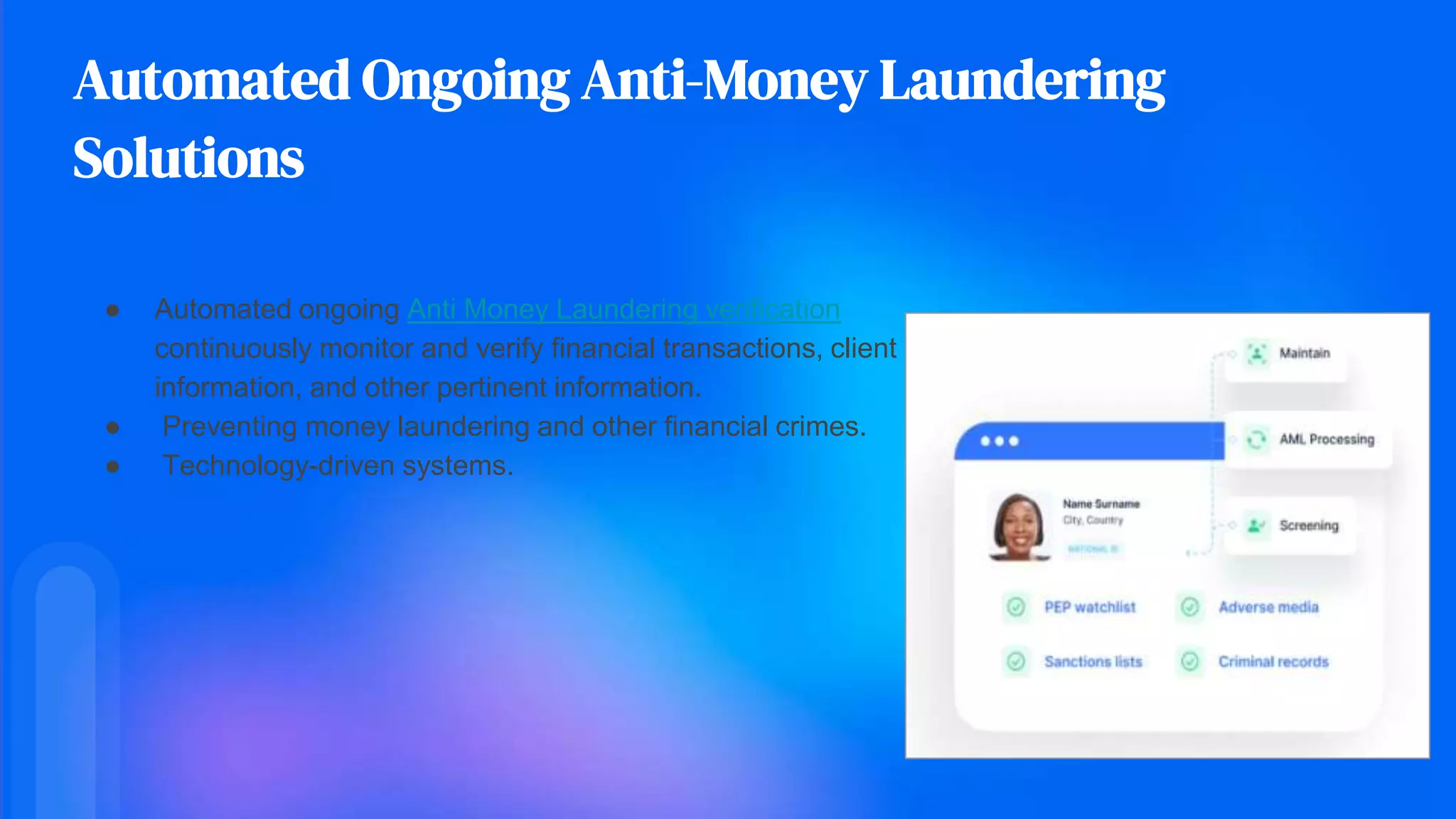

Anti-money laundering (AML) screening is essential for financial institutions to detect and prevent money laundering and associated financial crimes. The process involves verifying high-risk lists, screening politically exposed persons (PEPs), utilizing automated solutions, and monitoring adverse media for potential risks. Overall, AML screening is critical for regulatory compliance and safeguarding against illegal financial activities.