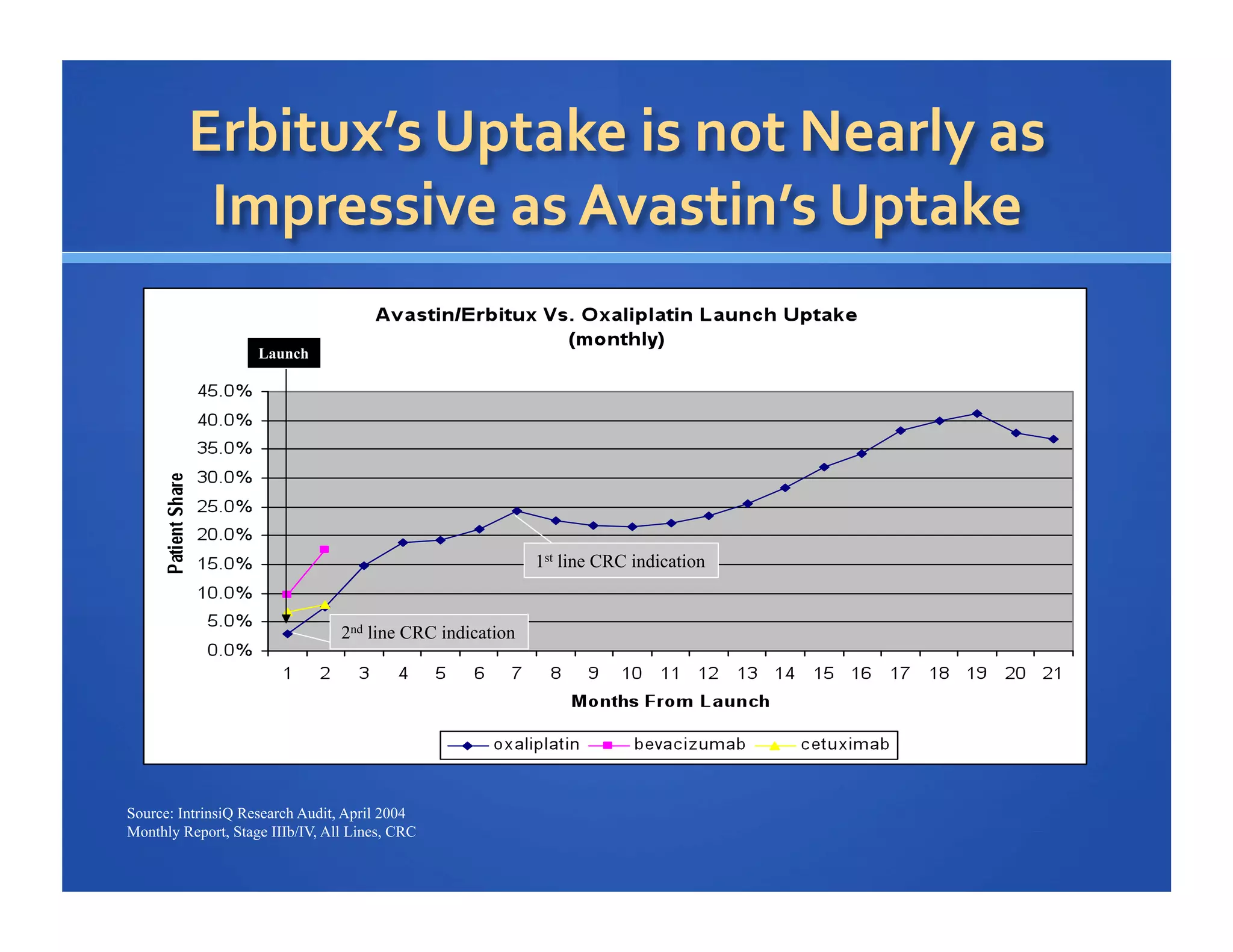

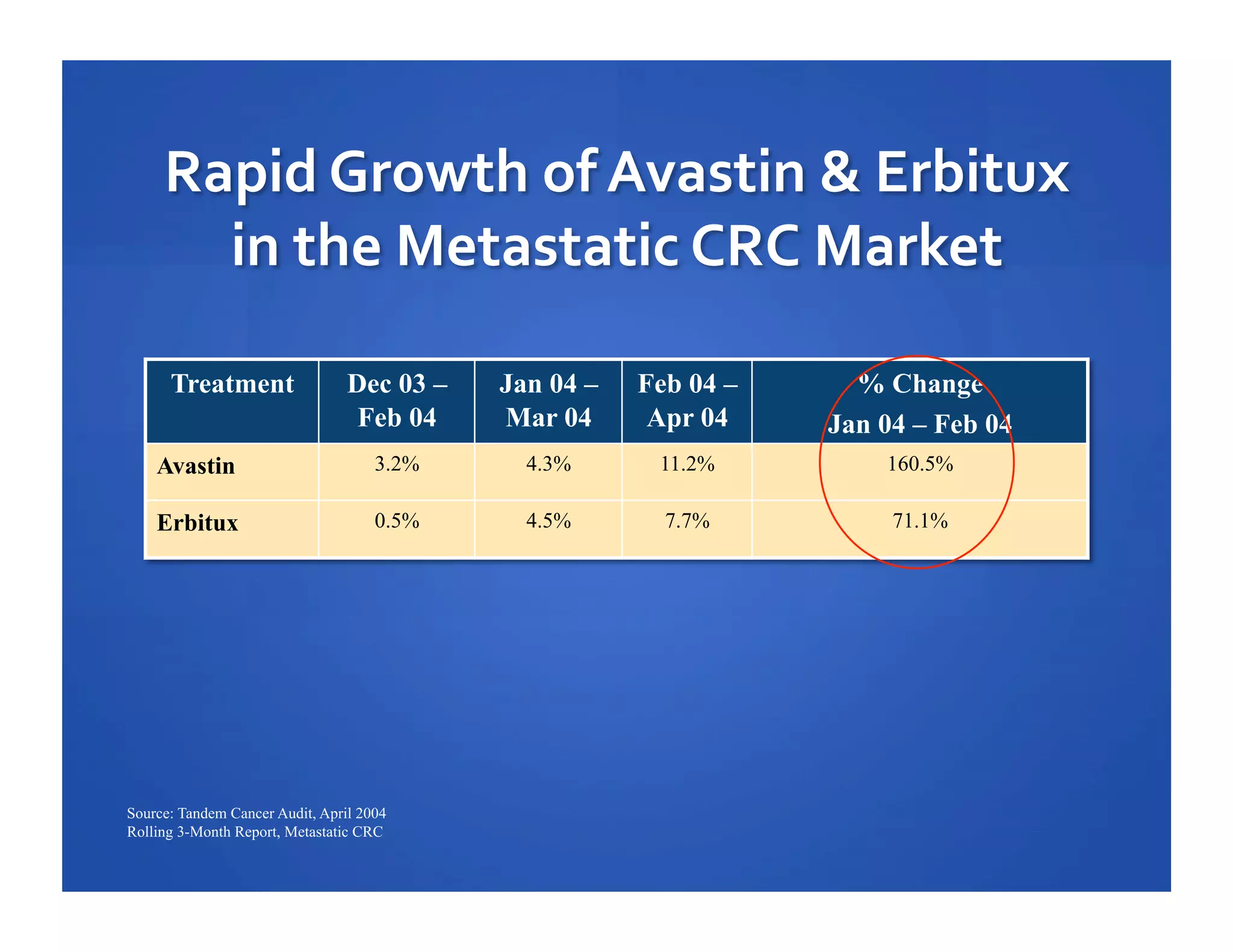

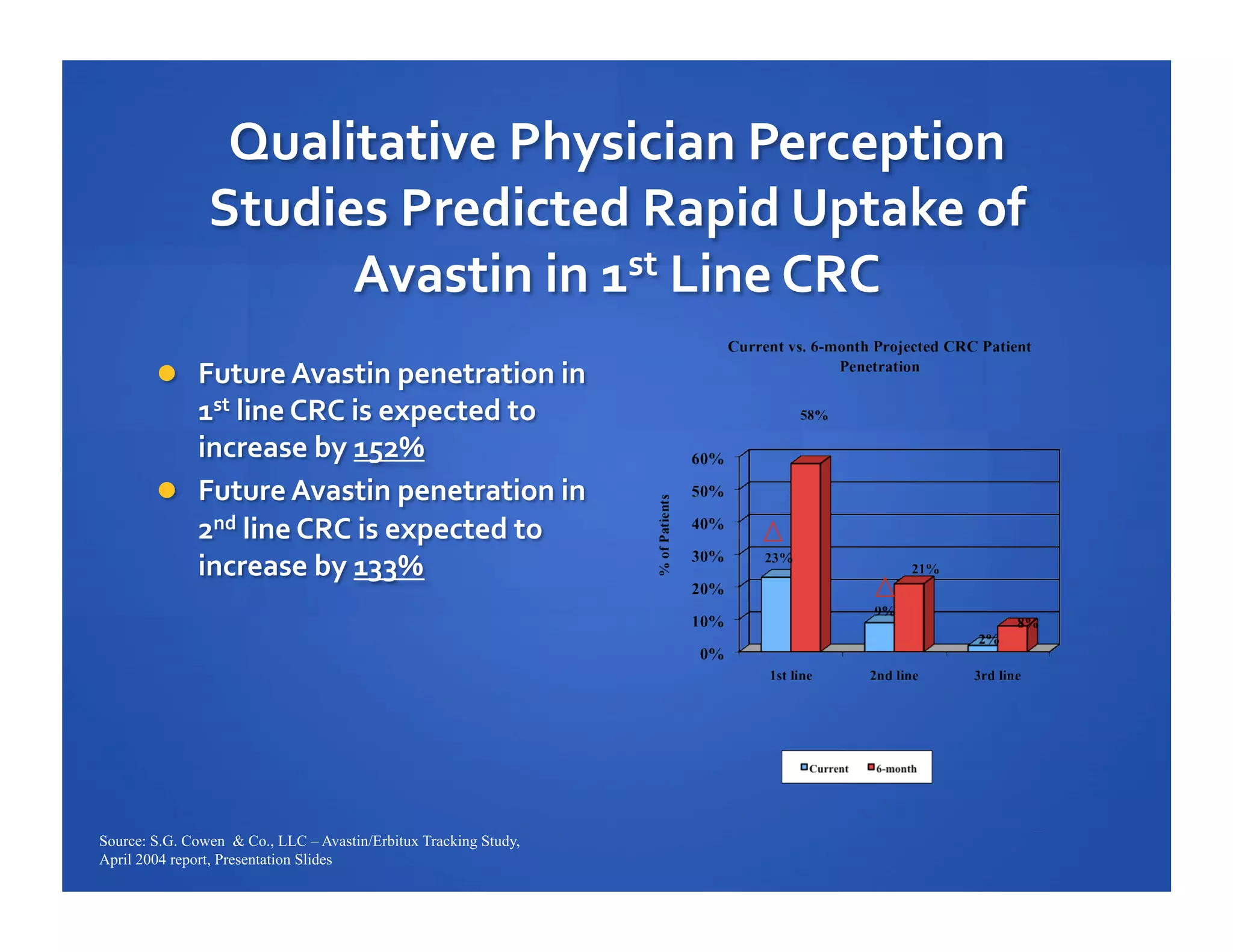

