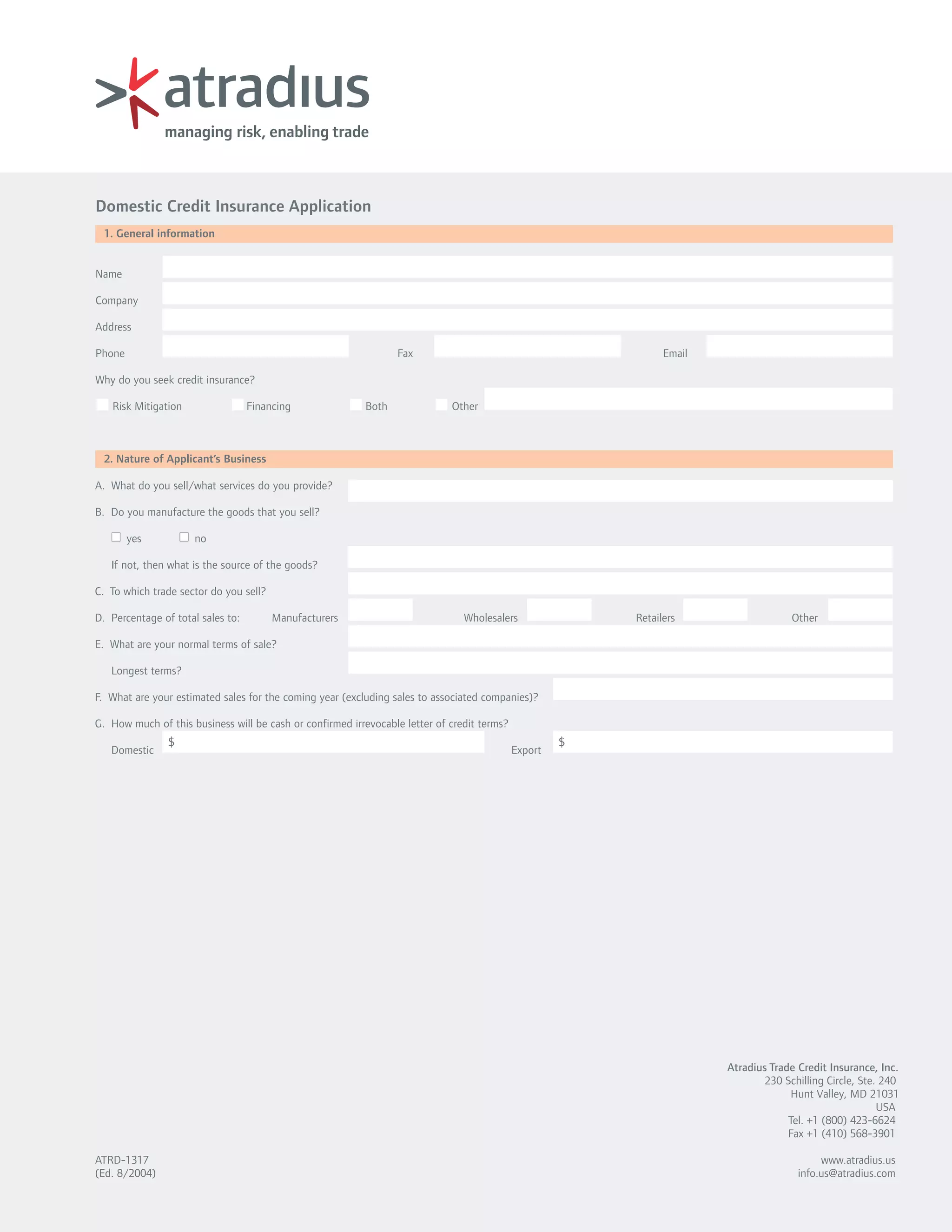

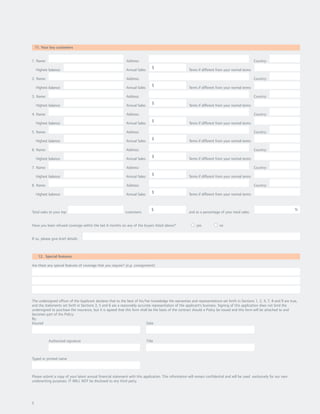

This document is an application for domestic credit insurance. It collects information about the applicant's business, including details of their sales, customers, credit management practices, and the type of insurance coverage they are seeking. The applicant must provide financial information over the past 5 years, a profile of their buyers, a list of key customers, and sign to confirm the accuracy of the information provided.