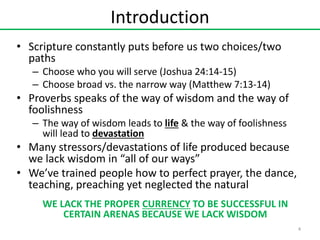

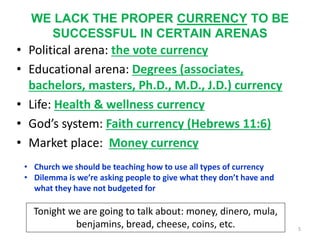

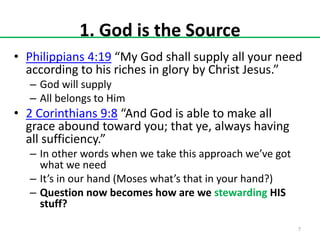

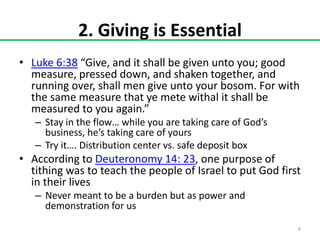

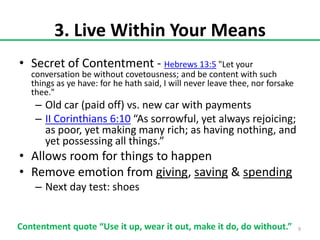

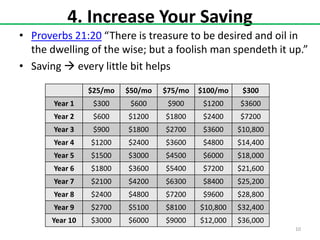

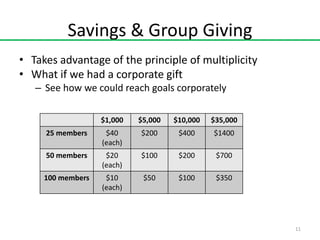

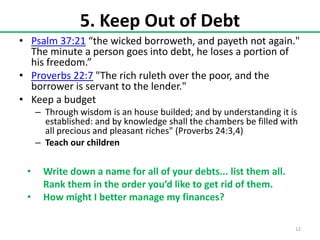

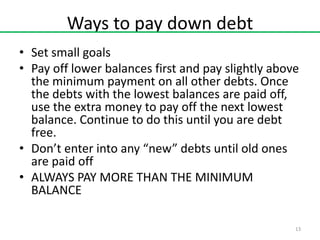

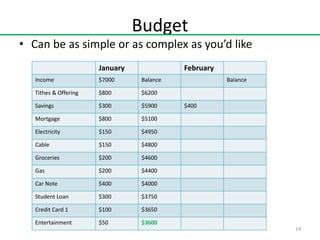

The document discusses the importance of financial wisdom and stewardship, emphasizing that various forms of 'currency' (such as money, education, and faith) are essential for success in different life areas. It outlines principles for managing finances, including budgeting, saving, giving, and living within one's means, while also warning against debt. Additionally, the document encourages learning about financial management through workshops and resources.