Analisis de los ratios financieros

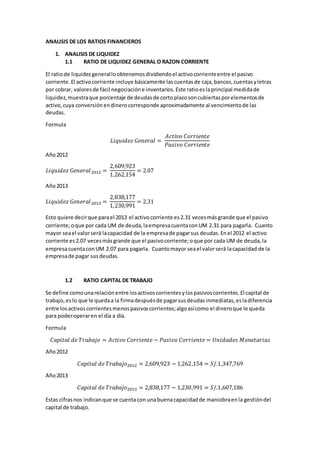

- 1. ANALISIS DE LOS RATIOS FINANCIEROS 1. ANALISIS DE LIQUIDEZ 1.1 RATIO DE LIQUIDEZ GENERAL O RAZON CORRIENTE El ratiode liquidezgeneralloobtenemosdividiendoel activocorrienteentre el pasivo corriente.El activocorriente incluye básicamente lascuentasde caja,bancos,cuentasyletras por cobrar, valoresde fácil negociacióne inventarios.Este ratioeslaprincipal medidade liquidez,muestraque porcentaje de deudasde cortoplazosoncubiertasporelementosde activo,cuya conversiónendinerocorresponde aproximadamente al vencimientode las deudas. Formula 𝐿𝑖𝑞𝑢𝑖𝑑𝑒𝑧 𝐺𝑒𝑛𝑒𝑟𝑎𝑙 = 𝐴𝑐𝑡𝑖𝑣𝑜 𝐶𝑜𝑟𝑟𝑖𝑒𝑛𝑡𝑒 𝑃𝑎𝑠𝑖𝑣𝑜 𝐶𝑜𝑟𝑟𝑖𝑒𝑛𝑡𝑒 Año2012 𝐿𝑖𝑞𝑢𝑖𝑑𝑒𝑧 𝐺𝑒𝑛𝑒𝑟𝑎𝑙2012 = 2,609,923 1,262,154 = 2.07 Año2013 𝐿𝑖𝑞𝑢𝑖𝑑𝑒𝑧 𝐺𝑒𝑛𝑒𝑟𝑎𝑙2013 = 2,838,177 1,230,991 = 2.31 Esto quiere decirque parael 2013 el activocorriente es2.31 vecesmásgrande que el pasivo corriente;oque por cada UM de deuda,laempresacuentaconUM 2.31 para pagarla. Cuanto mayor seael valorserá lacapacidad de la empresade pagarsus deudas.Enel 2012 el activo corriente es2.07 vecesmásgrande que el pasivocorriente;oque por cada UM de deuda,la empresacuentaconUM 2.07 para pagarla. Cuantomayor seael valorserá lacapacidad de la empresade pagar susdeudas. 1.2 RATIO CAPITAL DE TRABAJO Se define comounarelaciónentre losactivoscorrientesylospasivoscorrientes.El capital de trabajo,eslo que le quedaa la firmadespuésde pagarsusdeudasinmediatas,esladiferencia entre losactivoscorrientesmenospasivoscorrientes;algoasícomo el dineroque le queda para poderoperaren el día a día. Formula 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝑑𝑒 𝑇𝑟𝑎𝑏𝑎𝑗𝑜 = 𝐴𝑐𝑡𝑖𝑣𝑜 𝐶𝑜𝑟𝑟𝑖𝑒𝑛𝑡𝑒 − 𝑃𝑎𝑠𝑖𝑣𝑜 𝐶𝑜𝑟𝑟𝑖𝑒𝑛𝑡𝑒 = 𝑈𝑛𝑖𝑑𝑎𝑑𝑒𝑠 𝑀𝑜𝑛𝑒𝑡𝑎𝑟𝑖𝑎𝑠 Año2012 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝑑𝑒 𝑇𝑟𝑎𝑏𝑎𝑗𝑜2012 = 2,609,923 − 1,262,154 = 𝑆/.1,347,769 Año2013 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝑑𝑒 𝑇𝑟𝑎𝑏𝑎𝑗𝑜2013 = 2,838,177 − 1,230,991 = 𝑆/.1,607,186 Estas cifrasnos indicanque se cuentacon unabuenacapacidadde maniobraenla gestióndel capital de trabajo.

