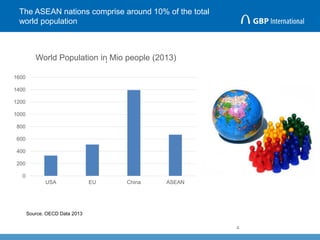

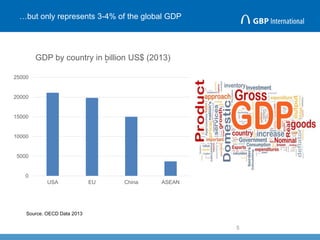

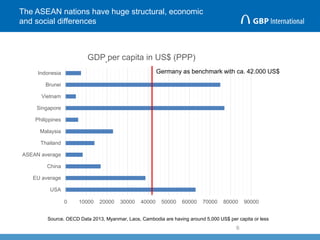

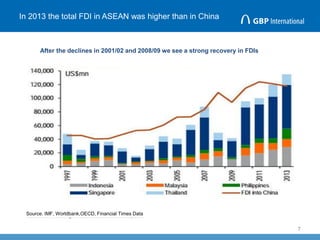

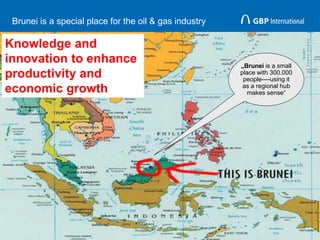

This document provides an overview of doing business in ASEAN countries. It begins with some statistics showing that while ASEAN countries make up about 10% of the world's population, they only represent 3-4% of global GDP. There are also huge economic and social differences between the ASEAN countries. The document then provides a brief overview of each ASEAN country, highlighting their economic focus and development goals. It concludes by introducing the presenting organization, GBP International, and thanking the audience for their attention.