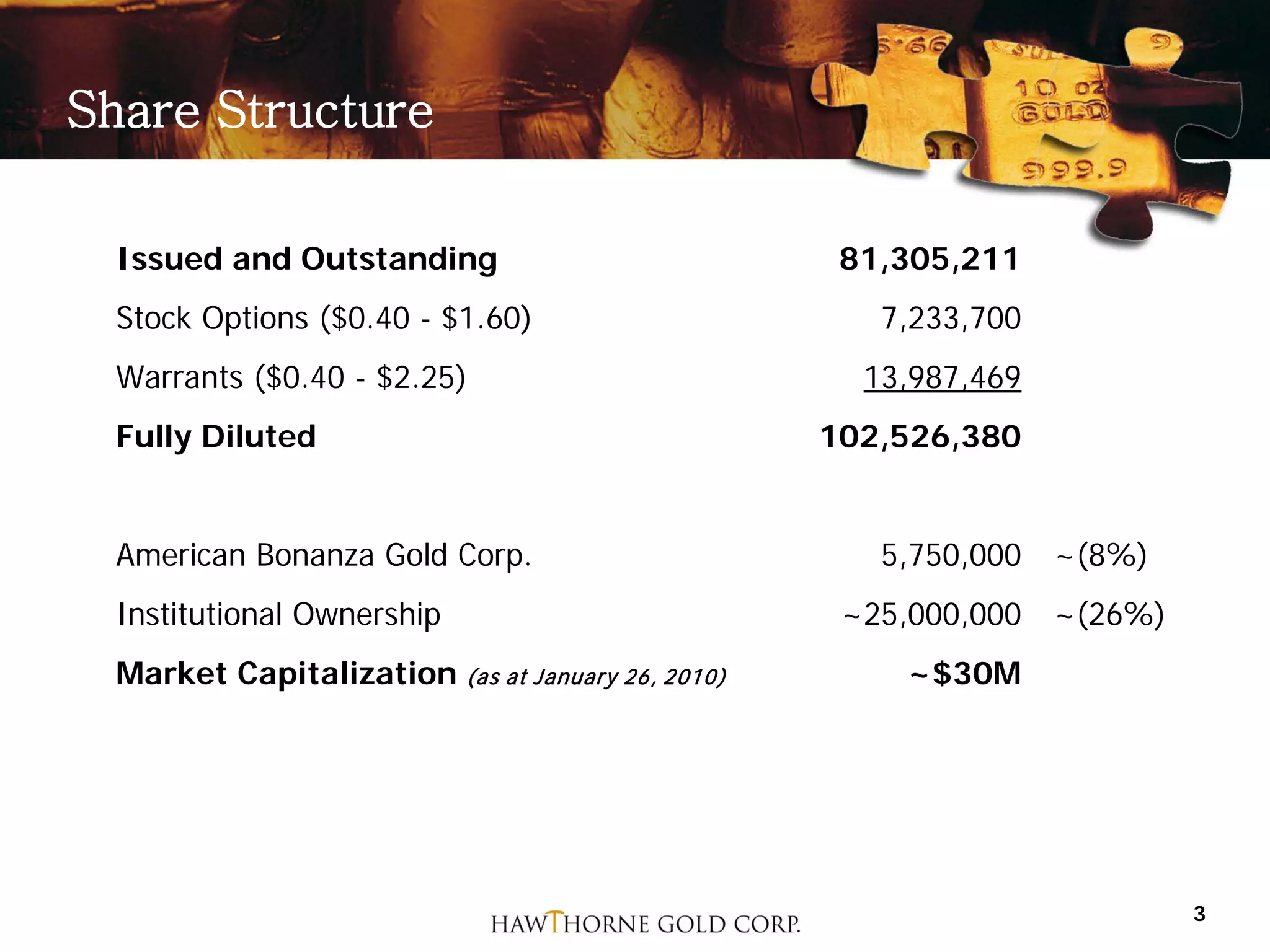

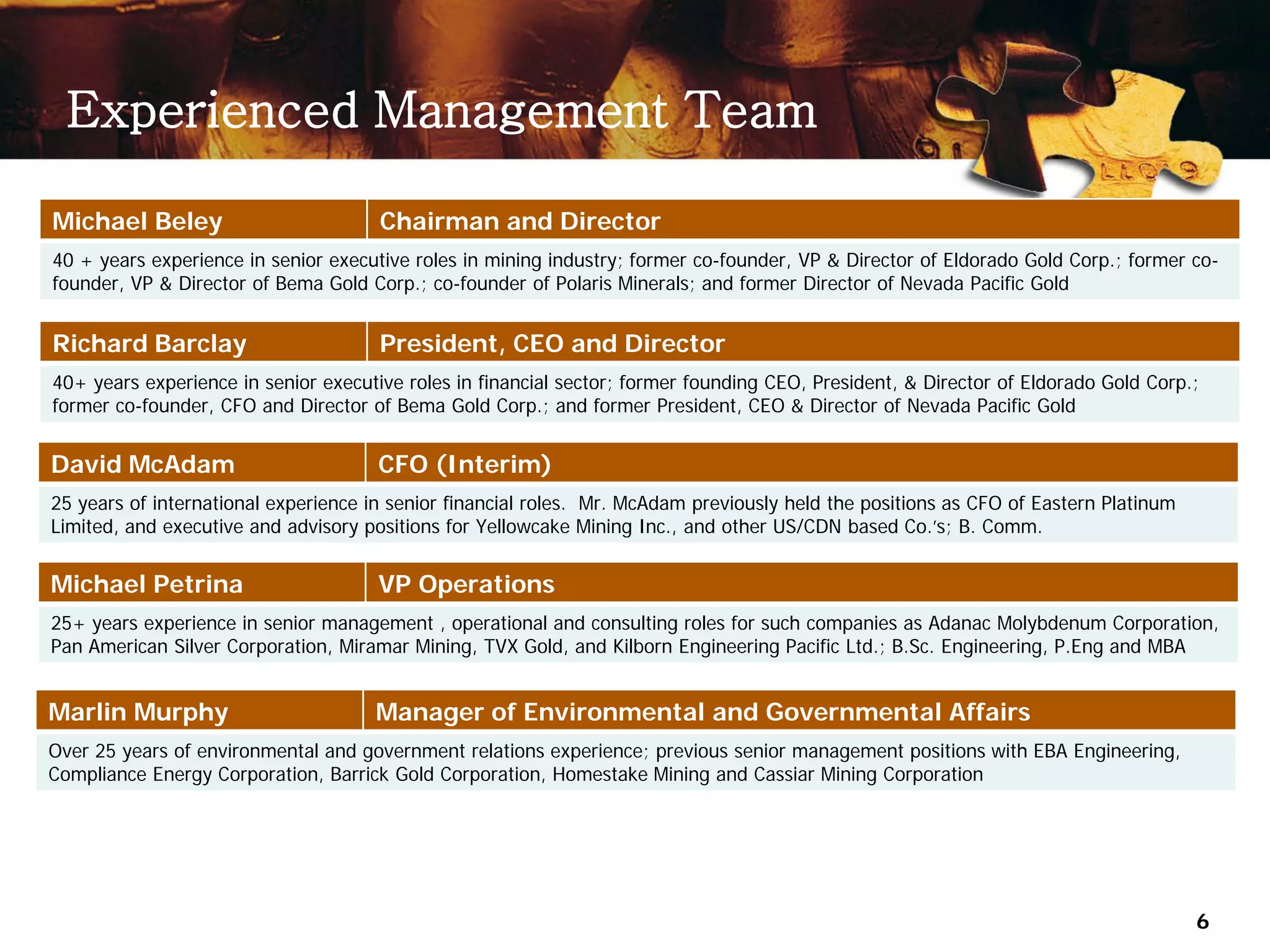

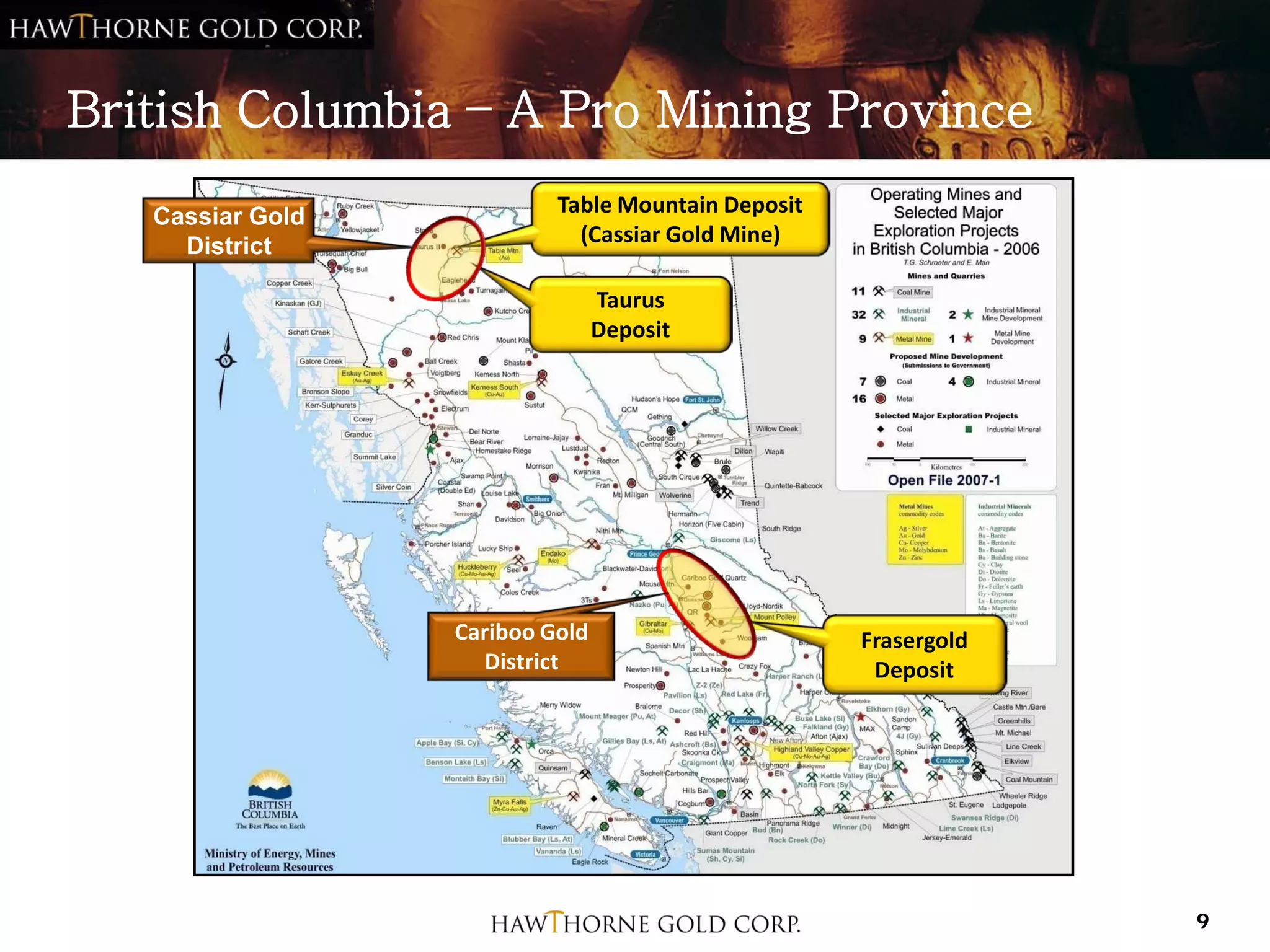

