Embed presentation

Download as PDF, PPTX

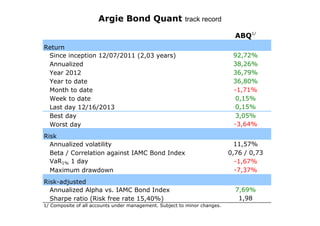

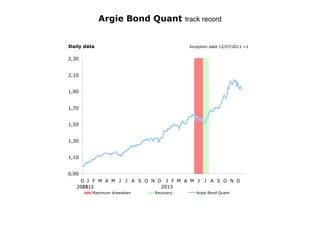

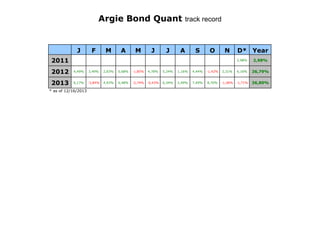

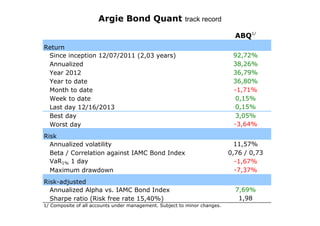

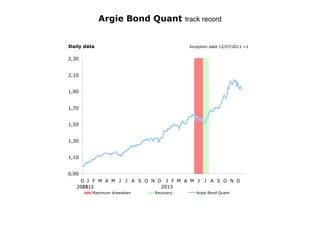

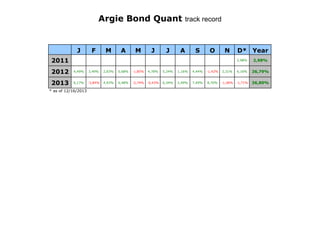

The Argie Bond Quant track record shows an annualized return of 92.72% since its inception on December 7, 2011. As of December 16, 2013, the fund has demonstrated notable performance metrics, including a Sharpe ratio of 1.98 and a maximum drawdown of -7.37%. The data reflects significant volatility and risk-adjusted returns against the IAMC bond index.