- 2. 2 INDICE DE GESTIONO ACTIVIDAD Midenla efectividadyeficienciade lagestión,enlaadministracióndel capital de trabajo, expresanlosefectosde decisionesypolíticasseguidasporlaempresa,conrespectoala utilizaciónde sus fondos.Evidenciancomose manejólaempresaenloreferenteacobranzas, ventasal contado,inventariosyventastotales.Estosratiosimplicanunacomparaciónentre ventasy activosnecesariosparasoportarel nivel de ventasconsiderandoque existe un apropiadovalorde correspondenciaentre estosconceptos. 2.1 ROTACION DE CAJASY BANCOS Dan una ideasobre lamagnitudde la caja y bancospara cubrir días de venta.Lo obtenemos multiplicandoel total de cajay bancospor 360 (díasdel año) y dividiendoel productoentre las ventasanuales. Formula 𝑅𝑜𝑡𝑎𝑐𝑖𝑜𝑛 𝑑𝑒 𝐶𝑎𝑗𝑎𝑠 𝑦 𝐵𝑎𝑛𝑐𝑜𝑠 = 𝐶𝐴𝐽𝐴𝑆 𝐵𝐴𝑁𝐶𝑂𝑆 𝑋 360 𝑉𝐸𝑁𝑇𝐴𝑆 Año2012 𝑅𝑜𝑡𝑎𝑐𝑖𝑜𝑛 𝑑𝑒 𝐶𝑎𝑗𝑎𝑠 𝑦 𝐵𝑎𝑛𝑐𝑜𝑠2012 = 13,505 𝑋 360 3,574,766 = 1.36 = 1 𝑑𝑖𝑎 Año2013 𝑅𝑜𝑡𝑎𝑐𝑖𝑜𝑛 𝑑𝑒 𝐶𝑎𝑗𝑎𝑠 𝑦 𝐵𝑎𝑛𝑐𝑜𝑠2013 = 3,251 𝑋 360 3,696,378 = 0.31 = 0.3 𝑑𝑖𝑎 En este rationos muestraque para 2012 la liquidezde cajay bancospermite cubrir1 día, mientrasque parael año 2013 disminuye significativamenteen 0.3 día. 2.2 ROTACION DE ACTIVOSTOTALES Ratioque tiene porobjetivomedirlaactividadenventasde lafirma.O sea,cuantasvecesla empresapuede colocarentre susclientesunvalorigual ala inversiónrealizada. Para obtenerlodividimoslasventasnetasporel valorde losactivostotales Formula 𝑅𝑜𝑡𝑎𝑐𝑖𝑜𝑛 𝑑𝑒 𝐴𝑐𝑡𝑖𝑣𝑜𝑠 𝑇𝑜𝑡𝑎𝑙𝑒𝑠 = 𝑉𝑒𝑛𝑡𝑎𝑠 𝐴𝑐𝑡𝑖𝑣𝑜𝑠𝑇𝑜𝑡𝑎𝑙𝑒𝑠 Año2012 𝑅𝑜𝑡𝑎𝑐𝑖𝑜𝑛 𝑑𝑒 𝐴𝑐𝑡𝑖𝑣𝑜𝑠 𝑇𝑜𝑡𝑎𝑙𝑒𝑠2012 = 3,574,766 3,190,872 = 1.12 𝑣𝑒𝑐𝑒𝑠 Año2013 𝑅𝑜𝑡𝑎𝑐𝑖𝑜𝑛 𝑑𝑒 𝐴𝑐𝑡𝑖𝑣𝑜𝑠 𝑇𝑜𝑡𝑎𝑙𝑒𝑠2012 = 3,696,378 3,414,878 = 1.08 𝑣𝑒𝑐𝑒𝑠