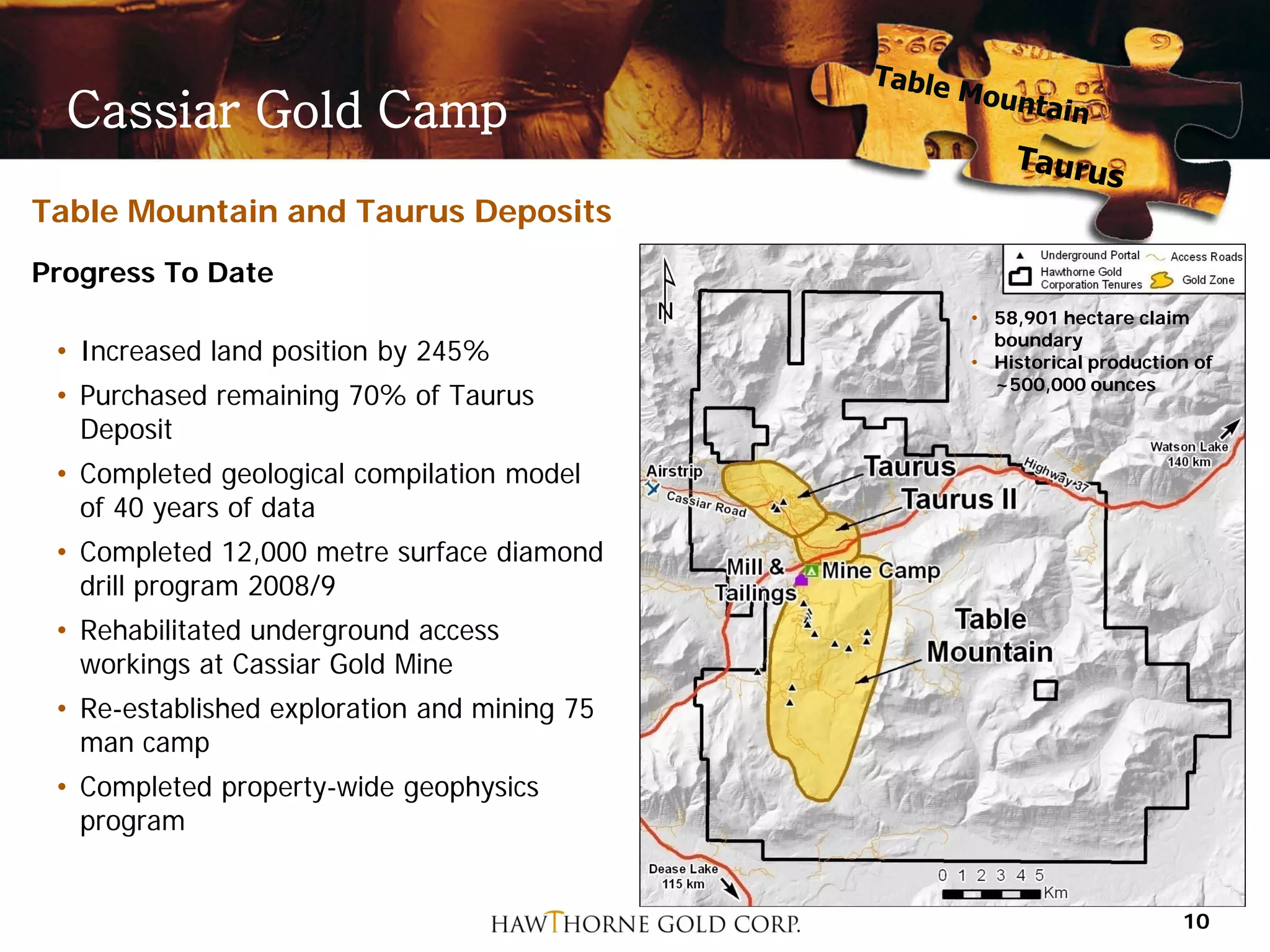

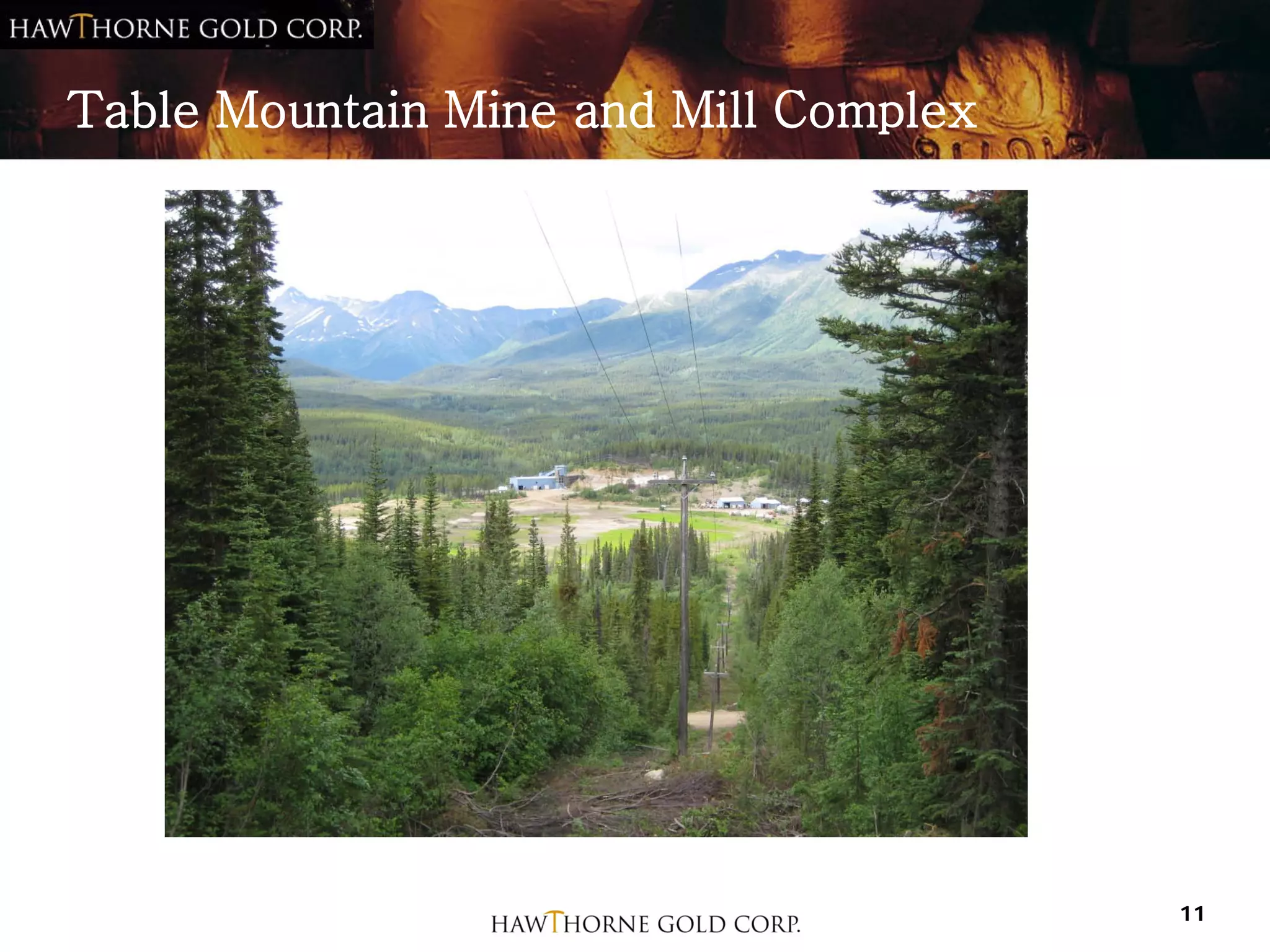

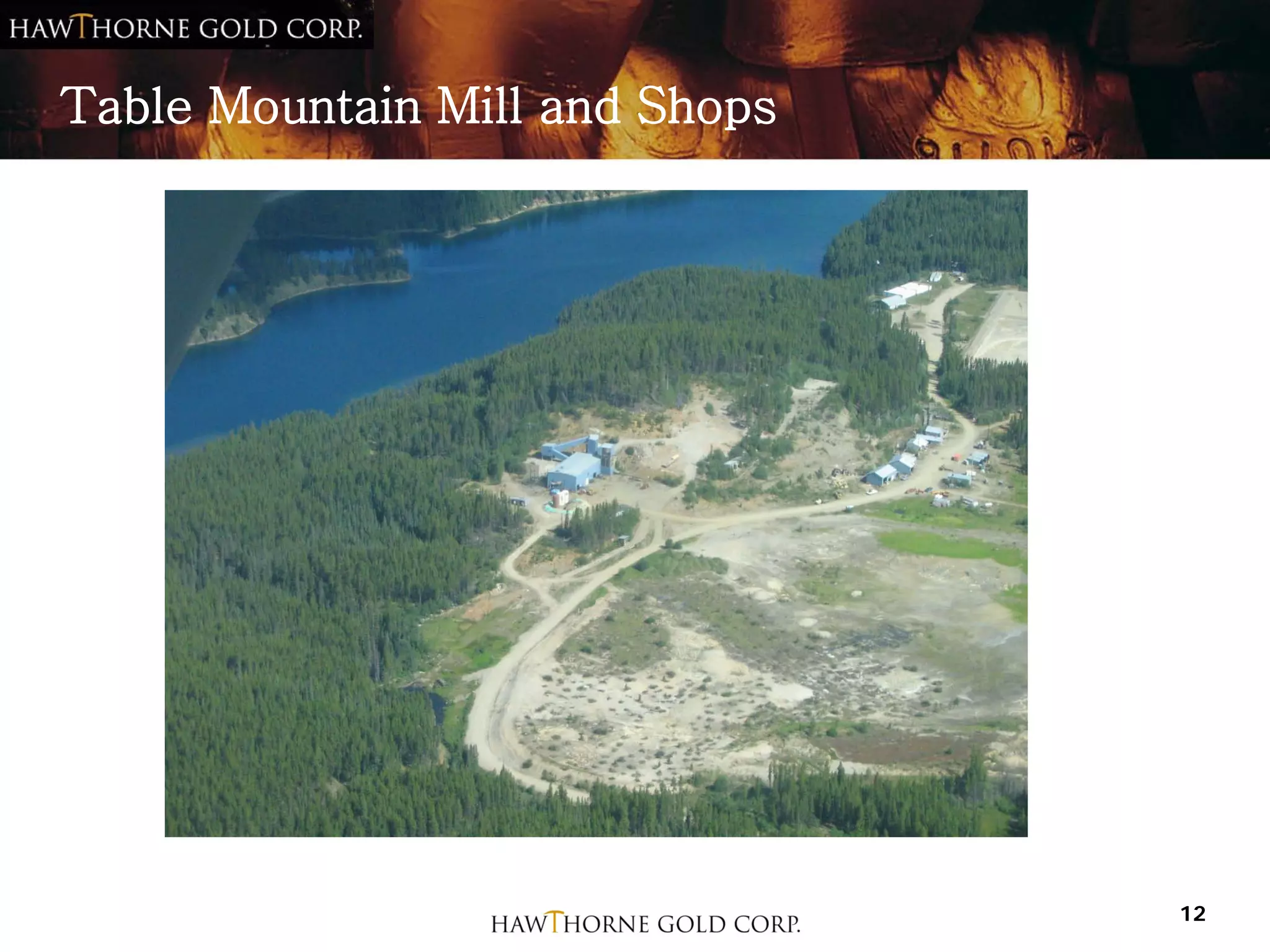

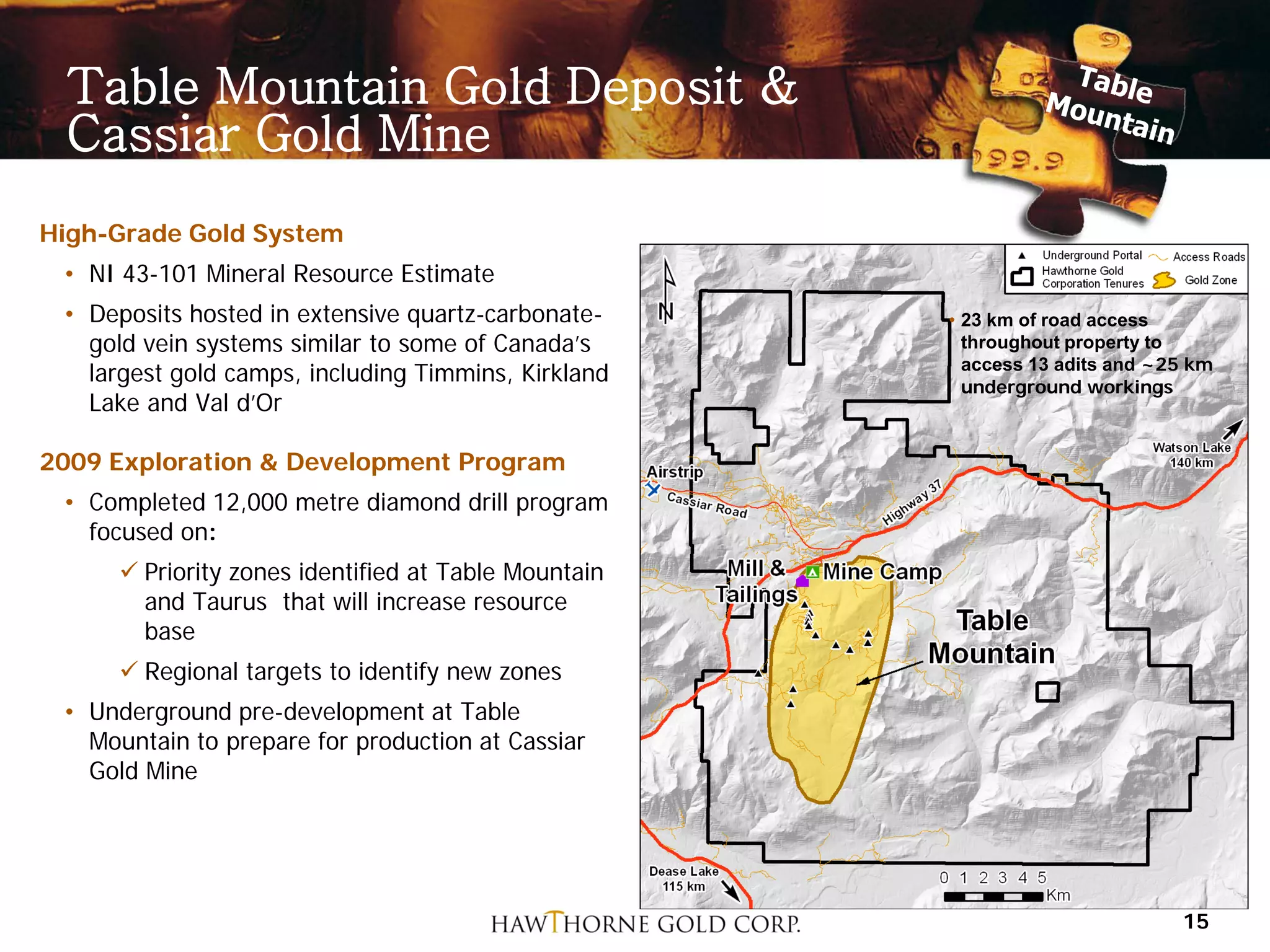