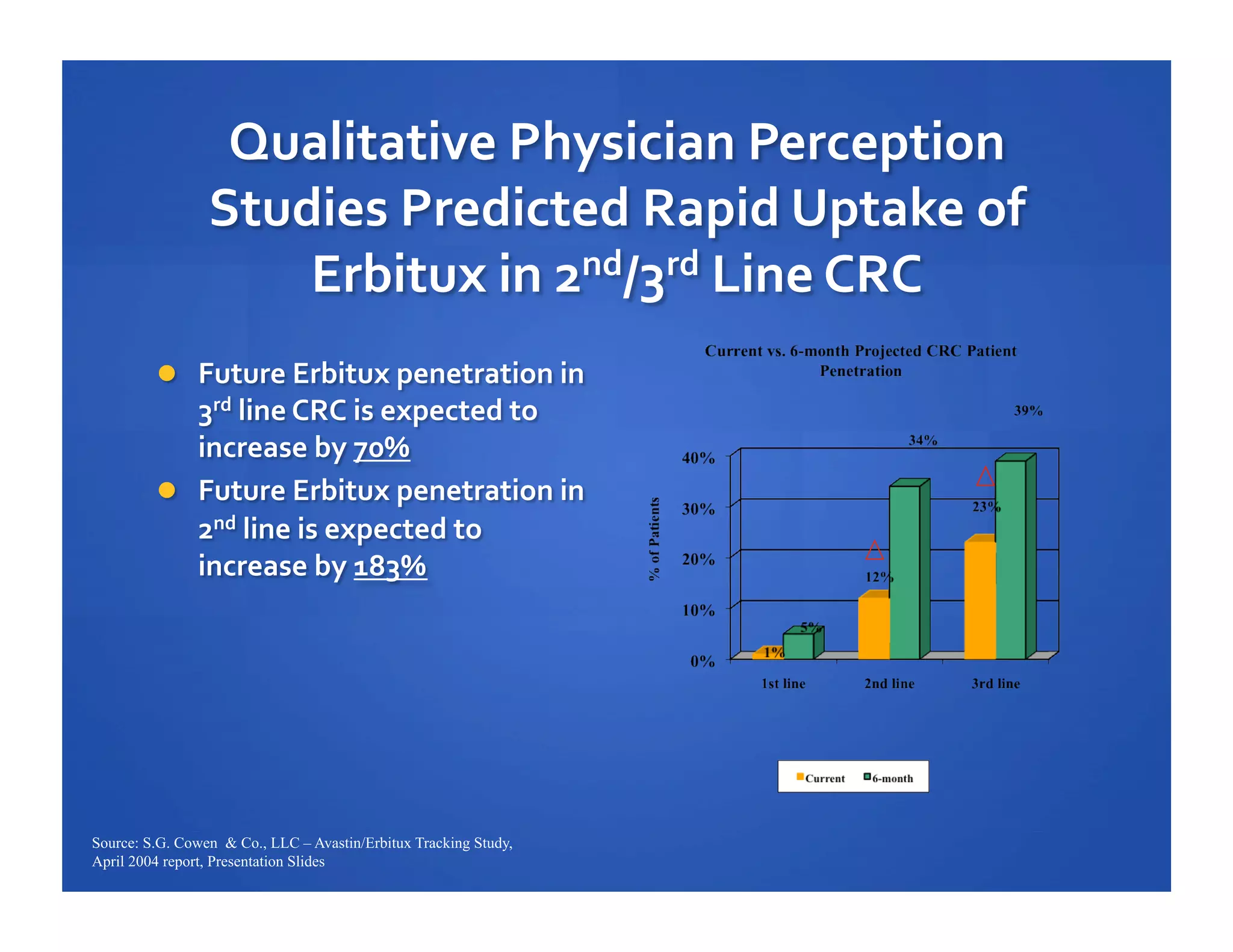

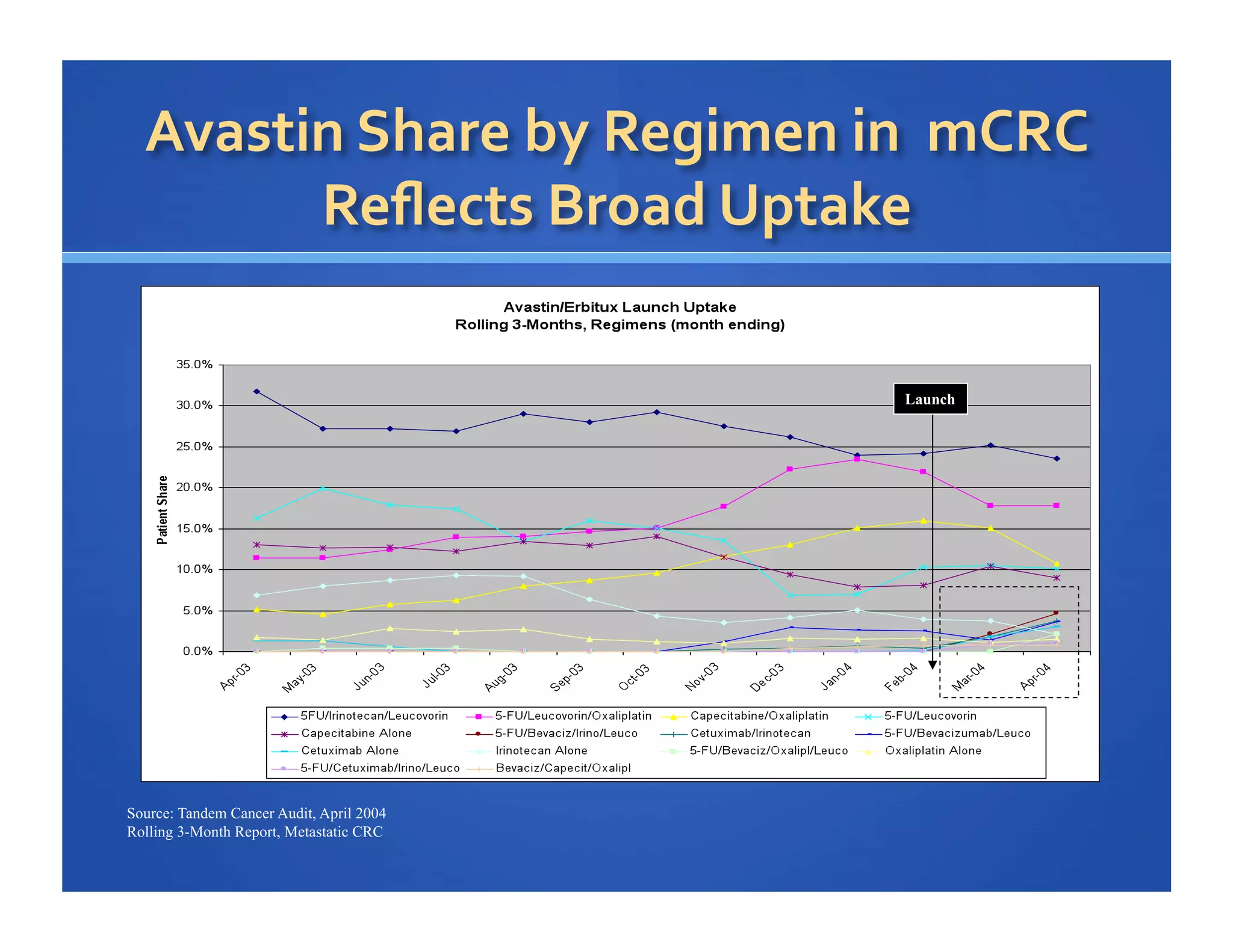

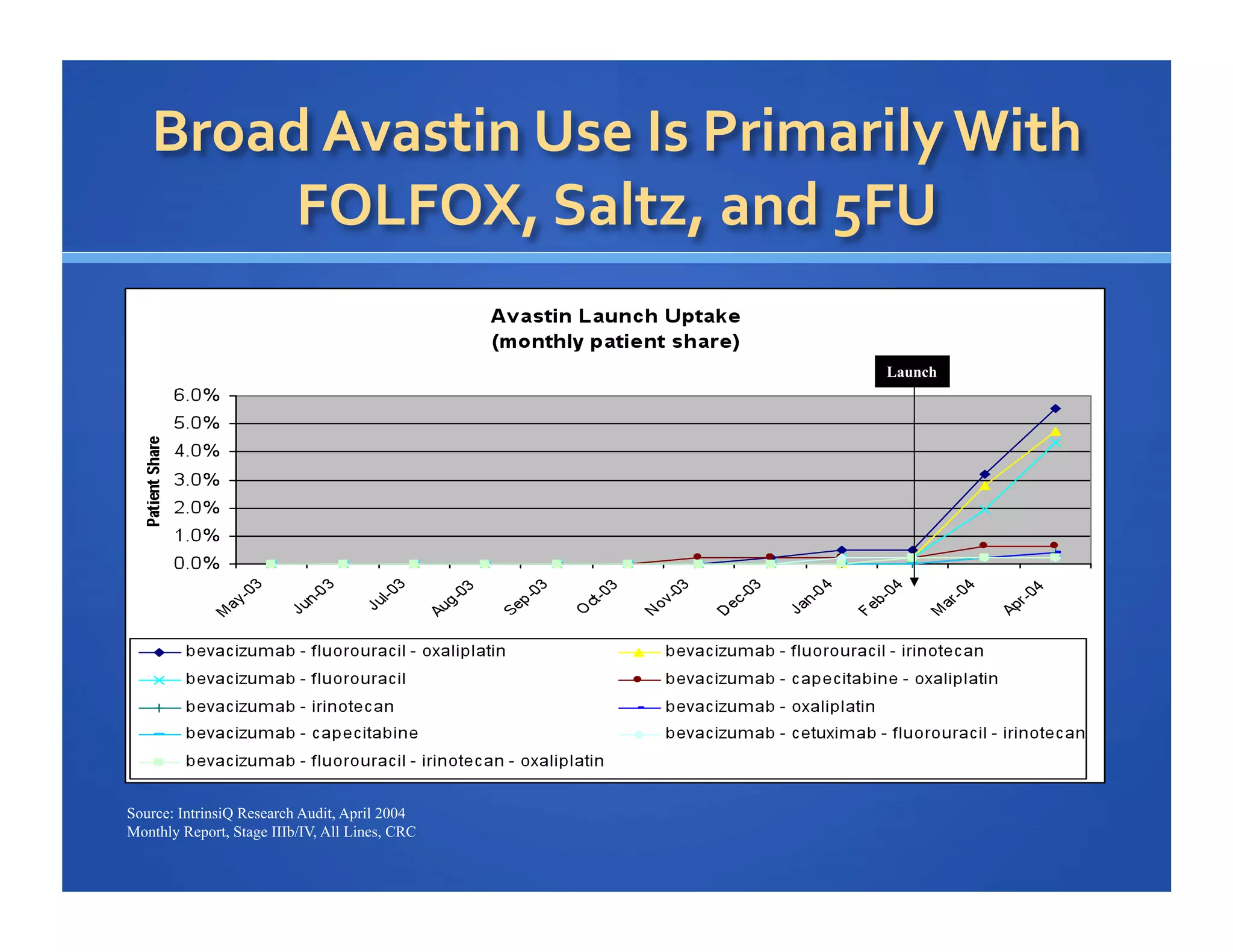

Will Roettger, a principal consultant at 20/20 Market Insights, has extensive experience in the pharmaceutical industry, focusing on oncology, hematology, and immunology product launches. The document analyzes the launch uptake of Avastin and Erbitux, providing estimated year-end sales projections of approximately $402 million for Avastin and $194 million for Erbitux in 2004. It also discusses the effectiveness of clinical trial development programs and strategies for these high-priced specialty products.