- 3. Es decir,interpretandoel rationosmuestraque laempresaenel año2012 ha colocadoentre sus clientes1.12vecesel valorde la inversiónefectuada,mientrasque parael año 2012 ha disminuidoa1.08 veces. 2.3 ROTACION DE ACTIVOFIJO Esta razón essimilara laanterior,con el agregadoque mide lacapacidadde la empresade utilizarel capital enactivosfijos.Mide laactividadde ventasde laempresa.Dice,cuantas vecespodemos colocarentre losclientesunvalorigual ala inversiónrealizadaenactivofijo. Formula 𝑅𝑜𝑡𝑎𝑐𝑖𝑜𝑛 𝑑𝑒 𝐴𝑐𝑡𝑖𝑣𝑜𝑠 𝐹𝑖𝑗𝑜𝑠 = 𝑉𝑒𝑛𝑡𝑎𝑠 𝐴𝑐𝑡𝑖𝑣𝑜𝑠𝐹𝑖𝑗𝑜𝑠 Año2012 𝑅𝑜𝑡𝑎𝑐𝑖𝑜𝑛 𝑑𝑒 𝐴𝑐𝑡𝑖𝑣𝑜 𝐹𝑖𝑗𝑜2012 = 3,574,766 581,262.76 = 6.15 𝑣𝑒𝑐𝑒𝑠 Año2013 𝑅𝑜𝑡𝑎𝑐𝑖𝑜𝑛 𝑑𝑒 𝐴𝑐𝑡𝑖𝑣𝑜 𝐹𝑖𝑗𝑜2013 = 3,696,378 576,658.03 = 6.41 𝑣𝑒𝑐𝑒𝑠 Esto quiere decirque enel año2012 se ha colocadoen el mercado6.15 vecesel valorde lo invertidoenactivofijo,mientrasque parael 2013 se ha incrementadoen6.41veces. 3 ANALISIS DE SOLVENCIA, ENDEUDAMIENTO O APALANCAMIENTO Estos ratios,muestranlacantidadde recursosque son obtenidosde tercerosparael negocio. Expresanel respaldoque posee laempresafrente asusdeudastotales.Danunaideade la autonomíafinancierade lamisma.Combinanlasdeudasde cortoy largoplazo. Permitenconocerque tanestable oconsolidadaeslaempresaentérminosde composiciónde lospasivosysu pesorelativoconel capital y el patrimonio. 3.1 ESTRUCTURA DE CAPITAL (DEUDA - PATRIMONIO) Es el cociente que muestrael gradode endeudamientoconrelaciónal patrimonio.Este ratio evalúael impactodel pasivototal conrelaciónal patrimonio Formula 𝐸𝑠𝑡𝑟𝑢𝑐𝑡𝑢𝑟𝑎 𝑑𝑒 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 = 𝑃𝑎𝑠𝑖𝑣𝑜 𝑇𝑜𝑡𝑎𝑙 𝑃𝑎𝑡𝑟𝑖𝑚𝑜𝑛𝑖𝑜 Año2012 𝐸𝑠𝑡𝑟𝑢𝑐𝑡𝑢𝑟𝑎 𝑑𝑒 𝐶𝑎𝑝𝑖𝑡𝑎𝑙2012 = 1,262,154 1,928,718 = 65%