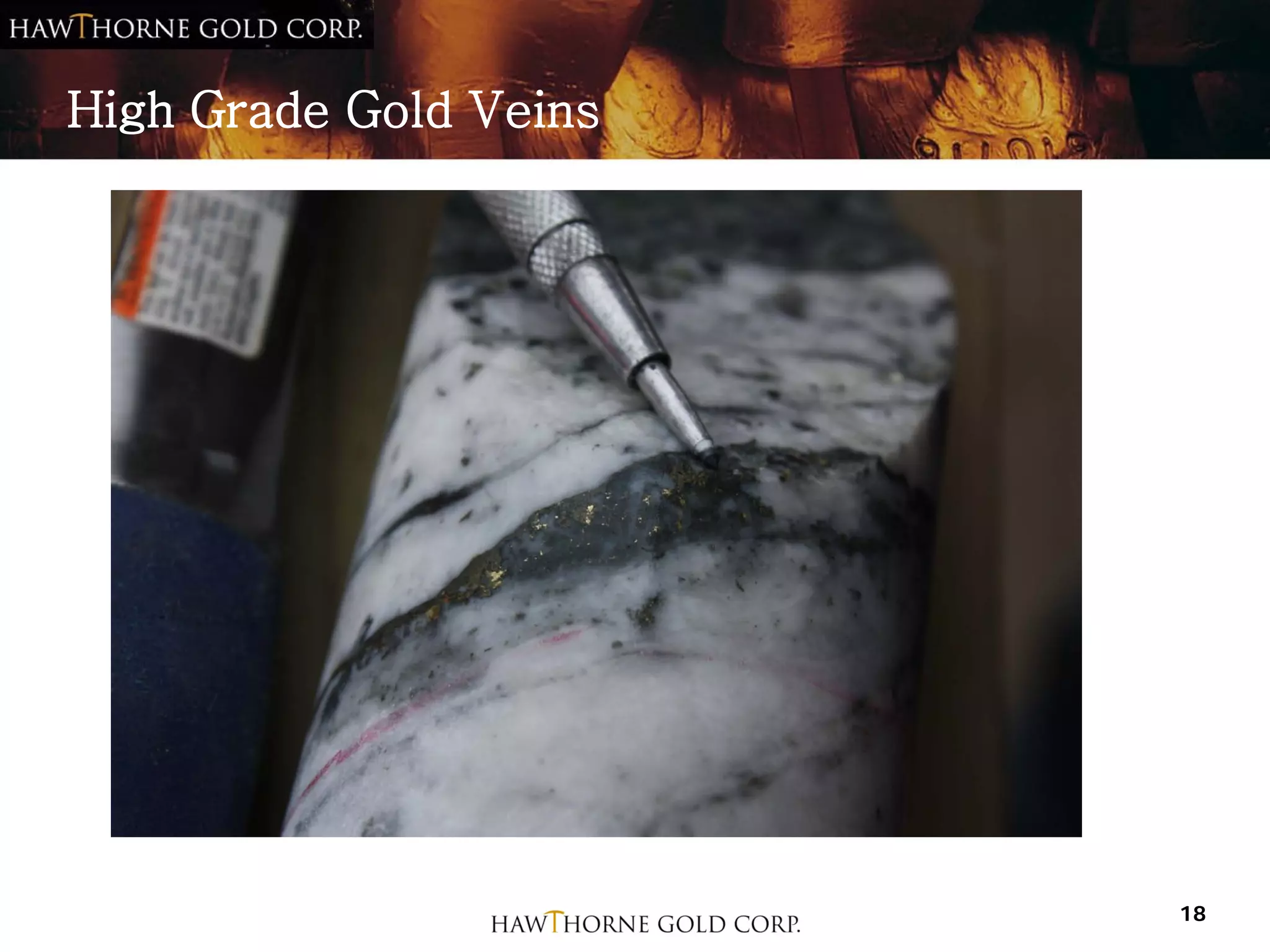

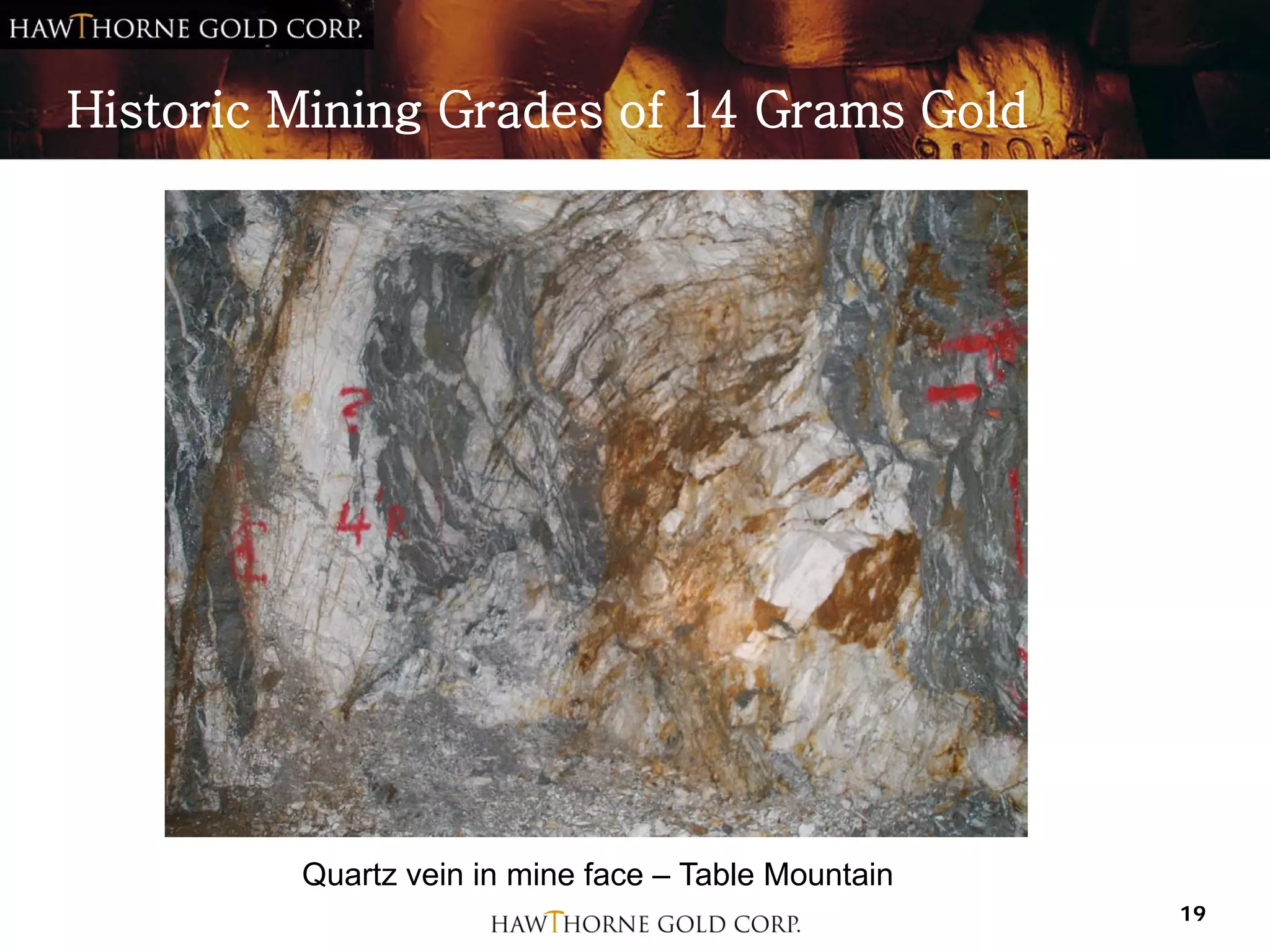

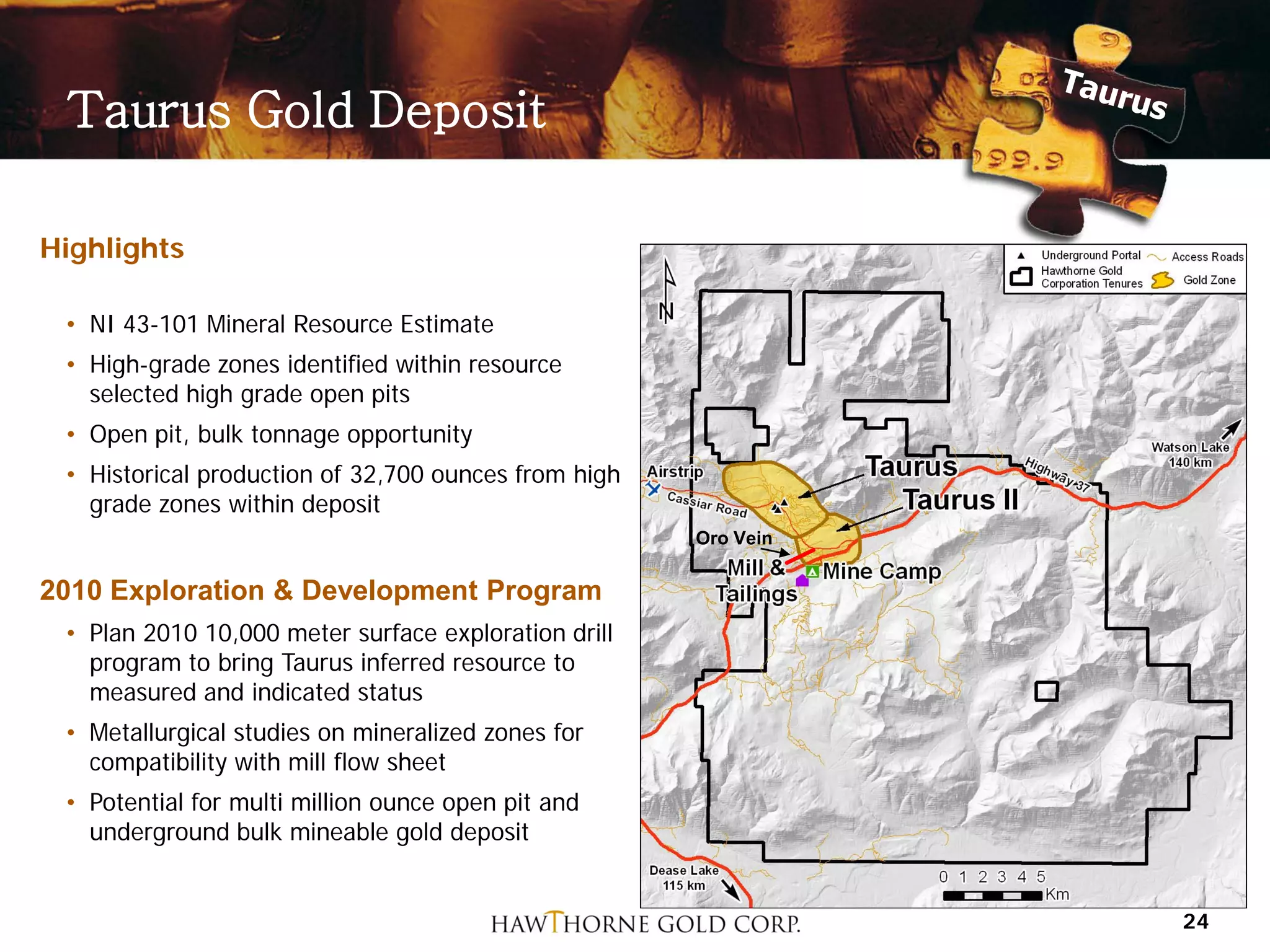

