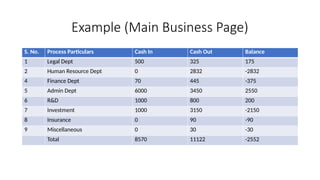

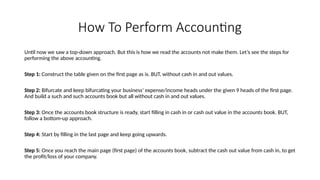

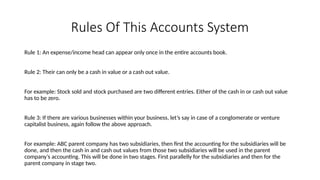

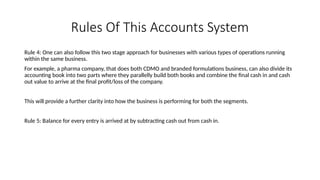

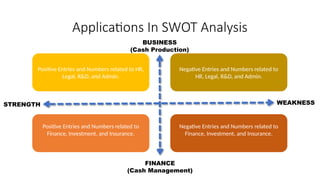

This document presents an alternative accounting method designed to enhance financial tracking within an entity, simplifying the recording process and making it accessible even for individuals without accounting backgrounds. It outlines a new account system, accounting processes, rules for proper accounting practices, and applications in SWOT analysis, all aimed at improving efficiency in finance management and tax filing. The method emphasizes a structured approach to recording transactions while ensuring clarity in profit and loss calculations.