- 4. Año2013 𝐸𝑠𝑡𝑟𝑢𝑐𝑡𝑢𝑟𝑎 𝑑𝑒 𝐶𝑎𝑝𝑖𝑡𝑎𝑙2013 = 1,230,991 2,183,887 = 56% Esto quiere decir,que porcada unidadmonetariaaportadaporlosdueños,hayun0.65 centavoso el 65% para el año2012; mientrasque para el año 2013 bajoa 0.56 centavoso56% portadopor losacreedores. 3.2 ENDEUDAMIENTO Representael porcentajede fondosde participaciónde losacreedores,yaseaenel corto o largoplazo, enlos activos.Eneste caso, el objetivoesmedirel nivelglobal de endeudamiento o proporciónde fondosaportadosporlosacreedores. Formula 𝑅𝑎𝑧𝑜𝑛 𝑑𝑒 𝐸𝑛𝑑𝑒𝑢𝑑𝑎𝑚𝑖𝑒𝑛𝑡𝑜 = 𝑃𝑎𝑠𝑖𝑣𝑜 𝑇𝑜𝑡𝑎𝑙 𝐴𝑐𝑡𝑖𝑣𝑜 𝑇𝑜𝑡𝑎𝑙 Año2012 𝑅𝑎𝑧𝑜𝑛 𝑑𝑒 𝐸𝑛𝑑𝑒𝑢𝑑𝑎𝑚𝑖𝑒𝑛𝑡𝑜2012 = 1,262,154 3,190,872 = 40% Año2013 𝑅𝑎𝑧𝑜𝑛 𝑑𝑒 𝐸𝑛𝑑𝑒𝑢𝑑𝑎𝑚𝑖𝑒𝑛𝑡𝑜2013 = 1,230,991 3,414,878 = 36% Es decirque en laempresapara el año 2012 el 40% de losactivostotalesesfinanciadoporlos acreedoresypara el 2013 losactivostotalessonfinanciadosenun36%. 4 ANALISIS DE RENTABILIDAD Mide la capacidadde generaciónde utilidadesporparte de laempresa.Tienenporobjetivo apreciarel resultadonetoobtenidoapartirde ciertasdecisionesypolíticasenla administraciónde losfondosde laempresa. 4.1 RENDIMIENTO SOBRE PATRIMONIO Esta razón loobtenemosdividiendolautilidadnetaentre el patrimonionetode laempresa. Mide la rentabilidadde losfondosaportadosporel inversionista. Formula 𝑅𝑒𝑛𝑑𝑖𝑚𝑖𝑒𝑛𝑡𝑜 𝑠𝑜𝑏𝑟𝑒 𝑒𝑙 𝑃𝑎𝑡𝑟𝑖𝑚𝑜𝑛𝑖𝑜 = 𝑈𝑡𝑖𝑙𝑖𝑑𝑎𝑑 𝑁𝑒𝑡𝑎 𝑃𝑎𝑡𝑟𝑖𝑚𝑜𝑛𝑖𝑜 Año2012 𝑅𝑒𝑛𝑑𝑖𝑚𝑖𝑒𝑛𝑡𝑜𝑠𝑜𝑏𝑟𝑒 𝑒𝑙 𝑃𝑎𝑡𝑟𝑖𝑚𝑜𝑛𝑖𝑜2012 = 155,318 1,928,718 = 8%

- 5. Año2013 𝑅𝑒𝑛𝑑𝑖𝑚𝑖𝑒𝑛𝑡𝑜𝑠𝑜𝑏𝑟𝑒 𝑒𝑙 𝑃𝑎𝑡𝑟𝑖𝑚𝑜𝑛𝑖𝑜2013 = 255,170 2,183,887 = 12% Esto significaque porcada unidadmonetariaque el dueñomantieneenel año2012 generaun rendimientodel 8%sobre el patrimonioyenel año2013 generaunrendimientodel12% 4.2 RENDIMIENTO SOBRE LA INVERSION Es una medidade larentabilidaddel