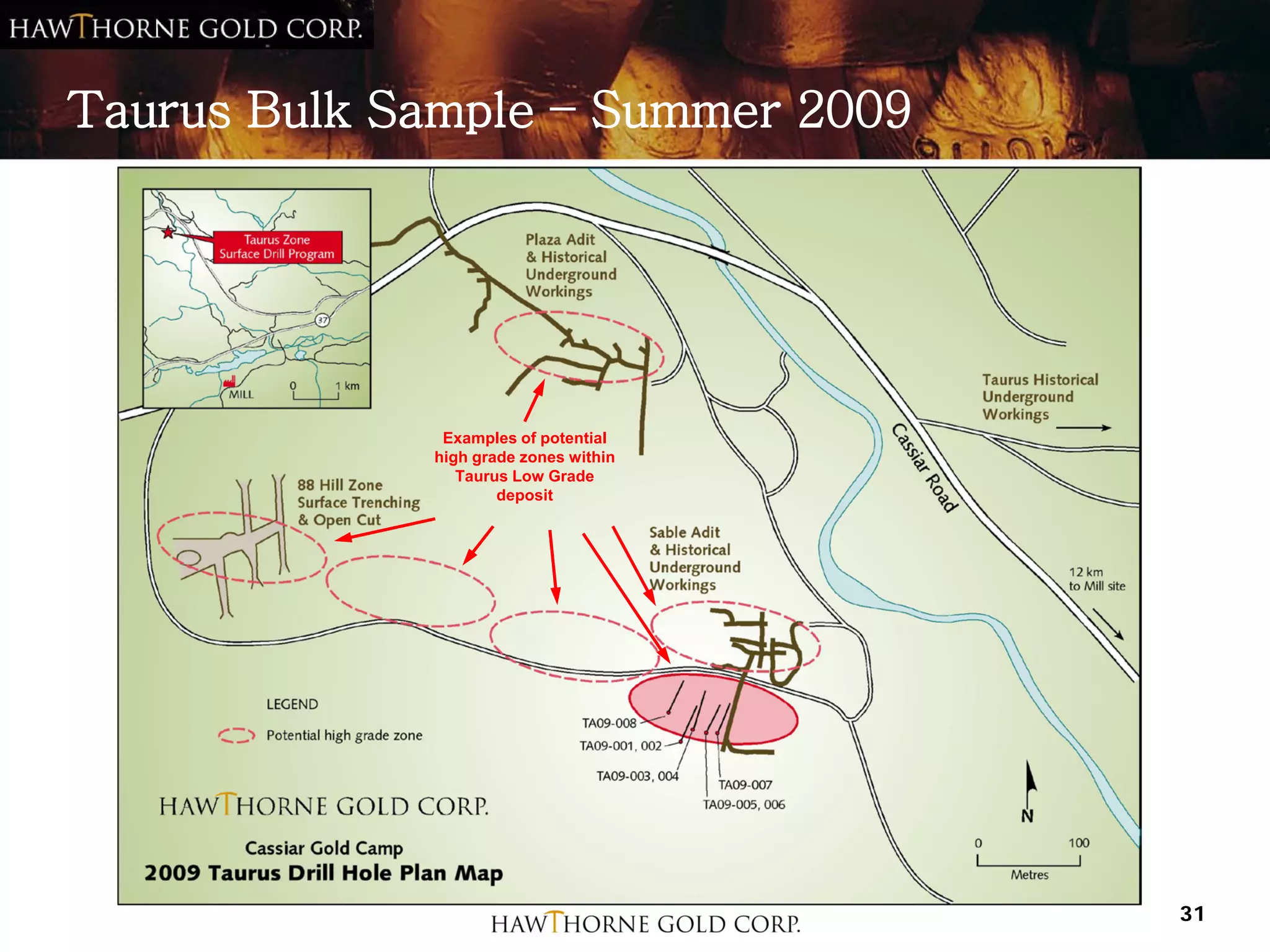

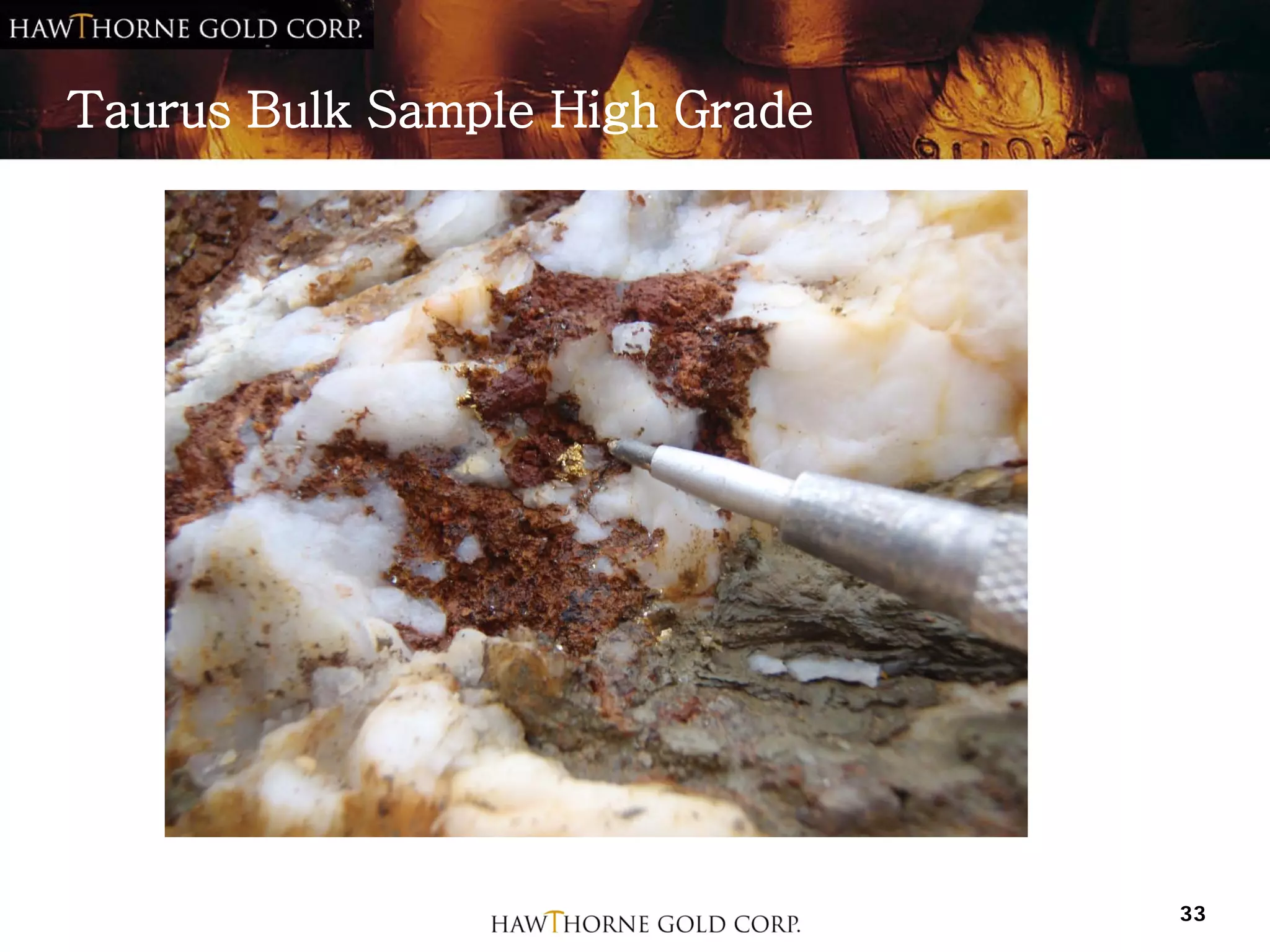

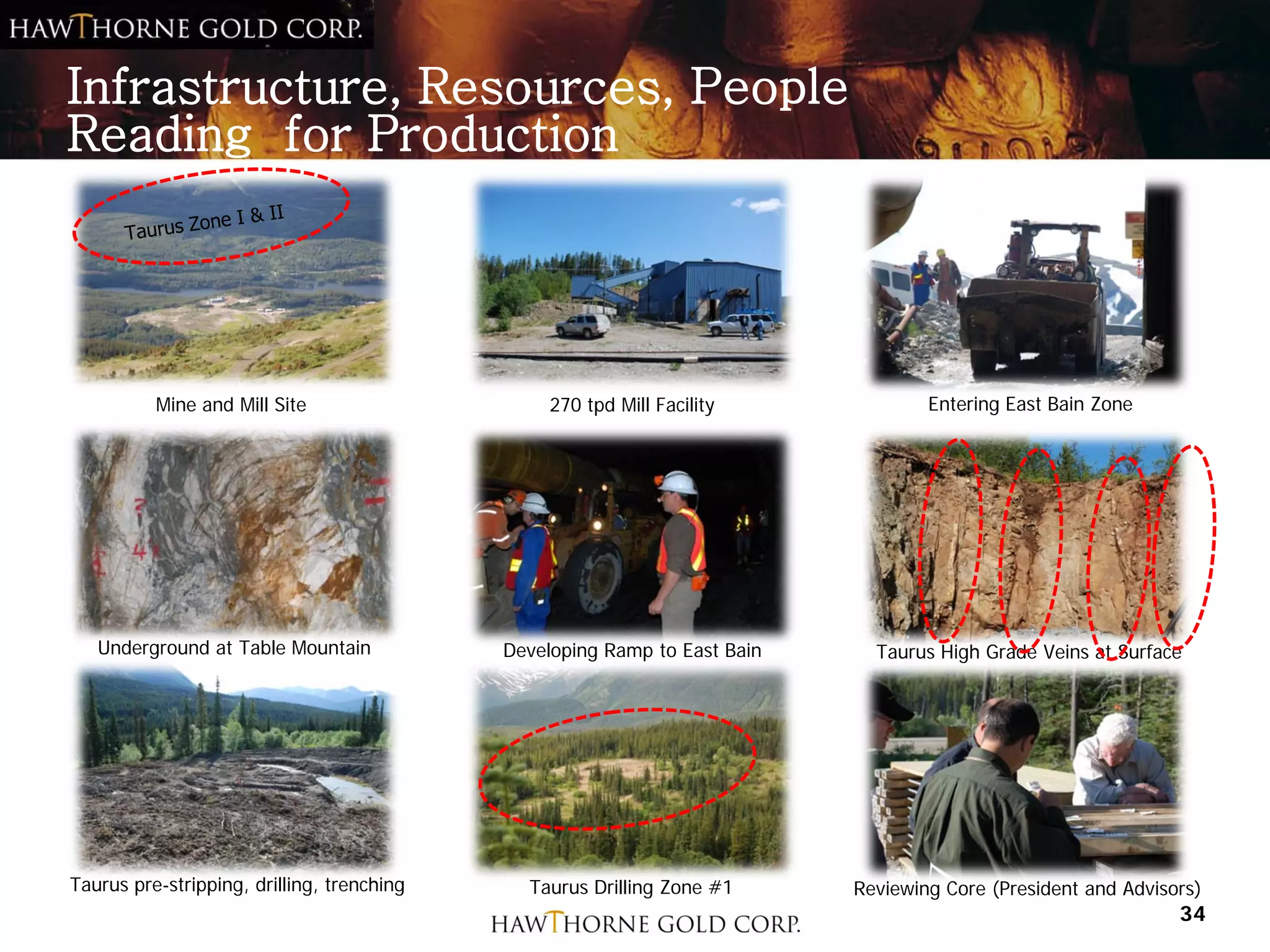

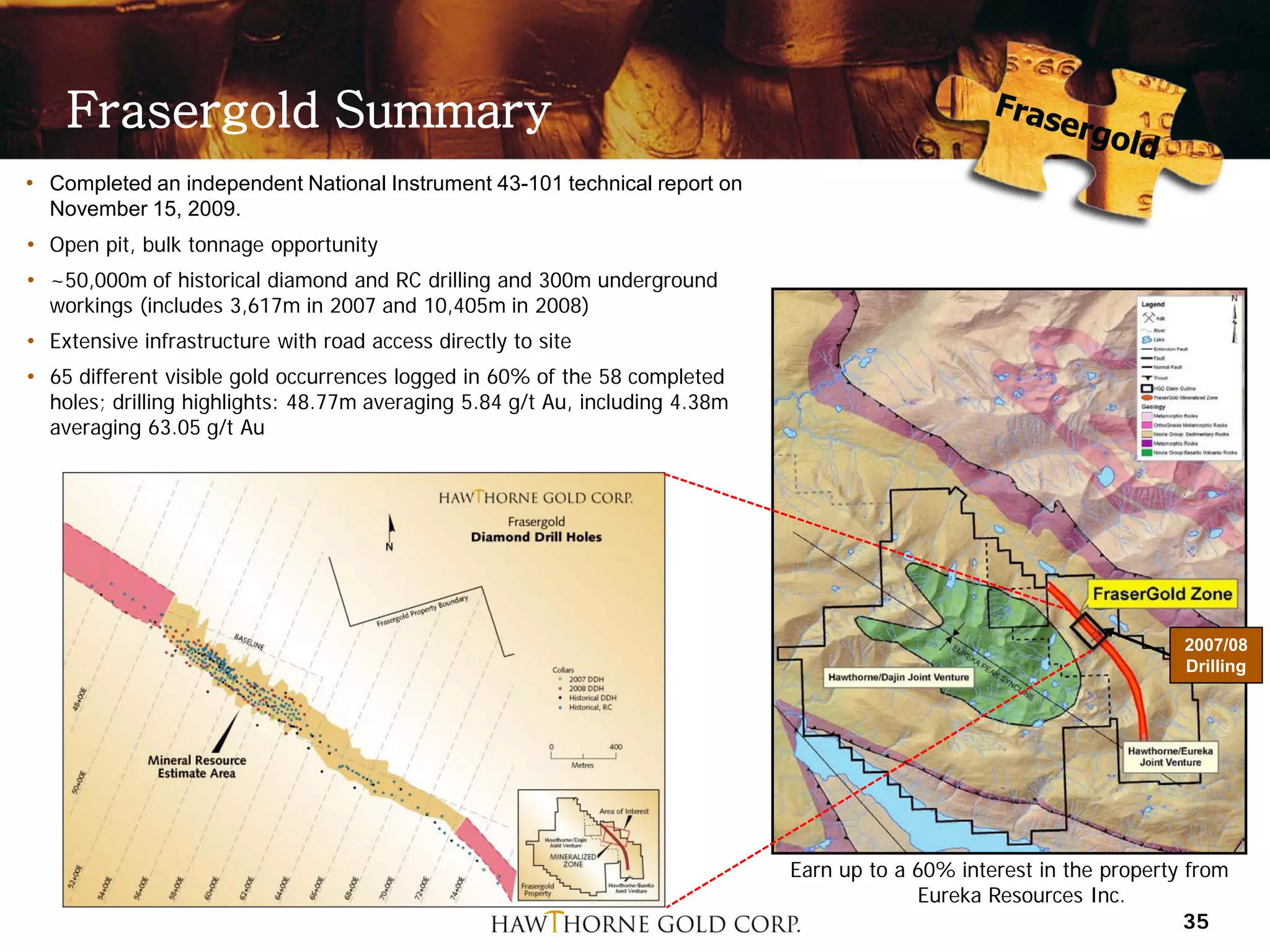

