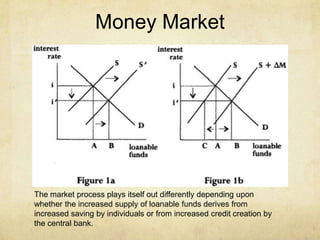

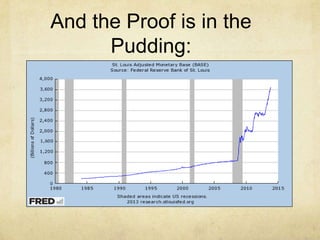

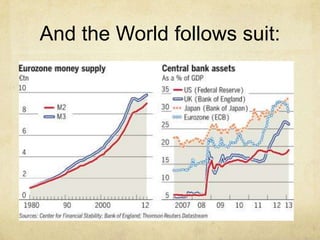

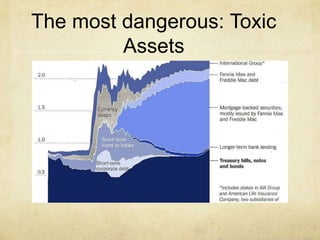

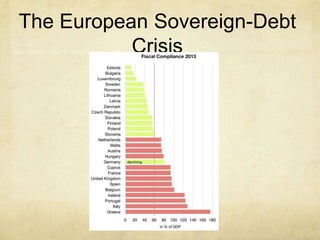

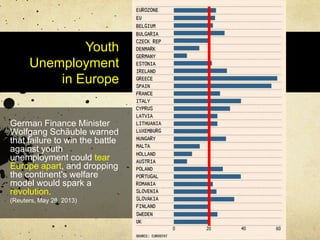

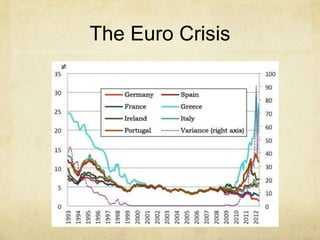

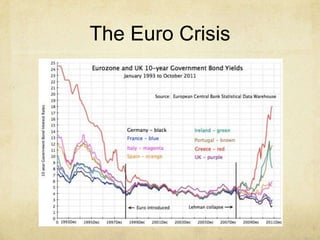

This document summarizes key Austrian economic concepts and their application to recent global economic crises. It outlines the Austrian school's contributions to theories of subjective value, the marginal revolution, and business cycles. It then discusses how the Austrian business cycle theory and emphasis on microeconomic foundations can help explain the Great Recession, European sovereign debt crisis, and Euro crisis. The document argues that central bank interventions distort market signals and create moral hazard, while an Austrian approach would be to stop quantitative easing and allow markets to organically correct malinvestments through the price system.