negociocomoproyectoindependiente de losaccionistas. Formula 𝑅𝑒𝑛𝑑𝑖𝑚𝑖𝑒𝑛𝑡𝑜 𝑠𝑜𝑏𝑟𝑒 𝑙𝑎 𝐼𝑛𝑣𝑒𝑟𝑠𝑖𝑜𝑛 = 𝑈𝑡𝑖𝑙𝑖𝑑𝑎𝑑 𝑁𝑒𝑡𝑎 𝐴𝑐𝑡𝑖𝑣𝑜 𝑇𝑜𝑡𝑎𝑙 Año2012 𝑅𝑒𝑛𝑑𝑖𝑚𝑖𝑒𝑛𝑡𝑜𝑠𝑜𝑏𝑟𝑒 𝑙𝑎 𝐼𝑛𝑣𝑒𝑟𝑠𝑖𝑜𝑛2012 = 155,318 3,190,872 = 5% Año2013 𝑅𝑒𝑛𝑑𝑖𝑚𝑖𝑒𝑛𝑡𝑜𝑠𝑜𝑏𝑟𝑒 𝑙𝑎 𝐼𝑛𝑣𝑒𝑟𝑠𝑖𝑜𝑛2013 = 255,170 3,414,878 = 7% Quiere decir,que cadaunidadmonetariaenel año2012 enlosactivosprodujoese añoun rendimientode 5%sobre lainversión,mientrasque parael 2013 aumentoel rendimientoaun 7% 4.3 MARGENBRUTO Este ratio indicalacantidadque se obtiene de utilidadporcadaunidadmonetariade ventas, despuésde que laempresahacubiertoel costode losbienesque produce y/ovende. Formula 𝑀𝑎𝑟𝑔𝑒𝑛 𝑑𝑒 𝑈𝑡𝑖𝑙𝑖𝑑𝑎𝑑 𝐵𝑟𝑢𝑡𝑎 = 𝑉𝑒𝑛𝑡𝑎𝑠 − 𝐶𝑜𝑠𝑡𝑜𝑠𝑑𝑒 𝑉𝑒𝑛𝑡𝑎𝑠 𝑉𝑒𝑛𝑡𝑎𝑠 Año2012 𝑀𝑎𝑟𝑔𝑒𝑛 𝑑𝑒 𝑈𝑡𝑖𝑙𝑖𝑑𝑎𝑑 𝐵𝑟𝑢𝑡𝑎2012 = 3,574,766 − 2,782,086 3,574,766 = 22% Año2013 𝑀𝑎𝑟𝑔𝑒𝑛 𝑑𝑒 𝑈𝑡𝑖𝑙𝑖𝑑𝑎𝑑 𝐵𝑟𝑢𝑡𝑎2013 = 3,696,378 − 2,441,246 3,696,378 = 34% Esto nosdice que el margende utilidadbrutaenel 2012 fue de un22% mientrasque enel año 2013 aumentoa 34%, estole conviene ala empresapuestoque cuandomasgrande seael margenbruto de utilidad,serámejor,puessignifica que tieneunbajocostode las mercancías que vende.

- 6. 4.4 MARGENNETO Rentabilidadmásespecíficaque el anterior.Relacionalautilidadliquidaconel nivel de las ventasnetas.Mide el porcentaje de cadaunidadmonetariade ventasque quedadespuésde que todoslosgastos,incluyendolosimpuestos,hansidodeducidos. Formula 𝑀𝑎𝑟𝑔𝑒𝑛 𝑁𝑒𝑡𝑜 𝑑𝑒 𝑈𝑡𝑖𝑙𝑖𝑑𝑎𝑑 = 𝑈𝑡𝑖𝑙𝑖𝑑𝑎𝑑 𝑁𝑒𝑡𝑎 𝑉𝑒𝑛𝑡𝑎𝑠 Año2012 𝑀𝑎𝑟𝑔𝑒𝑛 𝑁𝑒𝑡𝑜 𝑑𝑒 𝑈𝑡𝑖𝑙𝑖𝑑𝑎𝑑2012 = 155,318 3,574,766 = 4% Año2013 𝑀𝑎𝑟𝑔𝑒𝑛 𝑁𝑒𝑡𝑜 𝑑𝑒 𝑈𝑡𝑖𝑙𝑖𝑑𝑎𝑑2013 = 255,170 3,696,378 = 7 % Esto quiere decirque enel 2012 por cada unidadmonetariaque vendiolaempresa,obtuvo una utilidadde 4% y para el 2013 fue del 7%.