Embed presentation

Download to read offline

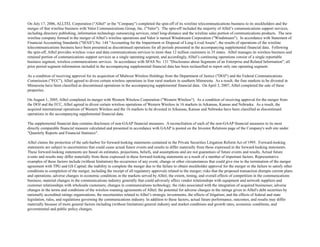

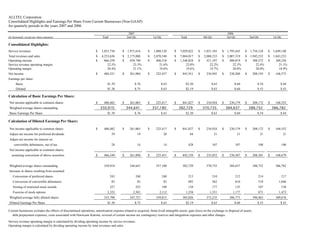

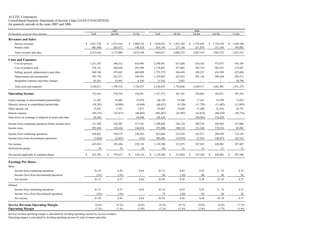

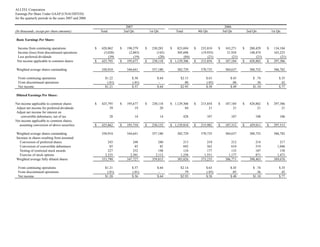

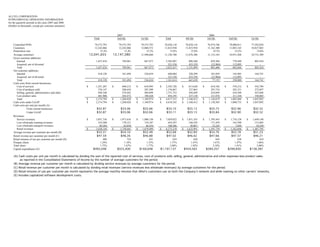

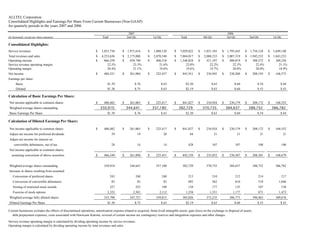

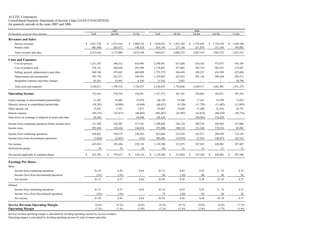

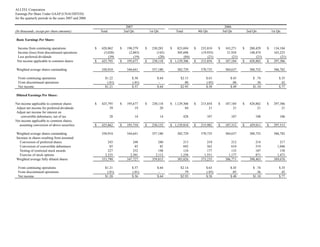

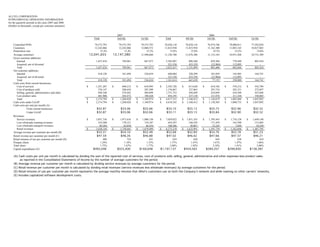

- Alltel Corporation completed a spin-off of its wireline business and merger with Valor Communications in July 2006, forming Windstream Corporation. Alltel now focuses solely on wireless services. - As required by regulators, Alltel divested certain wireless operations in Minnesota and from acquired companies Western Wireless and Midwest Wireless. These divested operations are classified as discontinued. - For the first half of 2007, Alltel reported service revenues of $3.9 billion, operating income of $866 million, and net income of $486 million from continuing wireless operations. Basic earnings per share were $1.39 and diluted were $1.38.