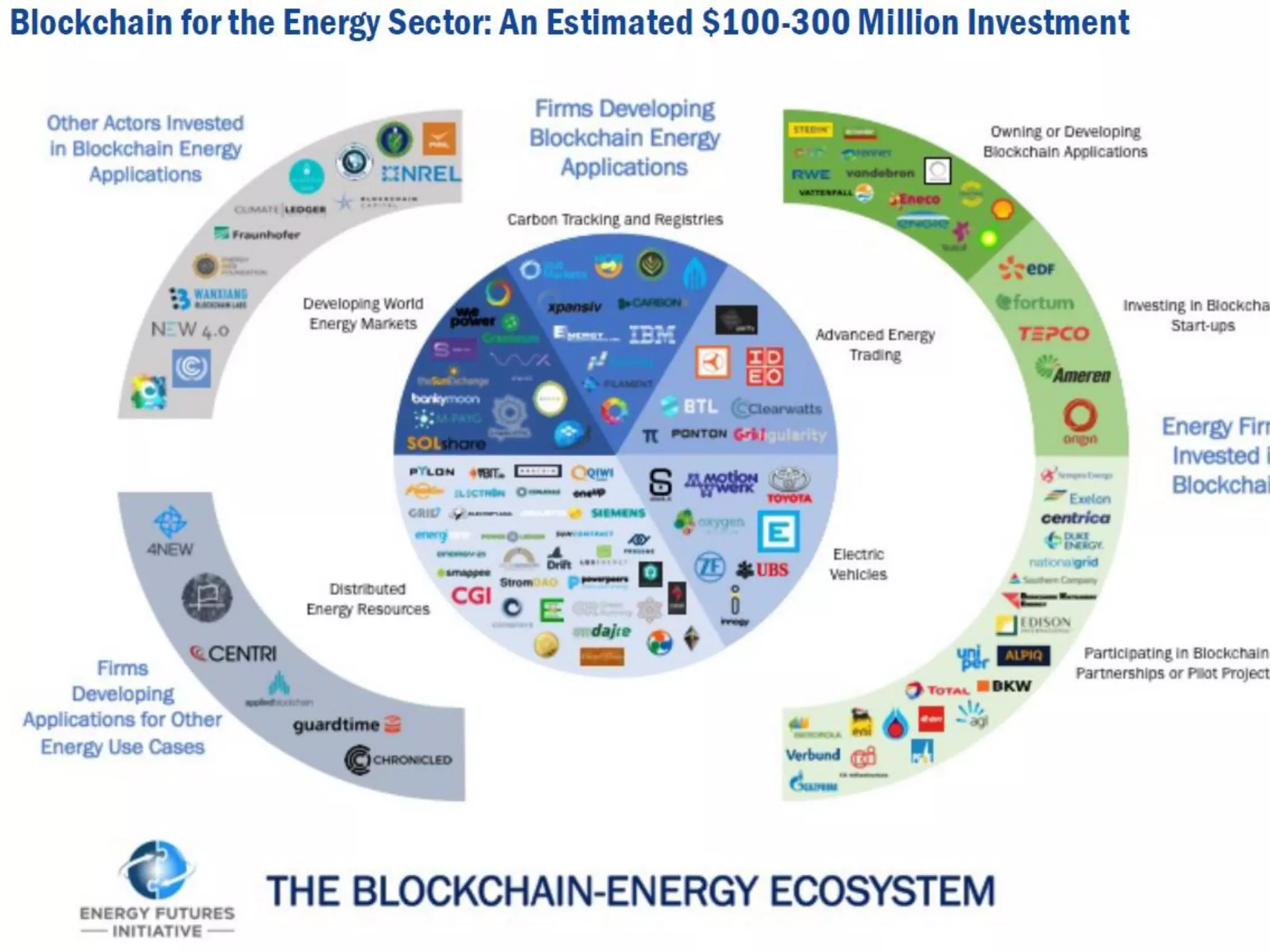

The document outlines discussions from the Blockchain and Energy Policy Forum held on January 16, 2019, focusing on the implications of blockchain technology in energy trading and policy developments in Arizona. It highlights recommendations for using blockchain in corporate records, financial technology, and decentralized corporate structures to foster innovation and streamline regulatory processes. The Arizona Technology Council advocates for creating regulatory sandboxes and clarifying securities laws to support a thriving fintech environment while exploring the wider applications of blockchain technology.