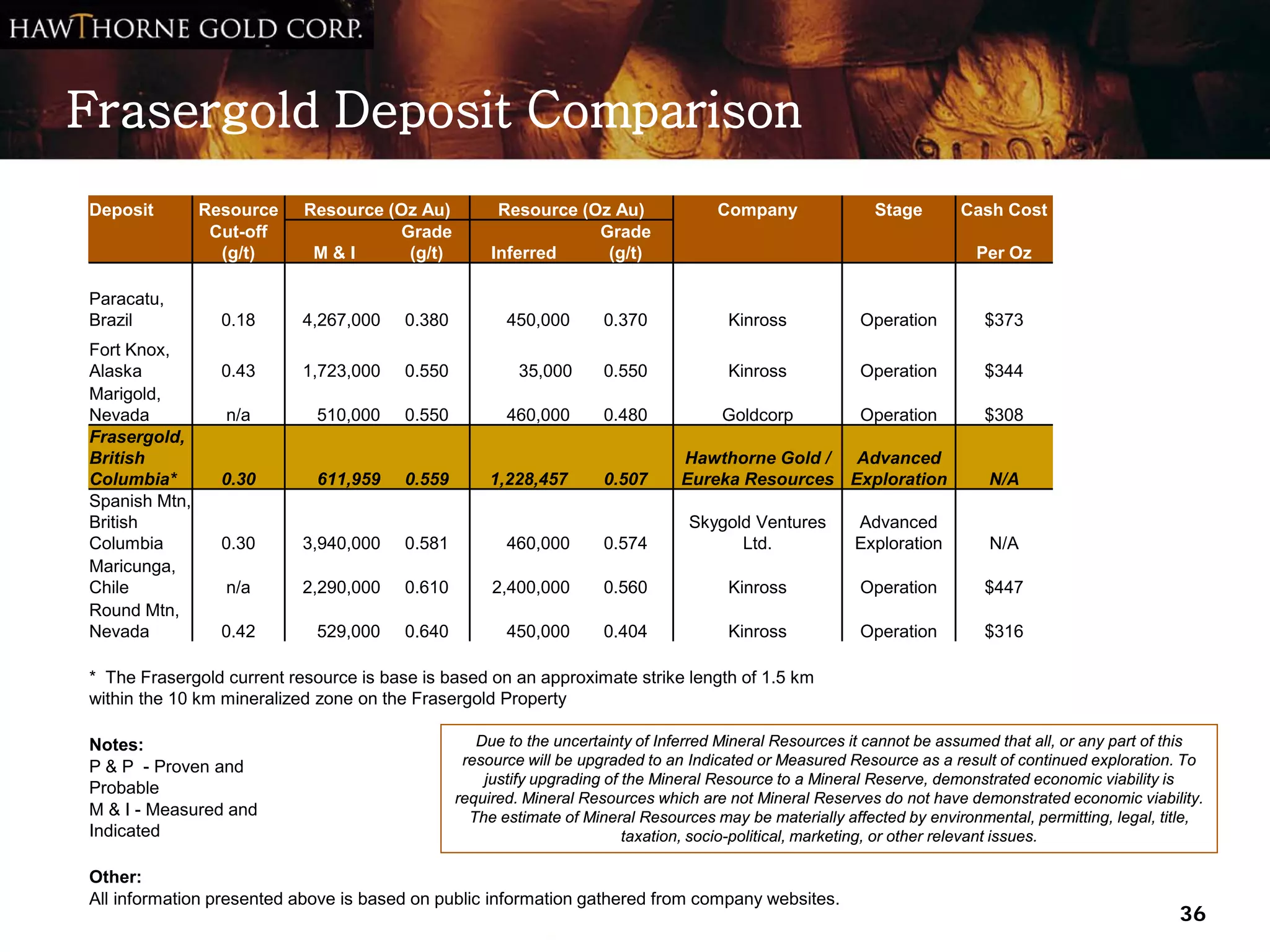

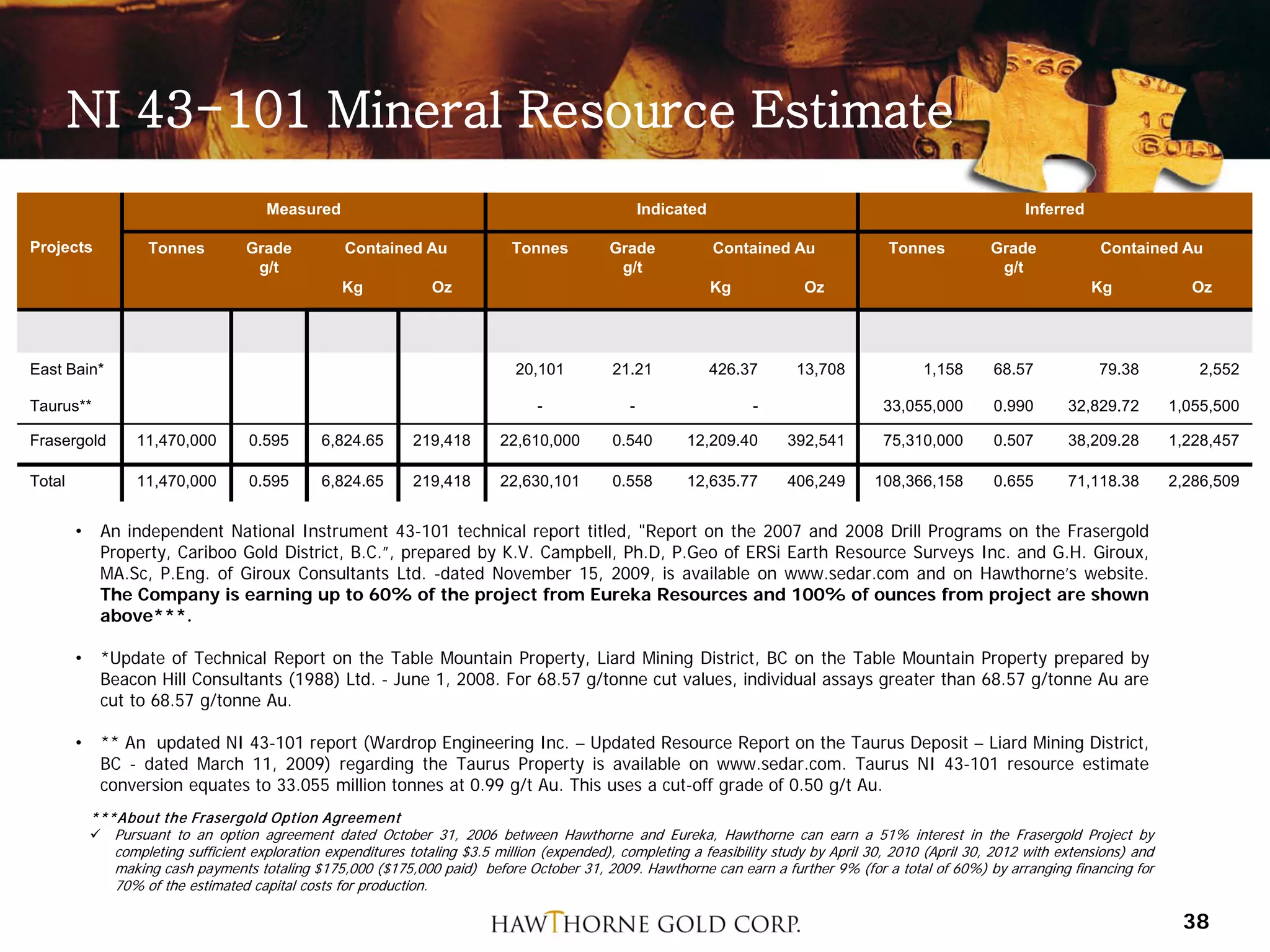

The document provides information on Hawthorne Gold Corp., a gold exploration and development company. It summarizes three of Hawthorne's advanced gold projects in British Columbia: the Cassiar Gold Camp which includes the Table Mountain and Taurus deposits, the permitted Cassiar Gold Mine, and the Frasergold deposit. It also provides details on Hawthorne's management team, properties, exploration and development plans, and NI 43-101 resource estimates for the projects.